Hey there, player. Today we’re serving Jensen weaseling the White House into handing him the keys to China’s piggy bank, David Ellison launching a full-blown hostile takeover for Warner Bros (with Daddy’s money), and Donnie lighting farmer’s crops on fire… to then show up with government bailout checks.

If you stick around for the whole ride, give yourself a pat on the back… that’s 2 minutes of focus most couldn’t muster on their best day.

Stay rowdy (within reason),

-Will

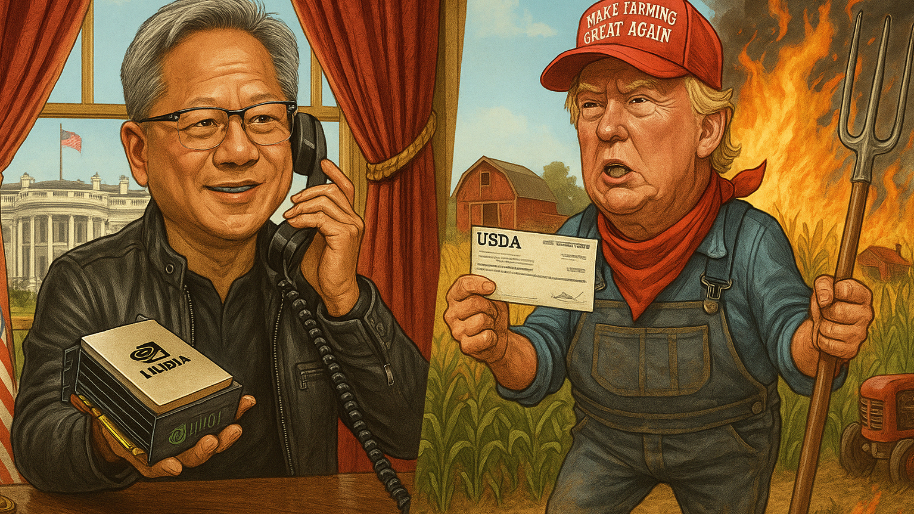

Jensen Got That Diplomatic Rizz

License to kill absolutely print…

There will be movies made about Jensen Huang, and one of those will be about how he just weaseled Donnie Politics to give him the official keys to the Red Dragon.

In case you were too busy figuring out how in the “flying F” Katy Perry and Justin Troudou happened, Nvidia now gets to ship its H200 chips back into China, that is, as long as Beijing pays a 25% “we’re America, deal with it” surcharge.

Intel and AMD technically got the same permission, but let’s be honest: China is not waking up in the morning wondering where its next batch of MI300s is coming from. They don’t want scrubs, they want H200s.

And while everyone was still arguing about the national security implications, Jensen was somewhere smiling like a man who just got unbanned from his favorite casino.

For more context, Nvidia was losing billions in potential China revenue from these bans. So it’s easy to see why this is a big deal. Because now with a 25% toll booth slapped on top, they get to make those billions plus a little extra “thanks for playing” fee from China that goes straight to the U.S. government.

Of course, not everyone is popping bottles here. Capitol Hill is having a meltdown. Elizabeth Warren called it a “colossal national security failure,” which means absolutely nothing because she also once called Bitcoin a “shadowy criminal syndicate” and then watched half of Harvard’s endowment pile into it.

Meanwhile, Trump framed it like a patriotic win: “We’re protecting national security, creating jobs, and keeping America’s lead in AI.” Translation: We’re letting Nvidia cook.

With that said, China doesn’t want downgraded chips. Jensen said it himself… “they won’t accept that.” So if the H200 gets approved at full strength, China’s either buying the real thing… or they’re building a time machine to go back and prevent Huawei from getting sanctioned in the first place. Either way, Nvidia wins.

Which is why Nvidia stock popped 1.72% on the day and investors immediately forgot everything they said last month about “AI being overpriced.” A.k.a., the usual cycle.

So where do we go from here? For starters, Nvidia’s U.S. customers are already moving to Blackwell and Rubin which are the actual money printers.

The H200 is basically inventory they weren’t allowed to sell until now. So China buying it just clears the shelf so Jensen can keep rolling out the high-end stuff uninterrupted. Bigly. Quick(er) Hits

-Ellison Pulls a “Surprise, B*tch” on Netflix

“Gator don’t play no sh*t” - Larry Ellison looking at himself in the mirror yesterday morning…

Run it back, my friends… because if you thought the Paramount-Skydance deal was an absolute clown circus, let me introduce you to its little friend: Netflix vs. Paramount.

After Netflix won the bidding war for Warner Bros. Discovery last week (at a $72B valuation, mind you) Paramount Skydance is now launching a full-blown hostile offer at $30/share, valuing WBD at $108.4B. Same price they got ignored at… just louder this time.

And Paramount isn’t even pretending it’s strategic anymore. They’re going straight to shareholders with a stack of cash and a threat to “finish what we started.”

They’re also tossing in all the cable assets Netflix couldn’t give two f*cks about… CNN, TNT Sports, the whole linear graveyard. Netflix wouldn’t even look at them.

Paramount, meanwhile, is assigning them a $1/share value just to make WBD swoon. Cute. Until the breakup fees come into play: Netflix owes WBD $5.8B if the deal dies. WBD owes Netflix $2.8B if they bail.

Meaning there’s an entire legal minefield between these giants and whatever version of “successful acquisition” they think they’re pulling off.

Add in a decent chance regulators toss a wrench into the whole thing, and suddenly you can’t help but wonder how many favors David Ellison and Daddy Ellison saved up with Donny Politics.

The market’s reaction was the total opposite of last week: Paramount popped 7%, Netflix dipped -3%, and WBD floated 4% as the only honest woman in town.

Now prediction markets (our 2025 crystal ball) give Paramount a 40% chance of stealing WBD from Netflix. That was 10% a few days ago.

And the big tell? Paramount texted Zaslav that $30/share wasn’t even the best and final. WBD just… didn’t respond.

“Soooo you’re telling me there’s a chance?”

Yep. Someone’s getting furious in January. Someone’s pretending they’re thrilled. And someone’s explaining why they spent $100B+ on a company still airing The View. Fun times.

-Farmer Don Plants a Trade War, Reaps a Bailout

“It ain’t much, but it’s honest work…” -Trump sending farmers bailout checks after lighting their crops on fire.

Donnie Politics just threw on his overalls and rolled out a fresh aid package for farmers getting bodied by his very own trade war… a poetic little loop: create the pain, then cut a check to the people feeling it.

It’s like torching your neighbor’s shed and showing up with a $20 Home Depot gift card like, “We good?”

Naturally, The White House is branding the whole thing as “bridge payments,” which sounds a lot better than “tax-funded emergency relief.”

Trump made the announcement with Treasury Secretary Scott Bessent and Agriculture Secretary Brooke Rollins flanking him like two people who know they’re about to spend six months explaining why this is not a bailout, even though it looks exactly like a bailout.

About $11 billion is being dumped into the Farmer Bridge Assistance Program… a one-time payout for every farmer whose crop was left on read by China the moment the trade war alarms started blaring.

Corn, cotton, sorghum, soybeans, rice, wheat, potatoes… if it grows and goes to Shanghai, the check is in the mail.

The remaining $1 billion? USDA stuffed it into a piggy bank while it “evaluates market conditions,” basically a Dave Ramsey emergency envelope labeled: “Open only if China ghosts soybeans again.”

Predictably, Democrats sprinted to microphones. Chuck Schumer hopped on X to yell, “Trump wants credit for fixing the mess he made,” while Ron Wyden added, “Farmers don’t need consolation prizes… they need markets.”

And they’re not wrong. China (America’s soybean megabuyer) went full Casper last fall, disappearing right when harvest season hit.

Beijing eventually reopened the wallet in October as Trump and Xi crawled toward a trade truce, but imports are still well below normal and China’s stash could feed an army for a decade.

Meanwhile, the White House is running full-speed with its “Biden wrecked farming, Trump is the comeback tour” narrative.

The pitch: new trade deals open new markets, the safety net gets beefed up, and this $12B package keeps farmers afloat until the “golden age” of farming finally arrives.

When that shows up? Your guess is as good as anyone’s.

-Home Depot Forecasts 2026: 100% Chance of Broke

Live look at every real estate agent after the orange apron’s investor call:

Home Depot dropped its preliminary forecast for 2025, and let’s just say if you have your house up for sale… prepare your soul for the “holy lowball” offers headed your way.

Here’s the headline:

Comparable sales: flat to +2%.

Wall Street: “Uh… that’s it?”

Home Depot (channeling its inner Jeb Bush): “Yes. Please clap.”

The whole thing reads like a company pre-apologizing for existing. And honestly, who can blame them? The US housing market is frozen… prices too high, rates too high, and the average American is basically eating Chef Boyardee by candlelight.

Sure, mortgage rates dipped from last year’s psycho levels, but they’re still chilling in the “don’t expect movement” zone.

And when people can’t move, they’re not dropping five figures on decks, granite countertops, or that $900 smart fridge that plays Spotify for reasons unknown.

Translation: if you’ve been procrastinating home improvement projects, congratulations… you’re now part of Home Depot’s earnings call.

But HD still pulled a “Choose Your Own Adventure” moment. High on copium, they offered a “market recovery” scenario: “If housing magically fixes itself, comps could grow 4% to 5%.”

This is Jack Black telling his trainer, “If I run five miles every morning, I might get abs.” Technically possible… but also… nah.

CFO Richard McPhail tried to pep-talk it: “We believe housing pressures will correct.” Love the confidence, Rich.

But the housing market currently looks like the final scene of Titanic. The general economy may actually be Rose… letting housing sink while hogging the door.

Meanwhile, HD stock is down 9% this year while the S&P is up 16%, and that “rebound in demand” everyone prayed for? Did not happen.

Ted Decker pretty much admitted: people are broke, scared, and only replacing things that are literally on fire.

Add fewer big storms (bad for sales) and Donnie Tariffhands raising import costs, and you’ve got inflation… with extra steps.

Home Depot is America’s accidental economic barometer… and right now? The economy is whispering: “uh oh…”

Movers and Shakers

Wall Street spent Tuesday in full “hurry up and wait” mode as traders stared down tomorrow’s big moment: the Fed’s final rate call of the year. And the vibes? Let’s call it… cautiously bored.

The S&P 500 barely budged, slipping just 0.09% to close at 6,840.51. The Nasdaq managed to stay awake long enough to eke out a 0.13% gain.

Meanwhile, the Dow wandered off in the wrong direction (down 0.38%, or 179 points) thanks mostly to JPMorgan sh*tting the bed on fresh cost warnings for 2026. Apparently rising credit card competition and higher AI spending is the new double whammy nobody on Wall Street asked for.

Dig a little deeper and the picture doesn’t get much more exciting. Stocks opened soft after job openings unexpectedly ticked higher, even as layoffs jumped. The Nasdaq initially took that personally before shaking it off and floating back into the green.

And over in small-cap land, the Russell 2000 decided to ignore everyone else’s mood entirely and ripped to a brand-new all-time high. (Small-caps hearing about the Fed: “Cool story, anyway watch this.”)

But the real story is what happens next. The Fed kicked off its two-day December meeting on Tuesday, and markets are basically treating tomorrow’s decision like a foregone conclusion. Nearly 90% of traders now expect a quarter-point rate cut.

In other words: everyone’s pretending to play it cool, but the market already sent Powell a “You up?” text. Now we wait for him to answer.

Today’s heatmap:

Who’s Up Next?

-Costco (COST) reports on Thursday and Lululemon (LULU) on Friday… both will shed light on how the consumer is holding up heading into year-end.

Lastly, make sure to check the official Stocks.News app (yes we have an app) to see the recap for today’s Stock Prophet Watchlist. If you haven’t yet, go here to download the app.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer