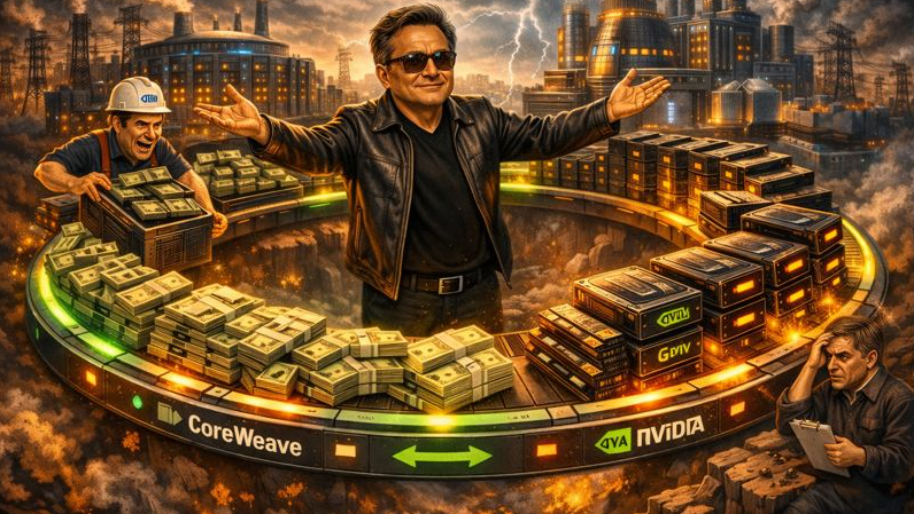

As the internet argues about whether Grok, ChatGPT, or Claude has the biggest brain (Claude clears), Jensen Huang is busy proving the AI boom is basically one giant closed-loop money machine… and Nvidia sits dead center.

This week’s episode includes Nvidia “investing” $2 billion into CoreWeave.

And by investing, I mean the money barely had time to stretch its legs before turning around and coming straight back as GPU revenue (allegedly).

As soon as the news dropped, CoreWeave stock popped 12%. Because nothing gets Wall Street going like a perfectly circular cash flow diagram (everyone except Michael Burry, of course).

Here’s how the loop works in real life.

CoreWeave builds massive AI data centers. Those data centers are stuffed to the ceiling with Nvidia GPUs. Nvidia then buys equity in CoreWeave so CoreWeave can build more data centers… which require more Nvidia GPUs. Repeat until morale improves.

All jokes aside, this was actually a pretty monumental deal. Nvidia bought CoreWeave Class A shares at $87.20, a discount to Friday’s close, locking in roughly 23 million new shares and nearly doubling its stake. Translation: Jensen didn’t come to network. He came to own capacity.

(Source: TechCrunch)

And capacity is the choke point now.

CoreWeave plans to scale toward 5 gigawatts of AI data center capacity by 2030. That’s roughly the annual power consumption of 4 million U.S. homes. Meaning, entire regions of the country are about to exist primarily to keep large language models from timing out.

This also wasn’t Nvidia’s first time running this play.

Back in September, CoreWeave disclosed a $6.3 billion order from Nvidia… plus a clause where Nvidia agreed to buy any unsold capacity through 2032. So yeah, demand isn’t really a question here.

Meanwhile, CoreWeave’s customer list reads like the AI power rankings. $14.2B to support Meta and $22.4B for OpenAI.

So what’s actually happening here?

Same thing we’ve seen all year. Nvidia is making sure its biggest customers always have enough money, power, and infrastructure to keep buying Nvidia chips… while strategically taking ownership stakes in the companies doing the buying.

Some (cough, Michael Burry) might argue it should be illegal.

It’s not… which is what makes it so aggressively efficient.

The loop props up demand, flattens revenue volatility, and creates the illusion of organic growth while everyone involved keeps feeding each other capital. As long as the music’s playing, the numbers look great.

The risk, of course, is obvious.

If the AI bubble ever cracks, this kind of closed-loop financing won’t soften the landing… it’ll amplify the fallout. Think about it, when everything is connected, everything breaks together.

Until then? Jensen keeps collecting rent. CoreWeave keeps building factories. And the money keeps chasing its own tail.

Sidenote: what are the odds on Kalshi that Michael Burry publishes a Substack post with “Jensen Huang Is a Con Artist” in the headline?

Because I’m smashing the over.

At the time of publishing this article, Stocks.News holds positions in Meta as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer