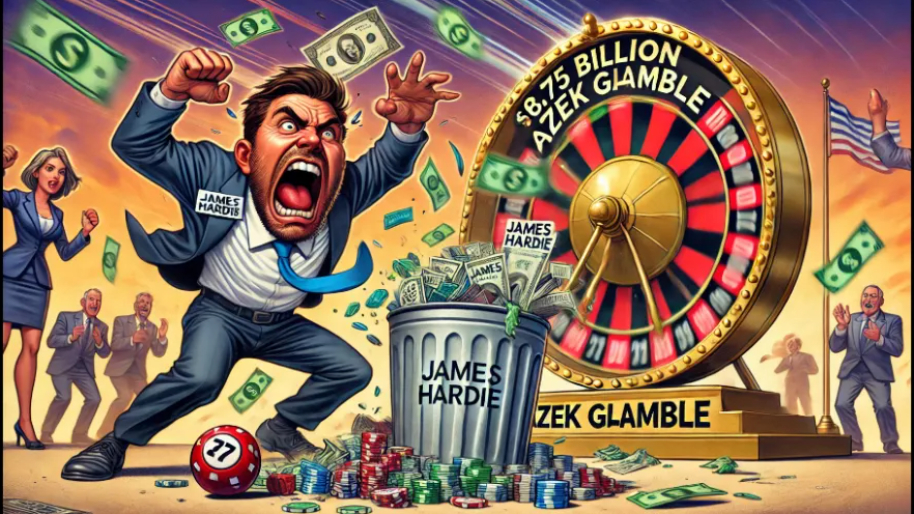

James Hardie Industries just bet the house (literally) on the future of U.S. housing, announcing an $8.75 billion cash-and-stock deal to acquire AZEK Company. The move makes sense on paper—two big names in building materials joining forces to dominate siding, decking, and all things exterior—but Wall Street reacted like Hardie just lit that cash on fire.

(Source: Giphy)

Shares plummeted 14.5% in Sydney after the announcement, wiping out A$2.9 billion in market value overnight. Meanwhile, AZEK’s stock soared more than 23% pre-market, because if someone offers you a 37% premium, you take the money and run. So, what in the hell happened?

Well first off, here’s some of the receipts on the deal: James Hardie will pay AZEK shareholders $26.45 in cash and 1.034 shares of Hardie stock for every AZEK share. In addition, the new company will be 74% owned by Hardie shareholders, 26% by AZEK investors, meanwhile Hardie gets deeper penetration into the U.S. market, where it already generates 75% of revenue. As a result, the new combined firm will push fiber cement, composite decking, and trim products—which is a bet on aging homes needing facelifts—and James Hardie will be listed on the New York Stock Exchange, officially cementing (pun intended) its U.S. presence.

(Source: Guru Focus)

Now from a strategic standpoint, the deal makes sense. Homeowners are staying put thanks to 6.67% mortgage rates, so instead of buying new homes, they’re renovating the ones they already have. That’s great news for siding, decking, and trim suppliers like Hardie and AZEK. However, Wall Street hates it, and here’s why:

Investors aren’t exactly throwing a housewarming party. Hardie’s stock got obliterated, and analysts are questioning whether the price tag is too rich. Barrenjoey analysts called the 37% premium “significant”, basically saying Hardie better squeeze every ounce of synergy out of AZEK to make this pay off. Then there’s the elephant in the room: the U.S. housing market is still a flaming dumpster. For instance, existing home sales just hit a 30-year low, and mortgage rates make you want to kick a fat kid at fat camp (Theo Von, anyone?).

(Source: Bloomberg)

So, yeah—Hardie is making a massive bet on a housing recovery that might not show up for a while. CEO Aaron Erter, though, isn’t sweating it. “We’re looking at this over the long term, and the long-term prospects of this are very, very strong,” Erter told investors. Translation: “Stop panicking, this will all work out... eventually.”

What’s more is that this deal also helps Hardie move further away from its asbestos-stained past. The company has spent billions cleaning up lawsuits from its old asbestos products, and this acquisition shifts the focus to high-growth, eco-friendly materials. On the other hand, AZEK has been riding the “wood conversion” wave, replacing traditional timber with composite materials. Investors like that trend, which is why some analysts actually think Hardie got AZEK for cheap. In fact, Trevor Allinson at Wolfe Research even admitted he was “surprised the premium wasn’t larger”, given AZEK’s double-digit EBITDA growth projections.

(Source: Giphy)

So yeah, in the end, James Hardie just went all-in on the U.S. housing market, and while the long-term thesis makes sense, the short-term optics are brutal. If the market rebounds, Hardie looks like a genius. If home improvement spending dries up, this could be a very expensive mistake. For now, investors aren’t buying the vision—literally. But if you’re a long-term bull on home renovation, aging houses, and composite materials, this could be a play worth watching. Just don’t expect Wall Street to suddenly stop whining anytime soon.

In the meantime, keep an eye on this buy-out, and place your bets accordingly. As always, stay safe and stay frosty, friends! Until next time…

P.S. Just when you thought our beloved congressmen couldn’t get any greasier, one Republican lawmaker decided to YOLO $175k into a stock—right before a major FDIC announcement hit. Lucky timing? Insider edge? You be the judge. We broke it all down inside last week's Stocks.News premium article—click here to check it out ASAP!

Stocks.News holds does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer