“F*ck around and find out” - Jamie Dimon, probably

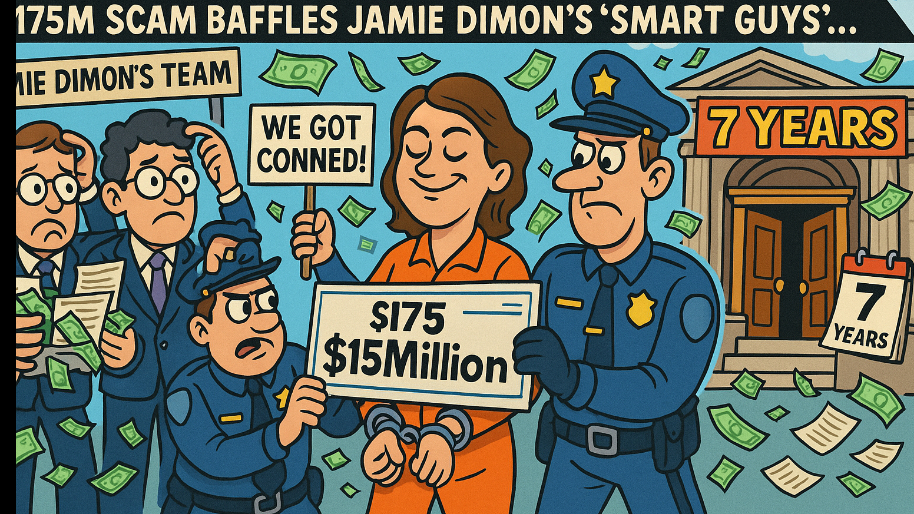

Charlie Javice just got the Theranos starter pack: seven years in federal prison, forfeiture of $22.4M, and a lifetime membership in the “elite founders who lied harder than JPMorgan’s due diligence team” club.

(Source: Giphy)

In case you missed it, Javice sold her college-finance startup Frank to JPM for $175M back in 2021 by claiming she had 4.25M users. In reality, she had about 300k. To fill the gap, she paid a data scientist $18k to conjure “synthetic students” out of thin air… a move so brazen I wouldn’t be surprised if the BLS took notes when it came to fabricating their jobs data.

(Source: New York Post)

And yet, JPM bought it anyway, because nothing gets Jamie Dimon’s people hornier than the thought of stealing “Gen Z customers” away from Bank of America. The crazy part though, is that the so-called “Smartest Guys in the Room” did zero diligence, launched a marketing push, and only signed up 10 actual new checking accounts before realizing they’d basically acquired a glorified Google Form. Which is why the Judge summed it up nicely: “A fraud is a fraud, whether you outsmart someone who’s smart or someone who’s a fool.” LOL savage. Translation: yes, JPMorgan was a clown show here, but Javice still gets the jumpsuit.

Now, Javice will serve 85 months. Prosecutors wanted 12 years, her lawyers begged for 18 months, and the court split the baby like Solomon with a calculator. Of course, throughout the whole trial, Javice’s defense tried to play the “at least her product worked” card against Elizabeth Holmes… which is true… Frank did help students fill out FAFSA forms. But the only people really helped here were Javice’s parents, who got to tell dinner guests their daughter sold a startup for nine figures… before the FBI showed up.

(Source: Giphy)

With that said, does JPM deserve sympathy because of this? Hell no. This is what they get after rushing the deal because they thought Bank of America was in a bidding war, even though Capital One had already walked away calling BS. They bought a fake customer list the same way your favorite trading guru on youtube buys fake Rolexes… and then they cried fraud when it turned out to be, well, fake. What’s even funnier though, is that this thing netted JPM exactly ten new accounts. That’s -$17.5M per checking account. Dimon should frame those debit cards and hang them in the lobby as a warning.

But alas, Charlie Javice is going away. She’s not Elizabeth Holmes, she’s not SBF, she’s not even Adam Neumann… he’s the B-list scammer who conned a trillion-dollar bank into paying Ferrari prices for a used Honda Civic with forged paperwork. Which to be fair, is kind of genius. Until next time, friends…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer