Kroger’s past month felt less like running a grocery empire and more like trying to host Thanksgiving dinner with your in-laws… someone quits halfway through, a fight breaks out in the living room, and by the end of it, nobody’s sure who’s actually in charge anymore (if you’ve never experienced family drama, do you even have a family?).

Anyways, in case you’re not caught up on Kroger news, let’s recap the story…

Rodney McMullen, Kroger’s longtime CEO (a man who literally went from stocking shelves in 1978 to running the whole joint), abruptly resigned after an investigation into his “personal conduct.” I know what you’re thinking, but it didn’t involve employees or business dealings, but it was apparently bad enough to trigger a full-blown exit and cost him $11 million in bonuses. That’s a lot of cheddar… especially for a grocery guy.

Ron Sargent, the former Staples CEO, is now holding the clipboard as Kroger’s interim chief. Because when your grocery chain hits a rough patch, naturally you call in the guy whose last big gig involved office supplies and toner cartridges (that ironically ended with him stepping down after the Office Depot merger failed in 2016).

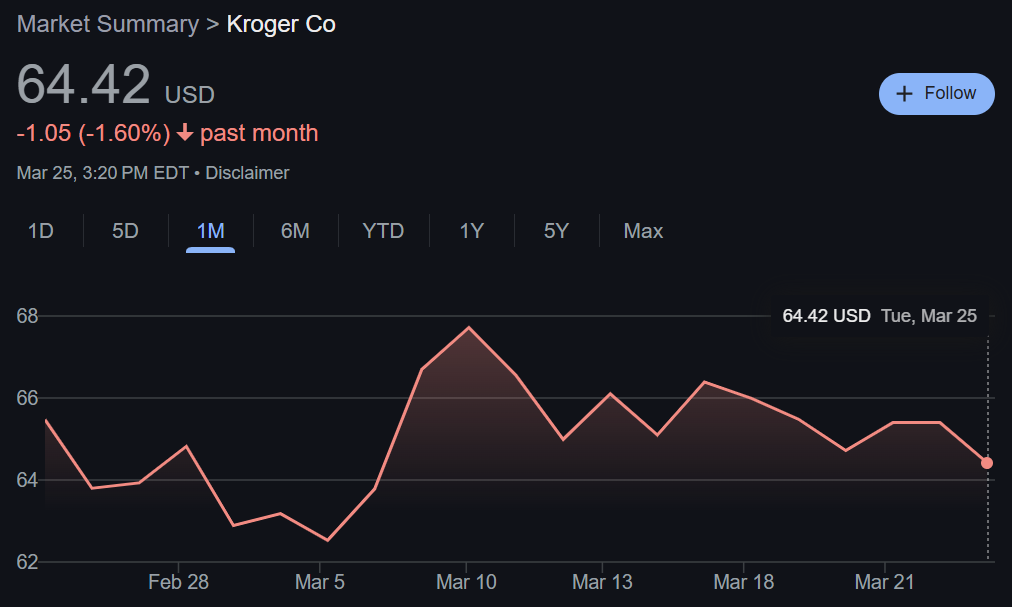

Even with all bad publicity and mystery about what actually went down with their former CEO, KR shares haven’t totally fallen apart. They've traded mostly sideways for the past month.

But zoom out, and Kroger’s been doing “quite lovely” (as my British friend would say). The stock’s up 42.3% over the past year, and 4% YTD… a lot better than the S&P 500’s -1% return. In other words, the market’s been willing to overlook the office shenanigans… at least for now.

That said, not everyone’s looking past the red flags. Wall Street has KR rated a “Moderate Buy,” and analysts expect full-year EPS to drop 6.7% to $4.44. The company may have beat or met earnings expectations for the past four quarters, but markets like stability… and right now, Kroger looks like it’s rewriting its leadership manual on the fly.

Which brings us to the legal mess. After the $24.6 billion merger with Albertsons was blocked in December by regulators (aka the fun police who apparently don’t want all your groceries coming from one place), Albertsons did what any mad corporate partner would do… they sued. They’re demanding billions in damages and a $600 million breakup fee (as if this is all Kroger’s fault).

Kroger’s response was obviously a countersuit. They’re accusing Albertsons of undermining the deal from the inside by working with C&S Wholesale Grocers to push for an overstuffed divestiture package… one that made C&S look incapable of competing on a national level. (Not a great look if you're trying to win over the FTC.)

And when that strategy didn’t pan out, Kroger claims Albertsons switched to “Plan B”: document everything, build a case, and sue if the merger failed. In legal filings, Kroger even said Albertsons “abandoned its contractual obligation to use best efforts to close the transaction”... implying the lawsuit wasn’t a reaction, but part of a backup plan all along.

Albertsons, of course, denies this and says Kroger’s just trying to shift attention away from its executive scandal and failure to cooperate with regulators.

So here we are… CEO? Gone. Merger? Dead. Legal teams? Clocking overtime. Kroger’s stock is still standing (for now) but let’s just say investors aren’t racing down the aisle with shopping carts full of shares.

And honestly, that says something. Most companies would’ve taken a never ending fall after this kind of chaos. But Kroger is hanging in there. If nothing else, that’s a vote of confidence in the underlying business. If you’ve ever shopped at Kroger, you know what I’m talking about.

P.S. Just when you thought our beloved congressmen couldn’t get any greasier, one Republican lawmaker decided to YOLO $175k into a stock… right before a major FDIC announcement hit. Lucky timing? Insider edge? You be the judge. We broke it all down inside our recent Stocks.News premium article… click here to check it out ASAP.

Stock.News does not have positions in companies mentioned.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer