The S&P 500 and Nasdaq closed at fresh all-time highs on Thursday… barely. The S&P ticked up 0.07% to 6,363.35, while the Nasdaq limped 0.18% higher to 21,057.96, both fueled by Alphabet’s algorithmic crack cocaine and a complete disregard for valuation multiples.

(Source: Giphy)

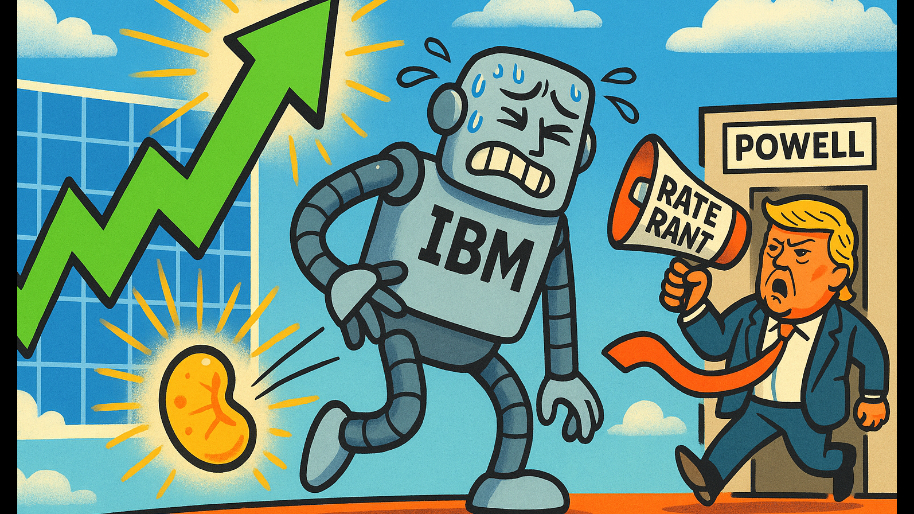

But the Dow? It decided to go off-script, face-planting 316 points after IBM reminded everyone that enterprise software is still corporate America’s version of passing a kidney stone. Shares of the “we promise this mainframe still does AI” company fell over 7% after missing software revenue expectations… again.

However, again, Gawd for Alphabet, who carried the friggin’ team on its back. Google's parent company beat earnings and said it’ll now spend $85 billion in capex next year, mostly to ensure it’s big swingin’ moat of search data + AI continues to be the pinnacle of Mount Bubble. As a result, shares popped north of 1%, because what’s a healthy market without lighting money on fire to stay in the AI race no one understands and everyone’s already faking. Meanwhile, Tesla continued its slow-motion identity crisis. The stock fell 8% as Musk warned about “rough quarters” ahead. Also, there was no guidance, no cheaper EVs, and no coherent business model to be seen during the show. And yet, Elon is gonna Elon.

(Source: Giphy)

As for the company who made E.Coli popular, Chipotle dropped another 13% after admitting that, yes, the $19 meat cylinder is finally too much for the average American who’s already financing toothpaste. Traffic declined for the second quarter in a row, but leadership insists there's “no smoking gun.” Sounds legit. Burrito apologists say this is just temporary. But when a company that has survived Wall Street’s own “Final Destination” events (see: norovirus and E.Coli) starts slipping on sales, maybe we should admit that things might not be all Cathie Woods and HODL.

Elsewhere, Donnie Politics would like a word. The Professional Roaster and Chief will reportedly visit J-Poww and the Federal Reserve… *checks notes*... in person. If that’s weird, it’s because it kinda is. This will be the first presidential visit in two decades, and probably the first to involve shouting, “you’re fired” threats, and at least one monologue about Mar-a-Lago.

(Source: Giphy)

Regarding individual stocks. Union Pacific and Norfolk Southern are apparently trying to merge into one SuperTrainCo. Stocks were flat because investors can’t spell “locomotive” and thought Norfolk Southern was a dental plan. Nvidia, Amazon, Meta, and Microsoft all floated higher on autopilot, while American Airlines fell 9% after releasing earnings and reminding people that flying coach is a nightmare of its own.

Oh, and Bitcoin hit $119k. Awesome. In the end, we are in a cycle where everything feels like it’s working… right before someone lights the match. Markets are partying. Fundamentals are somewhere in a ditch. And everyone’s pretending it’s fine. Which to be fair, is a good time to be riding the wave if you got in prior to April 22nd. If you didn’t, well, you may or may not be bagholding (jk)… but hey, what do I know? Meaning, keep your head on the swivel and place your bets accordingly. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

At the time of publishing, Stocks.News holds positions in Alphabet (Google), Amazon, Meta, and Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer