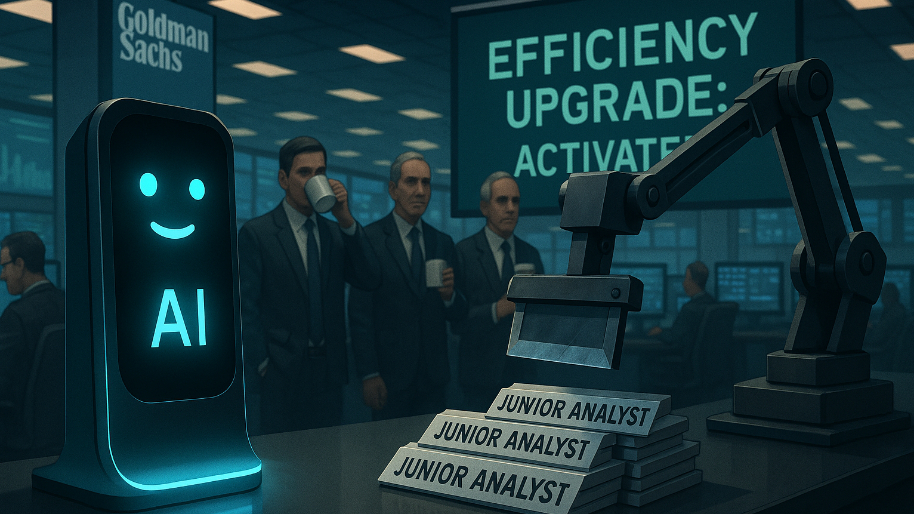

So DJ Sol and his merry band of raving bankers just hit Ctrl+Alt+Delete on the entry-level finance job market. On Monday, the bank announced it’s rolling out its new “GS AI Assistant” across the firm, an artificial intelligence tool that… if you believe the internal memo… is here to “boost productivity” and “help with everyday tasks.” If you believe literally anyone under 30 on Wall Street, it’s here to make half the analyst class obsolete before they can expense their first bottle of Malbec.

(Source: Giphy)

In short, the tool’s already been beta-tested on 10,000 employees, which is about the number of people Goldman cycles through in a bad year anyway. Now it’s going firmwide, and leadership is absolutely buzzing about how it can summarize complex documents, draft reports, and do “data analysis”... which, for anyone who’s ever worked a 90-hour week making pitch decks, is basically the entire job description. Pour one out for the ones who label “Excel” a premium skill on LinkedIn.

As for the tech itself, the GS AI Assistant is basically just generative AI that taps into everything from OpenAI’s GPT-4o to Google’s Gemini, plus a few other models that basically do the same thing. The AI can translate research for clients, spit out first drafts of presentations, and even crank through data sets faster than Taylor Mason. So apparently, it’s a quote on quote “Big Deal” for them when it comes to data analytics.

(Source: New York Post)

Of course, Goldman’s top brass insists this isn’t about layoffs. “Our people are our most valuable asset,” said some spokesperson, probably while feeding their résumé into ChatGPT just in case. “AI is here to help everyone focus on higher-value work.” Yeah, and Uber was just supposed to “supplement” taxi drivers LOL. Ask anyone who’s ever been disrupted how that worked out. Meanwhile, the writing is on the wall: Bloomberg Intelligence is now predicting 200,000 Wall Street jobs could get the guillotine treatment by 2029, mostly in the exact “routine” roles this tool is designed to vaporize. For instance, the AI being used in Investment Banking and Wealth Management, two places where junior staffers are famous for their ability to copy-paste, format PowerPoints, and pretend to understand what a “discounted cash flow” actually is.

With that said, the old guard isn’t sweating (yet). One trader told the press he’s “unfireable.” Which is great confidence, but again, AI could give two sh*ts about how much drawdown it goes into while dollar cost averaging the dip. Which is why the rest of Wall Street is racing to keep up. JPMorgan’s got its own AI companion, Morgan Stanley has a chatbot named Debrief that summarizes meetings so you can spend more time pretending to network, Citi’s got “Citi Assist” and “Citi Stylus,” which mostly help you figure out which compliance rule you’re violating this week. Even AQR’s Cliff Asness (who used to act like AI was a fad for nerds) is now waiving the white flag.

(Source: Giphy)

To be fair though, the AI isn’t perfect. It still needs a human to double-check that your $10 billion M&A deal isn’t built on a hallucinated spreadsheet. But the days of junior bankers “learning by doing” are about to look a lot more like “learning by watching the bot do it and then explaining it to your boss.”

As for me and my opinion that nobody asked for? None of this is that deep if you’ve actually been around the AI block. For example, most of these “revolutionary” Wall Street bots are just ChatGPT in a Patagonia vest, with an OpenAI API duct-taped to the back end. Slap a Goldman logo on it, call it “GS AI Assistant,” and suddenly it’s supposed to be the second coming of Alan Turing. Spoiler: it’s not. There are literally millions of tools out there doing the same thing (think: summarizing, drafting, pretending to understand your boss’s archetype).

(Source: Giphy)

Meaning, just because it’s got the Goldman Sachs branding doesn’t mean it’s any less of a glorified spreadsheet monkey than JPMorgan’s version. The only thing that’s really changed is how expensive the buzzwords are nowadays. But alas, that’s where we are at. And clearly, investors are here for it as shares are up 6% over the past five days. So really, what do I know? I just know there’s hype… and most of AI is still generative. The only mind blowing AI moment has been Google’s Veo (which is another and quite alarming story in of itself).

For now though, keep your eyes on any more tools and developments that come out on this and place your bets accordingly. Until next time, friends…

At the time of publishing, Stocks.News holds positions in Google and Uber as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer