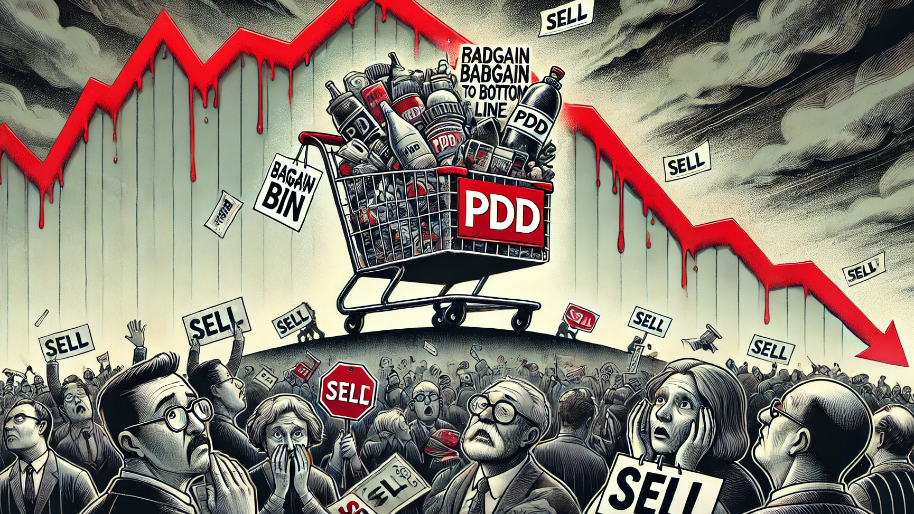

Bargain bin? Try bargain stock.

It seems PDD Holdings, the parent company of discount darling Temu, just got a taste of its own medicine. Yesterday, the company reported its Q3 earnings, and let’s just say they absolutely shat the bed on both top and bottom line estimates. As a result, shares plunged, dropping over 10% on the day. Meaning, for a company that made its name selling $0.99 socks, it’s starting to look like investors might need to ‘thrift’ some new confidence. (ha! Get it?)

(Source: Giphy)

For starters, revenue for the quarter was up 44% year-over-year, hitting $14.16 billion. Sounds legit, right? Wrongo. Analysts were hoping for $14.47 billion, and Wall Street doesn’t do participation trophies. Adjusted earnings per ADS came in at $2.65, also below the $2.82 consensus. Cue the absolute yeeting of shares.

(Source: IBD)

Now to be fair, 44% is still bigly. But compared to the 86% and 131% growth they clocked in Q1 and Q2? PDD is basically in the same camp as Nvidia (except Nvidia actually beat estimates). Whereas, by the same camp I mean, investors don’t like deceleration, especially when it’s paired with words like “intensified competition” and “external challenges.”

For instance, according to o PDD’s VP of Finance Jun Liu, the company’s top line growth has slowed thanks to, well, everyone else deciding they want a piece of the discount e-commerce pie. Amazon has rolled out Amazon Haul, which is basically Temu’s business model but with fewer spelling errors in the product descriptions. Back in China, Alibaba and JD.com are in full panic mode, throwing discounts like Oprah to claw back market share from PDD’s Pinduoduo platform.

(Source: Giphy)

And then there’s the U.S. government, always ready to play “Karen”. The Biden administration recently tightened a trade loophole that let Temu ship orders to American customers duty-free. So now, those $2 earbuds might cost $2.10. Tragic. And with Trump gearing up for round two, you can bet tariffs are going to be part of his playlist.

On the other hand, PDD is seeing how last year's highs are causing this year's problems. You see, PDD isn’t just fighting external pressures. They’re also up against their own success. Last year, Temu was the shiny new toy in global e-commerce, and PDD’s numbers reflected that. Now, those year-over-year comparisons are making growth look sluggish, even though the business is still expanding.

(Source: Giphy)

Revenue grew 44%, sure, but that’s down from the dizzying highs of earlier quarters. And this was PDD’s slowest sales growth since mid-2022. Investors don’t care about context—they care about momentum. And right now, PDD feels like it’s running uphill.

With that said though, despite the turbulence, PDD isn’t exactly strapped for cash. They’re sitting on a war chest of $44 billion, with $3.92 billion in operating cash flow for the quarter. They’re also doubling down on investments to improve their ecosystem, with moves like merchant support programs and enhanced trust and safety measures. Which is all well and good, but it doesn’t change the fact that competition is eating into their growth. And with consumer spending in China still shaky, it’s not like they can rely on a surge of demand to bail them out.

(Source: Giphy)

Aaaand then there’s the stock. After soaring nearly 90% in 2023, PDD is down a blistering 32% YTD. Even before this latest earnings miss, the stock was struggling to stand out in a market that’s increasingly skeptical of Chinese e-commerce plays. Plus, when it comes to PDD’s Relative Strength Rating—a measure of how it’s performing against other stocks—they are sitting at a lousy 18 out of 99. Translation? It’s been outperformed by 82% of the market. Not exactly a vote of confidence.

So in the end, PDD is clearly in a freefall as the golden days of effortless growth are behind them. Now sure, they’re still a major player in the space, and their fat stacks of cash definitely gives them more room to maneuver. But the competition is fierce, the headwinds are real, and Wall Street has no patience for companies that can’t keep up their breakneck pace.

(Source: Giphy)

For now, PDD has their work cut out for them if they want to win back investors. Of course, we are heading into the holiday season, and I know my wife is neck deep on Temu’s app at this very moment (my spidey senses are tingling). So we’ll see how PDD is really faring come the next earnings report. In the meantime though, whether you “BTFD” or not, keep an eye on PDD going forward.

And as always, stay safe and stay frosty, friends! Until next time…

P.S. I’ll be honest, I’m not one to overhype things, but here’s the deal: The next alert we’ll be dropping this week? It’s a game-changer. And if you miss out, well, it could be costly. Click here ASAP for the details.

Stocks.News holds positions in Amazon as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer