Yesterday felt like a dream. The S&P 500 soared 9.1%, marking its third-best day since World War II (back when my great-uncle’s plane got shot down over Germany and he spent six months as a POW… which, yes, somehow became his favorite story to tell at Thanksgiving).

But today was straight out of The Wolf of Wall Street… you know, the scene where Jordan Belfort wakes up thinking he drove his Lamborghini home flawlessly…

Only to find it completely totaled and wrapped around a mailbox (and that his wife was leaving him).

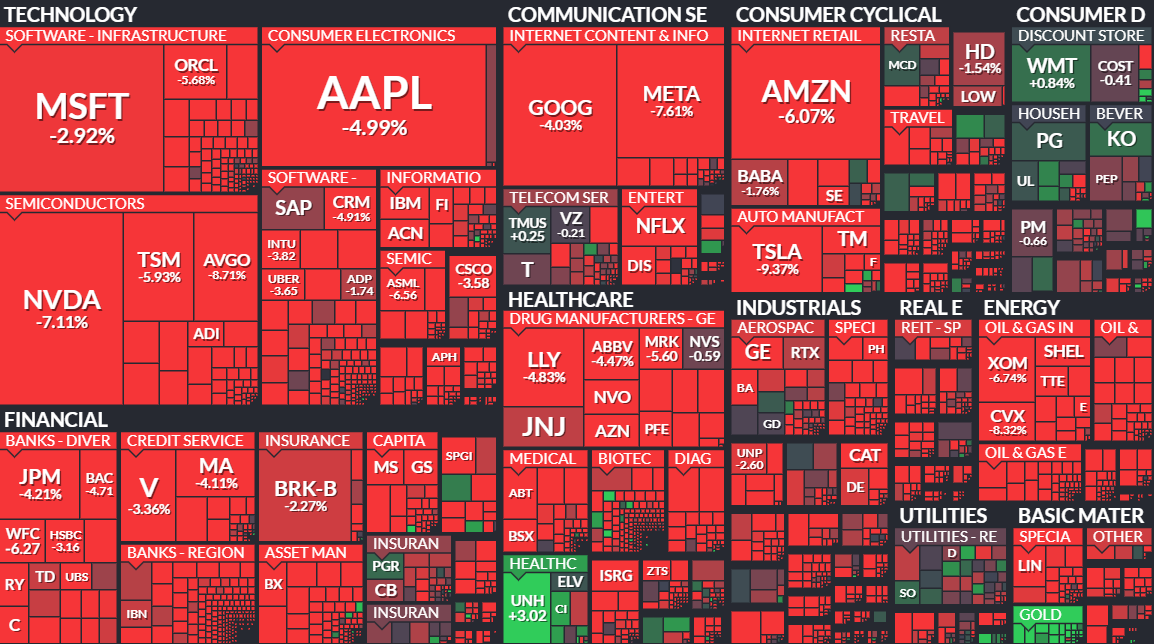

The Dow gave back 1,049 points (–2.7%), the Nasdaq tripped 4.4%, and the S&P 500 dropped 3.6% as investors realized that while Trump had eased up on Europe, Canada, and Mexico… he’s not giving up any ground on our largest trading partner, you know, the one that actually counts. CHI-NA (in trump voice).

In true fine-print fashion, the White House confirmed tariffs on Chinese goods weren’t 125% like everyone thought… nah, they’re 145% now, thanks to a stealth 20% surcharge tied to the fentanyl crisis.

Apple, Tesla, Nvidia, and Meta all sank 3–6%, and used car stocks got absolutely torched… CarMax dropped 16% after missing earnings, and Carvana fell 7%, with analysts blaming soft demand and Trump's 25% auto tariffs.

If you’re thinking about building a home, forget about it. Wells Fargo warned that tariffs on materials like steel, copper, aluminum, and engineered wood could jack up costs for builders… just in time to ruin spring housing season. New homebuyers can’t catch a break between interest rates and construction materials increasing.

Even Bitcoin took a hit (so much for tariff hedge), falling nearly 4% to $79,158, while Ether dropped 8% and Solana tumbled over 7%.

But for me, the funniest part of the day was Trump. When asked about the market tanking, he said, “I haven’t seen it” (after bragging about the market’s gains yesterday). Not long after, his Treasury Secretary tried to calm the panic: “We’re up 10%, down 5%... not a bad ratio.”

Tomorrow could be the turning point. The Producer Price Index will reveal if inflation is quietly building beneath the surface… right as tariffs are making everything more expensive.

We’ll also see the Consumer Sentiment Index, which tells us how Americans are feeling about the economy. If confidence drops, spending could follow… and that’s the last thing this fragile market needs.

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer