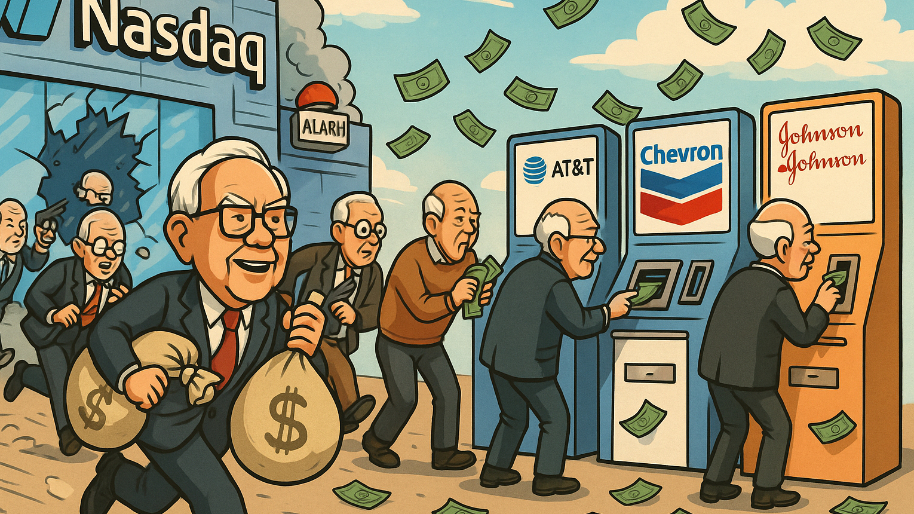

Well, isn’t it poetic that the Dow wakes up from its coma and stunts on these AI hoes just as Warren Buffett’s Last Dance takes its final bow? Once again, old-school capitalism is back in style… and the rotation into real companies with actual revenue is hitting harder than ever.

The Granddaddy index climbed another 0.7%, brushing up against 48,000 and flirting with yet another record close. Meanwhile, the S&P 500 left the chat (+.06%), and the Nasdaq fell 0.3% as Big Tech tripped over the mountain of expectations it built during earnings season.

AMD was the lone standout, ripping nearly 10% higher after CEO Lisa Su unveiled her “AI world domination” plan, complete with a promise of 35% annual revenue growth over the next few years. Institutions ate it up. But Nvidia, Apple, Amazon, and Tesla clearly missed the memo… each dropped between 1% and 3% as even the unbearable AI defenders on Twitter rotated out of the overvalued names into healthcare stocks.

Circle learned the hard way that its true CEO isn’t in Boston… it’s Jerome Powell. The newly IPO’d stablecoin posted one of its strongest quarters since going public (revenue up 66% to $740 million, earnings tripled to $0.64) and still got punished with a 10% selloff.

Why? Because the gravy train that is interest income is slowing down. The company’s average reserve yield dropped to 4.15%, down nearly a full percentage point, signaling the easy-money era for stablecoin profits might be fading fast.

Beyond Meat got tossed back on the grill after Barclays halved its price target to a single, lonely dollar… citing collapsing demand, horrific margins, and a terminal case of brand fatigue. Translation: consumers have officially tapped out on fake beef.

While it stings watching the Mag 7 get bodied, today was a textbook reminder that Buffett’s gospel still hits harder than ever… own slower, steadier, stabler businesses that make real money. If you’ve had the patience to hold onto a few of those in your portfolio, give yourself a pat on the back for staying sane and not panic-selling your dividends just to YOLO into Palantir after its millionth “classified government contract” headline.

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

At the time of publishing this article, Stocks.News holds positions in Apple, Amazon, and Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer