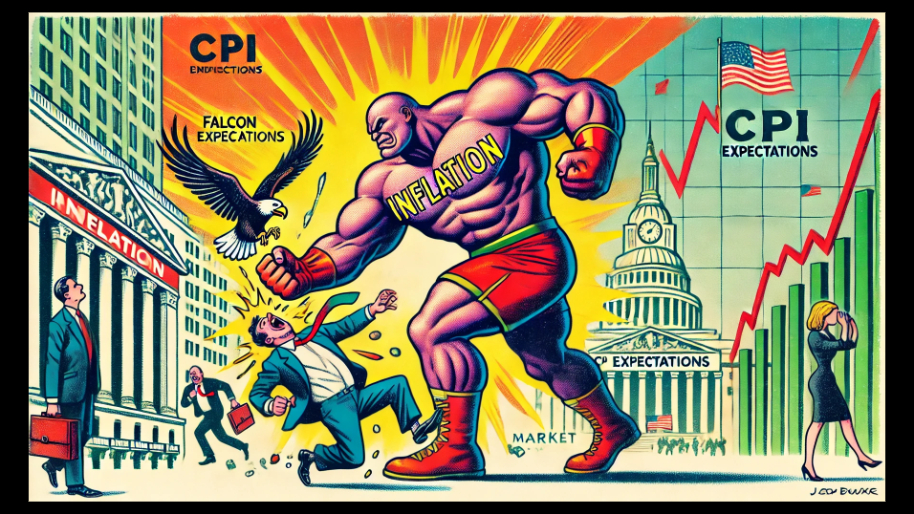

The market just got slapped across the face by inflation, and Wall Street is throwing the same kind of tantrum as I did when I found out Santa wasn’t real. The Dow cratered 225 points, the S&P 500 sank -0.27%, and the Nasdaq barely kept its head above water with a 0.031% gain, all because the CPI print came in hotter than expected—which, if you’ve been outside in the past year and paid for literally anything, should surprise absolutely no one.

In short, economists were expecting a 0.3% monthly increase and 2.9% annual inflation, but reality decided to kick them in the teeth with 0.5% and 3% instead. Core CPI—aka the Fed’s favorite excuse for ignoring how expensive food and gas are—also came in too dayum high. Naturally, the bond market reacted accordingly, with the 10-year Treasury yield spiking to 4.65%.

Additionally, Powell testified before Congress and basically confirmed what anyone with a functioning brain already knew: inflation isn’t under control yet, and the Fed isn’t about to pivot just because some hedge fund managers want to pump their bags.

(Source: Giphy)

Meanwhile, Super Micro Computer was too busy mooning to care (up 2.77%). Since it’s a key Nvidia supplier and AI is still the market’s drug of choice, its earnings crushed expectations, sending the stock into orbit while the rest of the market burned. AI is still the only trade that matters, and as long as the hype machine keeps rolling, investors will throw money at anything even remotely connected to it, fundamentals be damned.

On the other side of the bloodbath, Amazon and Alphabet got knee-capped (down 1.65% and 0.88%, respectively), because rising rates are terrible for companies that depend on cheap money and infinite optimism.

(Source: Giphy)

Now over in the “holy hell, what just happened section”, CVS Health popped 14% after a massive earnings beat, marking its best day since Bill Clinton was president and people still rented VHS tapes from Blockbuster. Zillow, on the other hand, got obliterated due to the fact housing isn’t thriving when mortgage rates are hovering between 6.5%-7%. Avis also tanked hard, because people aren’t exactly lining up to drop a small fortune on rental cars when they could just Uber their way through life for less.

So yeah, a lot of action today that led to nowhere (except for CVS holders who are probably still in the red, but not as much in the red—if you know what I mean). In the end, it appears the market is going to have to suffer through more volatility, more whining, and more AI-driven insanity until Powell finally decides inflation is dead enough to risk another cut. Meaning if you’re bag-holding anything that needs lower rates to survive, you might want to start praying, because Powell & the Boys won’t be saving us soon. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

Stocks.News holds positions in Amazon, Alphabet (Google), and Uber as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer