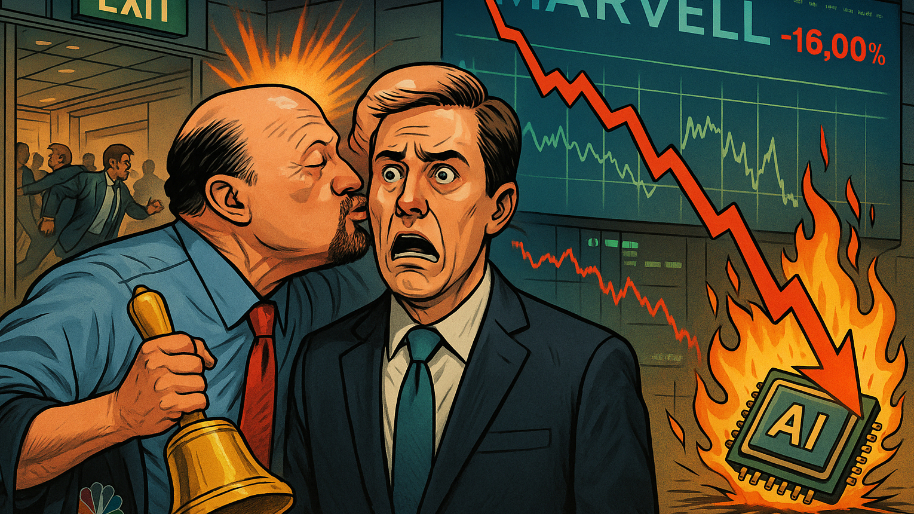

Cramer rang the bell, and investors headed for the exits.

Welp, Marvell just got thrown into the Wall Street woodchipper. Shares are down 16% today alone, and if you’re wondering what set it off… it’s a combo platter of “yuck” guidance, an AI narrative that lost a little juice, and, of course, the “Cramer Curse” showing up like Pennywise in a CNBC blazer.

Back in May, our guy Jim was on CNBC laying hands on the Marvell ticker like he was about to baptize it. “I would buy the stock of Marvell, and I’d buy it on Monday,” he said, with the confidence of a man who’s never read his own Twitter replies. His thesis this time was that Wall Street was asleep at the wheel, the stock hadn’t caught up to its AI makeover, and CEO Matt Murphy was buying up shares himself, which obviously meant this thing was about to go vertical. In Cramer math, that’s a sure thing.

But anyways, let’s look at the earnings report… because the numbers were lowkey good. Revenue hit $2.01 billion, exactly in line with estimates, and EPS squeaked past at $0.67 vs. $0.66 expected. Year-over-year growth was also juicy 58%, mostly thanks to strong demand for custom AI silicon and electro-optics. But Wall Street doesn’t care that your house looks good from the curb if the foundation’s cracked. The minute you throw “AI” into your investor deck, you’re getting graded on a curve that starts at Nvidia and ends somewhere in fantasyland. And when Marvell followed up all that decent growth by saying, “Hey btw, next quarter’s data center revenue is gonna be… flat,” the Street hit the eject button. Hard.

(Source: CNBC)

Marvell’s data center division (supposedly the lead singer of the AI band) hit the stage and forgot the lyrics. Revenue came in at $1.49 billion, just shy of the $1.51 billion analysts had on their setlist. Not catastrophic, but enough to throw off the rhythm. Then, instead of an encore, they dropped the real memeworthy moment: guidance for next quarter is flat as a pancake.

You have to give the man an A for effort, Matt Murphy, Marvell’s CEO, tried to massage it. He blamed “lumpiness” in demand from hyperscalers (read: Amazon and Microsoft taking their sweet time), and promised that Q4 would look much better. But this comes down to trust. Investors don’t want to hear about “lumpy” pipelines and delayed hyperscaler buildouts when they’re paying AI multiples. They want to see momentum. They want to see clarity. And unfortunately, they didn’t get much of either.

Even the analysts at Cantor basically threw up the deuces. Their note might as well have said, “Cool ambition, but unless you’re dropping hard numbers or actual signed hyperscaler deals, we’re not buying the fan fiction.” You can only ride the AI hype train so long before someone asks to see your ticket.

And sure, if you zoom out, Marvell might look cheap now. The stock trades at around 25x forward earnings (way below Nvidia’s 40x) and if you believe AI infrastructure will keep booming, there’s a real case for a rebound. But short-term, this is what it looks like when a growth story hits a pothole. Bank of America’s already moved to the sidelines, cutting their rating to neutral and annihilating the price target like it owes them money (which to be fair, after today it kinda does).

So yeah, the Cramer curse lives on. And after today’s selloff, it’s definitely going to need a few quarters (and probably Jimbo to never mention its name again) to convince anyone it still belongs in the AI winner’s circle.

At the time of publishing this article, Stocks.News holds positions in Amazon and Microsoft as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer