To literally everyone outside the Midwest who thinks Kroger is just that place where their grandma buys scratch-offs and (occasionally) chicken noodle soup with exact change: surprise, surprise. They pulled off another earnings beat. And now the scrappy grocery-and-gas conglomerate is creeping up on its arch nemesis… Walmart. I’m telling you right now, Wally World better keep its foot on the gas before Kroger steals the keys and drives off with the whole grocery market.

While net sales came in a bit lighter than analysts had hoped, the bottom-line profit was comfortably ahead of expectations. That means Kroger is doing what Wall Street loves best: squeezing more dollars out of every gallon of milk and fuel stop, even when top-line growth isn’t blowing anyone away.

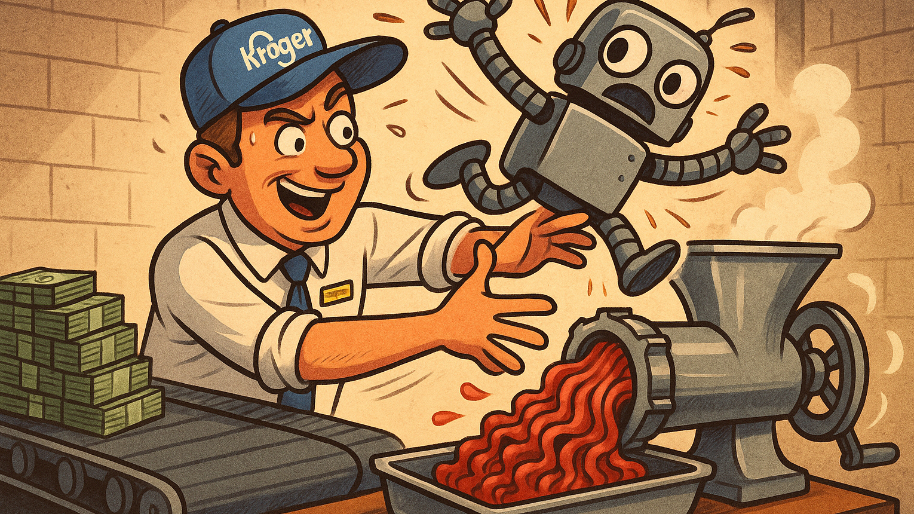

But every earnings report has a subplot, and unfortunately for Ocado, it was the villain in this story. Ocado, the UK-based firm that sells automated warehouse systems, saw its stock tank by as much as 11% after Kroger’s interim CEO Ron Sargent hinted that the partnership might not be as bulletproof as everyone thought. His exact words were: “We are evaluating all options across all facilities to improve profitability.”

(Source: Reuters)

To put another way: “These robot warehouses cost us a fortune, and we’re not sure our customers are ordering enough eggs and ice cream off the app to make this math work.” Wall Street didn’t miss the subtext. Ocado’s stock got yeeted 11% in London trading, erasing nearly $500 million in market cap just like that.

While it might seem like an insane overreaction, this is just a case of investors seeing the writing on the warehouse wall. You see, when the deal was signed back in 2018, the vision was ambitious… 20 futuristic fulfillment centers across the U.S. Well, five years later? Only eight are live, with two more supposedly coming. And the results are split. In dense metros like Florida and Ohio, they’re performing well. But in smaller markets, these warehouses are essentially billion-dollar Roombas moving Cheerios from one shelf to another (aka a huge revenue killer).

(Source: Yahoo Finance)

At the same time, Kroger’s been leaning more weight on Instacart and using its 2,700+ stores as mini fulfillment hubs. Sargent even bragged that 97% of orders can now be delivered in under two hours. So naturally that begs the cost-saving-question: why keep paying for giant robot palaces when the corner store gets the job done?

Fortunately, for shareholders, Ocado does have other partners (Sobeys in Canada, Marks & Spencer in the UK) but Kroger is by far the grandaddy of them all. If Kroger cuts back, the signal to the rest of the grocery world is that the robot-warehouse model might not be worth the billions it eats in capital. And as we all know, in the stock market… perception is half the battle.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer