Siri, how do you say “to the moon” in Spanish?

If I could place a theme song on today's market action, it’d no doubt be “Don’t Stop Me Now” by Queen. Because while most investors woke up Tuesday, and looked around at the geopolitical wreckage… the markets shrugged, said “bet”, and printed another all-time high. Case in point: The Dow flirted with 49,000 like it was just another Tuesday errand.

(Source: Giphy)

In short, things like these are supposed to be the part where the markets panic. We got Venezuela headlines, military noise, and fake news doing the whole “uncertainty looms” routine. Instead, stocks did the most American thing possible: priced it in, priced it out, and kept climbing. Turns out if the conflict doesn’t spike oil, wreck supply chains, or threaten corporate margins, Wall Street files it under “background radiation.” And that’s exactly what has happened as stonks keep doing stonk things.

That said, the real fuel was the same old suspects. Amazon (+3.63%) caught a bid and dragged the indices higher like it always does, reminding everyone that when megacaps move, the rest of the market just sort of follows out of habit. AI-adjacent names piled on. Micron (+9.53%) ripped again, because apparently being up 240% last year wasn’t enough humiliation for anyone who sold it early. Palantir (+2.89%) kept grinding higher, quietly daring people to short it on valuation while it keeps not caring.

(Source: Giphy)

In fact, semis in general are already acting like it’s mid-cycle again… which is nutz considering it’s literally the third trading day of the year. But that’s where we’re at. Capital isn’t rotating away from tech. It’s rotating within it, chasing whichever name looks like it might still have room to YOLO. Meanwhile, energy caught a second wind. The sector just posted its best one-day move in months, helped along by the same Venezuela math that markets decided wasn’t scary enough to sell stocks over. More supply later, but tighter dynamics now. Traders love that kind of ambiguity. It gives everyone something to argue about while prices drift higher.

Aaaand then… There's silver. Silver slugs basically said “enough foreplay” and pushed toward an $80 handle like it had a personal vendetta against central banks. Translation: When silver starts behaving like this, it’s usually a sign that liquidity is sloshing around and people are reaching for anything that still feels underowned. Oh, and just to keep things spicy, Tesla (-4.39%) caught a stray after Boston Dynamics rolled out a humanoid robot powered by Google’s AI stack. No word (read: angry X post) yet from Elon on the torch passing.

(Source: Tenor)

Zooming out though, three days into the year and we are no doubt printing. And considering the liquidity is decent and narratives are surprisingly still intact, the path of least resistance is still up (even if it feels a little unhinged watching it happen in real time.) So place your bets accordingly, friends. Until next time…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Market Gossip

> Elon Musk’s xAI raises $20 billion from investors including Nvidia, Cisco, Fidelity (CNBC): Who cares about Tesla, when you have xAI?

> Manhattan Home Sales Rise, Juiced Up by Lower Mortgage Rates (Bloomberg): Cassandra Unchained post loading…

> Commonwealth Fusion Systems installs reactor magnet, lands deal with Nvidia (Tech Crunch): Monopolies gonna monopoly…

> Meta delays Ray-Ban Display glasses global rollout due to inventory limits, U.S. demand (CNBC): Zuck probably heard about my bad review at Best Buy (iykyk).

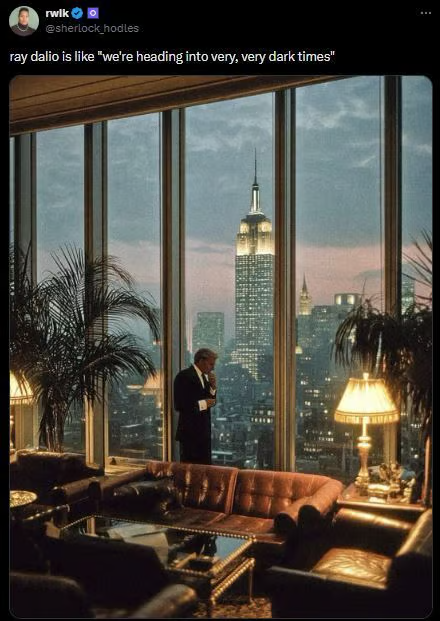

Meme of the Day

“The apocalypse looks incredible from up here.”

At the time of publishing, Stocks.News holds positions in Amazon, Tesla, and Google as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer