Hey there, player. Today we’ve got Elon testing the waters for a trillion-dollar IPO, Cracker Barrel committing another hate crime, and teachers giving Congress a hard F for their blockchain pension experiments.

If you stick around for the whole ride, give yourself a pat on the back… that’s 2 minutes of focus most couldn’t muster on their best day.

Stay rowdy (within reason),

-Will

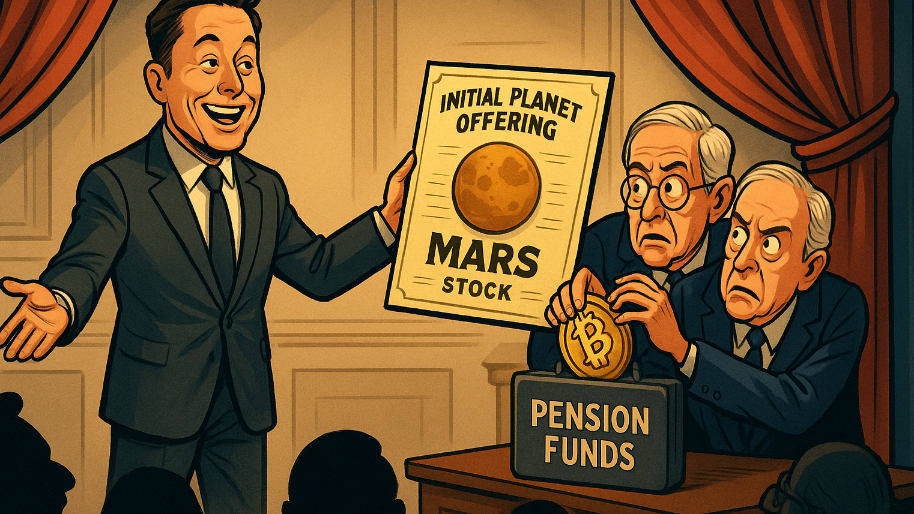

Initial Planet Offering

Elon a decade ago: “I’m going to build a civilization on Mars…”

Entire Internet (minus Tesla fanboys): “This guy’s joking, right?”

Today: Reports say SpaceX is planning a 2026 IPO…

Those same people: “You son of a b*tch, I’m in.”

Because now it’s not just Elon yelling about terraforming and Martian democracies… there’s a real shot SpaceX goes public in a $25+ billion IPO that could slap a $1T+ sticker on the rocket factory.

Yes, the most unhinged brain in the game might soon run two trillion-dollar public companies. Get your popcorn and brokerage account ready.

Someone who definitely signed an NDA (and praying Elon isn’t tracking them via Starlink) says SpaceX is already talking with banks about a June or July 2026 listing. If it happens, we’re talking Saudi Aramco-sized history.

The hype train, of course, is Starlink. What started as a “cute little satellite project” is now a global internet empire welded to reusable rockets. Direct-to-mobile is coming, military contracts are printing, and SpaceX wants IPO money to build orbital data centers. Cloud computing… in space. (Bezos is somewhere punching a drywall panel at Blue Origin HQ).

Then there’s Starship… the stainless-steel skyscraper built to yeet humans to the moon, Mars, or whatever coordinates Elon fat-fingers. And the scary part: it’s actually progressing. Meaning his 2018 “civilization on Mars” rant might’ve been the most honest thing he’s ever said.

Meanwhile, Wall Street Executives are already whispering that if SpaceX goes public, a flood of unicorns (OpenAI, Anthropic, and every random startup with “AI” in its name) will stampede into the public markets right behind it.

As for the catch? Well, SpaceX is… expensive. A former ECM head even said, “I’d be suspect if OpenAI or SpaceX are worth $1T based on their revenues and growth rates.” Cute. As if valuation has ever stopped anyone. Remember when Uber went public at $75B when it was losing $8 million a day?

Here’s the dilemma: SpaceX is a generational engineering miracle and a public-market nightmare. Capital-intensive, moon-shots over profits, run by a man who spends more time tweeting than soothing Tesla shareholders.

Elon and Co. once famously said they wouldn’t IPO until “we’re flying regularly to Mars.” So either that policy died… or they’re about to promise a Mars shuttle service in 2026.

Oh and a $1.5T listing that floats just 5% requires feeding $75B worth of shares to the market… the financial equivalent of dropping a whale into a koi pond.

But hedge fund managers don't get graded on effort; it gets graded on FOMO. Miss a debut that jumps 30-50% and your next project is updating your résumé.

So despite all the complaining, they’ll show up with bags of cash the second Musk even mentions paperwork.

Shockingly, Musk denies the rumors… which usually means the countdown to him doing exactly that has officially begun.

Pro tip: when this thing prices, shorting anything will be a terrible life decision.

Quick(er) Hits

-Live look at Cracker Barrel’s CEO after earnings:

Cracker Barrel reported yesterday and… it was violent. The Street did not congratulate them for trying something “fresh.” Shares tanked nearly 10% after hours on missed revenue, missed earnings, and guidance so awful it should come with a waiver.

And yes, this all ties back to The Logo Fiasco… the 72-hour “modernization” attempt that rattled the customer base harder than when Bud Light force-fed Dylan Mulvaney down everyone’s throats (pun not intended).

In August, Cracker Barrel decided to be “updated,” stripped the country-store feel, ditched the mascot, brightened the walls… and immediately incinerated its brand equity.

People revolted. People who have never even used the word revolt. Corporate walked it back in a week, but the damage was baked in, and these numbers are the chalk outline.

Uncle Herschel’s receipts:

Same-store restaurant sales down 4.7%. Retail down 8.5%. Net income flipped from a $5M profit to a $25M loss. Guidance cut from $3.35B-$3.45B to $3.2B-$3.3B… deep enough to qualify for disability.

Then there’s the board drama: shareholders kept the CEO but punted a director, which tells you exactly how confused everyone is. When your governance looks like jury duty in a town of 400 people, nothing good is happening.

So now what? Besides trying to stop the internal bleeding… fans pray Cracker Barrel remembers you cannot rebrand nostalgia without getting dragged behind the metaphorical tractor.

The customer base doesn’t want “fresh.” They want the porch. The rocking chairs. The laminated menu from the Bush presidency. And the scent of a candle store trapped in 2004. That is the assignment.

Instead, they tried to become Panera with fiddles… aimed at people who responded, “Eat sh*t.”

The stock will bounce eventually. “BTFD,” right? People love breakfast with emotional support. But for now… the negative sentiment isn’t done hitting an old man in public.

-Babe, wake up, Mrs. Stevenson just put Capitol Hill in detention for financial malpractice…

The American Federation of Teachers dropped a “with all due respect, stop being idiots” letter on Tim Scott and Elizabeth Warren, torching their new crypto bill… the Responsible Financial Innovation Act. Their take? The name is responsible. The bill… absolutely isn’t.

AFT president Randi Weingarten went full-caps-lock, warning the bill strips the few crypto safeguards that exist, weakens traditional securities protections, and might let retirement portfolios accidentally pick up assets cooked by bored teenagers between classes.

She’s not wrong, considering the nightmare scenario where non-crypto companies tokenize their stock and sidestep securities law entirely.

Translation: Boeing or Walgreens slaps their shares on the blockchain like some “NFT but make it corporate” experiment… and suddenly your pension owns assets your regulators can’t even spell.

Even Larry Fink (tokenization’s Top G) is probably thinking, “Alright, maybe not that fast.”

But like any teacher when the bell rings, Weingarten wasn’t done. She also argued the bill treats crypto like it’s mature and stable.

Hard to disagree when the industry’s defining saga starred SBF and his runway-model girlfriend convincing Washington they were the future of finance… until one tweet nuked their entire fake empire.

Hence why the AFT says this bill could “set the stage for the next financial crisis.”

They’re not alone. The AFL-CIO hates the bill. State regulators hate the bill. Plenty of Democrats hate the bill. Senator Mark Warner literally said he’s “in crypto hell” trying to negotiate it.

Meanwhile, Bank of America, Citi, and Wells Fargo are shuffling into meetings with lawmakers because even they don’t know what radioactive asset cocktail they’re about to inherit.

Yet Senators Cynthia Lummis, Bernie Moreno, and Tim Scott insist the bill simply gives digital assets a regulatory framework. Translation: our crypto donors want this passed, stop asking questions.

And look, the Senate version builds on a House bill that already passed… but to reach Trump’s desk, it needs seven Democrats. Current count? Rhymes with “hero.”

As much as I’d love to dunk on the teachers, they’re not wrong. Stocks should stay in their boring SEC-supervised lane. If I want to wander into the lawless crypto saloon, I’ll go myself… I don’t need a Fortune 500 stock moonwalking into token territory.

-America’s Obesity Problem: “I never said thank you…”

Eli Lilly: “And you’ll never have to…”

The company that single-handedly disbanded your mom’s Weight Watchers meetings is now dropping a new manufacturing plant right in the middle of GLP-1 mania… Huntsville, Alabama, where Waffle House is a state religion.

Why? Because demand is still so stupidly high that Big Pharma is pouring concrete as fast as zoning boards can blink.

The new Huntsville site is part of Lilly’s larger “we’re building factories everywhere” era… $27B in new U.S. plants announced this year alone, on top of the $23B since 2020.

The drug behind it? Orforglipron… a pill America will fistfight their neighbor for.

The $6B plant starts construction in 2026, finishes in 2032, and will boost U.S. API production, give the FDA fewer things to whine about, and help Lilly pump out enough orforglipron to keep TikTok weight-loss trends alive and absolutely printing.

Trump’s threatened drug-import tariffs didn’t hurt either. They opened the door for Lilly to ink enough deals to calm the onshoring panic.

Result: Huntsville gets 450 high-paying jobs and 3,000 construction roles… Alabama basically won the economic-development lottery without buying a ticket.

And once the pill gets approved (the FDA already tossed it a priority-review voucher), production ramps, and every clinic in America starts prescribing GLP-1s like they’re Flintstones vitamins… Lilly gets to keep wearing the crown in the single hottest market on earth.

Translation: if you think Alabama football is intense, wait until the state becomes ground zero for America’s skinny-pill surge. And yes, this only means one thing (money), which is presumably why investors yeeted Lilly shares -1.54% on the day.

Apparently cap-ex wasn’t on the menu… though it’s nothing compared to whatever Jamie Dimon and the boys are lighting on fire in Manhattan and London (see: JPMorgan’s $5B budget oopsie).

So yeah… Eli Lilly is once again making waves. And the people of Huntsville will now be arguing not only over which cousin to marry, but who gets first dibs on the skinny pill.

Movers and Shakers

Well well well… if it isn’t Wall Street realizing that begging Powell for rate cuts does occasionally work… just not the way anyone thinks it will.

Stocks ripped on Wednesday after the Fed dropped a 25 bps cut in its final policy move of the year. The Dow yeeted itself 1.1% higher (over 500 points), the S&P 500 climbed 0.8% toward a record close, and the Nasdaq added nearly 0.5% because tech simply refuses to sit quietly like the rest of us.

But before anyone breaks out the cigars, Powell also slipped in a little “don’t get cute” warning. Yes, it was the third cut of the year… but the Fed now expects one more cut in 2026 and that’s it. The easing train is slowing down, folks. Please stand clear of the doors.

And the vote? Oh, the vote was messy. Kansas City’s Jeff Schmid and Chicago’s Austan Goolsbee wanted to hold rates steady (boo). Fed governor Stephen Miran wanted a bigger cut… half a point.

Translation: nobody agrees, and Powell was seen walking into his presser like a dad trying to convince three screaming kids that, yes, they’re all going to the same restaurant.

The split reflects the whole vibe on Constitution Ave right now: some officials think the cooling labor market needs help, others think cutting again risks kicking inflation back to life like a cursed doll in a horror movie.

Meanwhile in corporate land, GameStop slipped 3% after missing revenue (tough week for the meme economy), while GE Vernova doubled its dividend and the stock responded like it just got handed the keys to a new company car (+16%).

The takeaway? Powell handed over the cut, then immediately reminded everyone he still enjoys being mysterious. Hence the collective office-chair pacing.

Today’s heatmap:

Who’s Up Next?

Wednesday: Oracle (ORCL)

Thursday: Broadcom (AVGO), Costco (COST)

Friday: Lululemon (LULU)

Lastly, make sure to check the official Stocks.News app (yes we have an app) to see the recap for today’s Stock Prophet Watchlist. If you haven’t yet, go here to download the app.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer