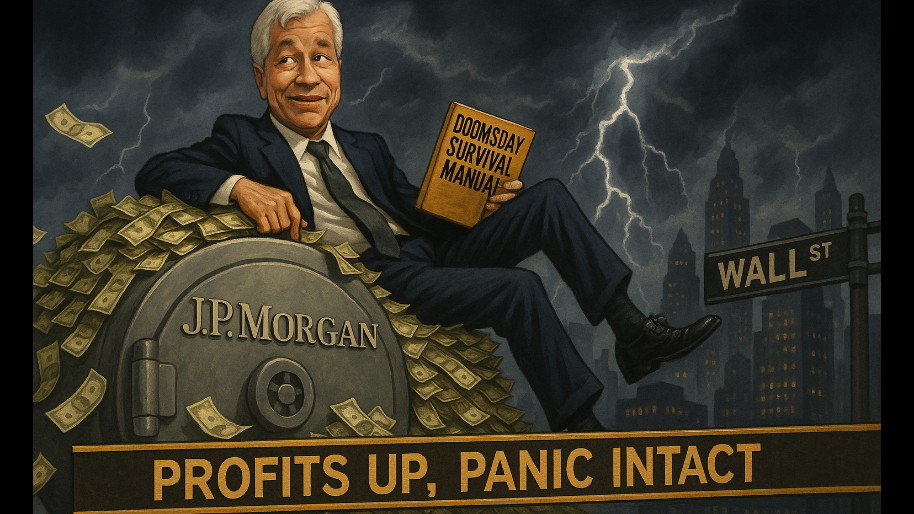

Per usual, Jamie Dimon’s aura right now is basically “I’m still the king of Wall Street… but also, everything might blow up tomorrow, don’t say I didn’t warn you.” Classic. And yet, his behemoth of an empire put on an absolute clinic when it came to their earnings report.

(Source: Giphy)

In short, JPMorgan Chase hauled in $45.68 billion in revenue, smoking estimates by $1.6 billion, thanks mostly to traders and bankers doing lines of dealflow like it’s 2006 and nobody’s heard of mortgage-backed securities. Earnings landed at $5.24 per share, which was higher than Wall Street’s $4.48 forecast… even after peeling out one-off crap like a tax benefit that gave EPS an extra 28-cent bump.

(Source: CNBC)

As for profits, well they technically fell 17% versus last year. But nobody gave a rats a$$ considering that last year's YoY number has the $7.9 billion sugar rush from selling off Visa shares baked into it. Meaning, the YoY drop is about as shocking as learning that Guy Fieri uses hair bleach. With that said, where JPMorgan really proved “it’s not your grandpa’s bank” was in their trading. Fixed income trading popped 14% to $5.7 billion, beating expectations by half a billion bucks because, apparently, the only people more hyped about volatile markets than CNBC anchors are JPMorgan’s rates desk. Equities trading also spiked 15% to $3.2 billion because even hedge funds who swear they’re “long-term focused” can’t resist stepping over themselves to pile drive straight into Nvidia.

Additionally, investment banking pulled-off the Lazarus effect as IB fees jumped 7% to $2.5 billion. Dimon admitted things were ugly early in Q2 as Trump was quite literally, trumping the markets, but by June, bankers were printing advisory fees like it was their second stimulus check. That result is $450 million above prior estimates, so let’s pour one out for anyone who shorted the IB rebound based on Jamie’s own cautious guidance back in May.

(Source: Giphy)

But, but, but… despite the greed gland infused number padding, Dimon couldn’t resist doing his favorite “Debbie Downer” routine on the call. The man immediately coughed up a laundry list of sh*t that could kill the party: tariffs, trade wars, “geopolitical conditions,” bloated asset prices. Pick your apocalypse. He even made time to deliver a sermon about how trying to mess with the Fed’s independence is about as wise as telling my wife to “calm down”.

However, despite Dimon nuking everyone’s mood with his chicken little speech… It's still abundantly clear that JPMorgan is an absolute tank. Case in point: Net interest income guidance is up to $95.5 billion for the year… $1 billion higher than previously forecast. Credit provisions came in lower than expected at $2.8 billion, which tells you they’re not exactly prepping for 2008: The Remix. Meanwhile, the stock is mooning +19% YTD.

(Source: Giphy)

In the end, JPMorgan still has that dawg in them, and Dimon still can’t shut up about the existential risks. To which, I say, he’s not entirely wrong. The U.S. is sitting on high asset prices, bloated deficits, and an electorate that might elect literal chaos incarnate. Plus, investment banking could stall again if rates stay elevated and dealmakers keep waiting for cheaper money.

Until then though, at least Dimon is the only CEO who’ll remind you the ice is thin… and there’s sharks under it. So points for honesty. But for now, take it with a grain of salt considering he’s predicted about 15 of the last 2 global economic meltdowns (sarcasm, obvi lol). So with that, keep your eyes on JPMorgan and place your bets accordingly, friends. Until next time…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer