Jerome Powell got up in front of a room full of economists this week and, instead of offering the usual bland reassurance that everything will be fine if we just believe hard enough in the invisible hand, he basically said: “Yeah, we might be screwed. Indefinitely. Good luck.”

(Source: Giphy)

In short, at the Fed’s Thomas Laubach Research Conference, Powell told the truth out loud, which is rare and mildly horrifying. The U.S. economy, he said, may be entering a period of “more frequent and persistent supply shocks.” Not temporary or fleeting… but persistent. As in: buckle the F up, things might stay broken.

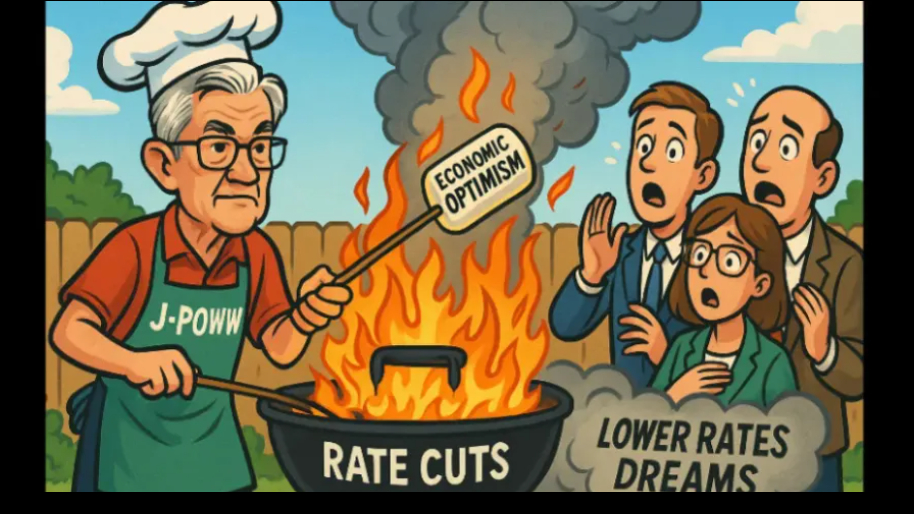

Meaning, if by chance you were clinging to the fantasy that we’re heading back to the low-rate, low-inflation Disneyland of the 2010s, Powell just lit that illusion on fire and pissed on the ashes. According to him, the Federal Reserve’s framework may need to be “adjusted,” which is his evil way of saying: everything we’ve been doing for the past three years might be obsolete and we’re not sure what comes next.

(Source: Fox Business)

He made it clear that interest rates could be structurally higher going forward. Because apparently, with pandemics, wars, tariffs, and shipping bottlenecks… the economy is basically operating like a malfunctioning washing machine that randomly explodes every few months. But the thing is, the Fed has been telling the same story for years: that inflation is transitory, that monetary policy is a scalpel not a club, that we can thread the needle between growth and stability if we just tweak the dials hard enough. However, with his recent comments, Powell just admitted that the needle’s gone, the thread is frayed, and the dials are mostly for show.

Historically though, in a recession, the Fed would slash the policy rate by 500 basis points. That’s their go-to move. But we’re already at 4.25–4.5%. So unless Powell plans to take rates back to zero, which he just said is no longer the base case, the Fed’s red room toolbox is looking tragically empty. They’ve got interest rates and vibes, and right now the vibes are cooked.

(Source: Giphy)

Which means, Jerome’s charade performance was less about policy and more about narrative control. Powell’s trying to get ahead of the next wave of finger-pointing by laying the groundwork now: “Hey, just so you know, things might be permanently unstable, and it’s not totally our fault. Don’t yell at us later.” And honestly, he’s not necessarily wrong. The world is objectively more chaotic. But it’s wild to watch the head of the most powerful central bank on the planet effectively shrug and say, “We’ll see.” The Fed is supposed to be the adult in the room. Right now, it sounds like your dad telling you the transmission’s gone but insisting the family minivan will be fine if you just don’t take it on the highway.

So no, we’re not getting lower rates anytime soon. And no, there’s no master plan. Right now, all it feels like is a bunch of economists recalibrating their models while the economy starts to burn. Bigly. Meaning, for now, keep your head on the swivel considering Powell is notorious for nuking the markets with a single sentence… and place your bets accordingly. Until next time, friends…

P.S. Oh, I’m sorry, I didn’t know you liked getting rekt. Let’s face it, retail investors get the short end of the stick all day everyday. It’s the smart money’s world, and we are just living in it–only useful when it comes to liquidity purposes in the market. Meaning, if you’re as pissed off as I was when I found out Milli Vanilli was lip syncing the whole time, then it’s time to go from investing blind, to investing smart. Luckily for you, the key is right here as a Stocks.News premium member. Click here to see exactly how our premium members are printing while others quake in the face of today’s market chaos.

Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer