Americans to the economy: “It’s not you, it’s me… actually no, it’s definitely you.”

The Conference Board just announced that consumer confidence has dropped to 88.7, down a nasty 6.8 points and officially back in “April-but-somehow-worse” territory. Economists were expecting 93.2, probably banking on a holiday bump… but the economy clearly didn’t get the invite.

The outlook around the future economy could best be described as “opening your fridge and discovering nothing but condiments.” The expectations index slid to 63.2, and anything under 80 typically means recession clouds are forming. We haven’t even sniffed 80 in ten months… and may I remind you what was going on ten months ago?

Right now, the job market is giving off mixed signals worthy of an election-year debate stage. Only 6% of Americans say jobs are “plentiful,” down from 28.6% last month. Which makes you wonder if Elon’s robot army is taking over 10 years early.

Yet weirdly, the share of people saying jobs are “hard to get” fell too… meaning we’ve entered that awkward “no-hire, no-fire” Twilight Zone where companies don’t want to lay anyone off but also won’t risk hiring someone who might ask for PTO.

ADP didn’t help the mood by flippantly announcing that private companies shed 13,500 jobs over the past four weeks. The economy said “season’s greetings,” and ADP said “also… you’re fired.”

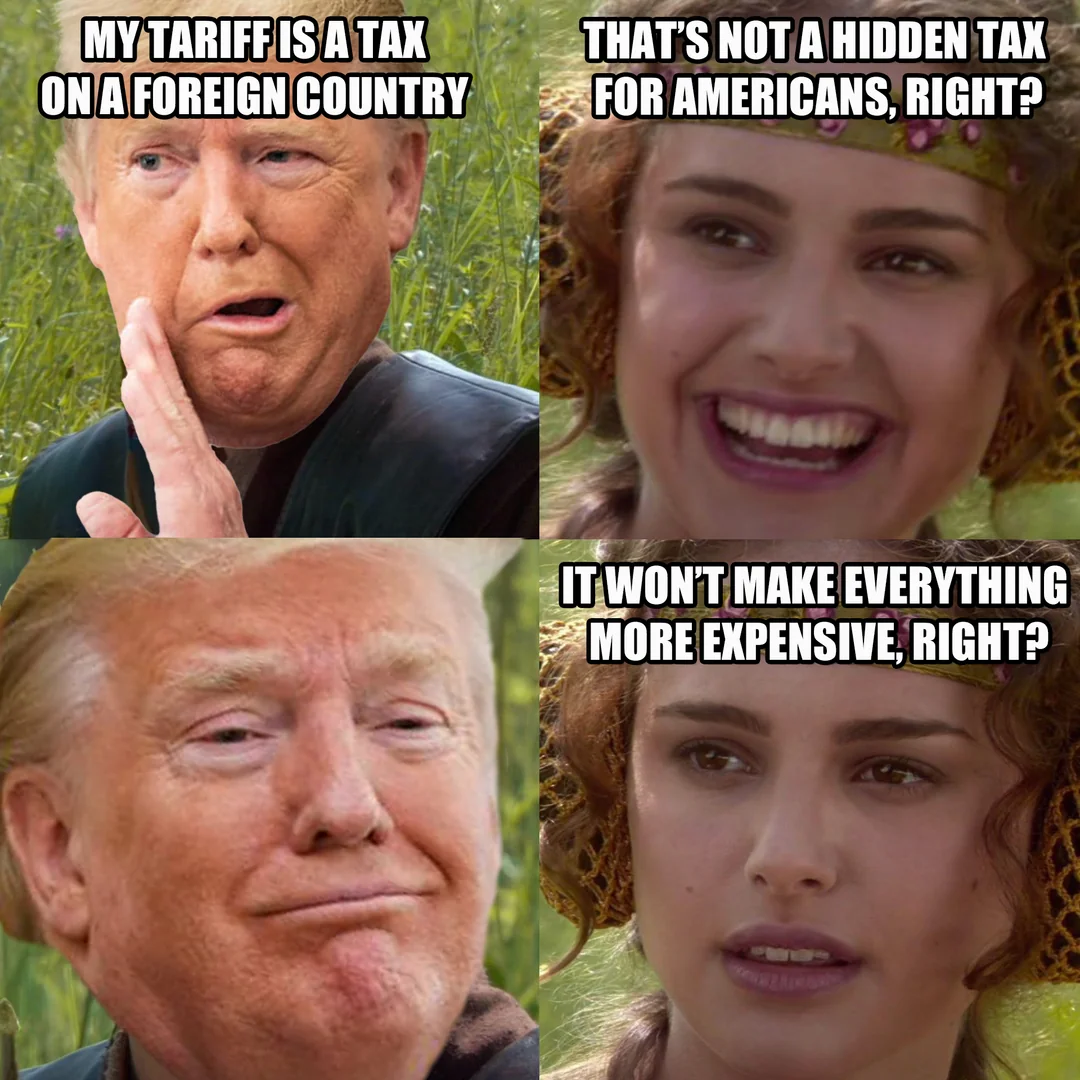

Consumers, for their part, are stress-typing about inflation, tariffs, politics, and the shutdown… the Mount Rushmore of nationwide anxiety. Inflation expectations rose to 4.8%, which is adorable because the Fed still thinks it can land at 2%. It’s giving “I’ll start eating healthy after the holidays” energy.

(Source: CNBC)

But get this… even though everyone feels financially screwed, people somehow have "strongly positive" expectations for the stock market next year. Incredible. We are truly a country that says, “My job feels unsafe, my bills are up, everything costs more, but yeah… S&P 500 to the moon.”

As for business conditions? Only 1% of consumers said they’re “good.” One percent. You have better odds of finding someone still rocking a Motorola Razr.

Even worse, expectations for income growth left the building after six straight months of people feeling mildly hopeful. No one knows what cause the change, but the mood now reads like: “I thought we escaped the woods… yet here I am assembling furniture in a cabin.”

Fed officials (cough John Williams), for their part, are out here hinting that more rate cuts are coming… probably in December. Which is nice in theory, but consumers are so wound up right now they’d miss it even if Powell shouted it through a megaphone.

And remember, the government shutdown pushed back a mountain of data, so the numbers we’re finally getting are showing up like a friend who wanders into Friendsgiving with cold mashed potatoes and zero apology. Bottom line? The numbers look rough… but somehow everyone’s still betting on a happy ending.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer