Well, that escalated quickly.

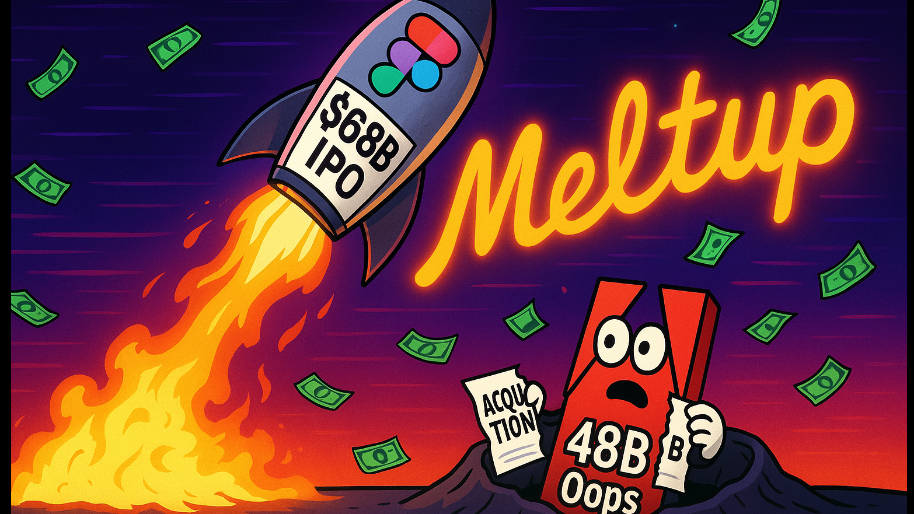

Figma, the design startup that let’s plebs like me feel like a UX god, just made the glorious circus that is, their IPO Debut, it’s b*tch. Priced at $33, Figma opened at $85, halted after ripping through $112, and finally closed at $115.50. That’s a 250% gain and a $68 billion market cap for a company that was supposed to be sold for $20 billion just two years ago… before the fun police in the UK and EU regulators stepped in and canceled Adobe’s monopoly wet dream.

(Source: Giphy)

Side note: If you’re CEO Dylan Field, you now owe Brussels a fruit basket and maybe a small country. The man just netted $6 billion personally thanks to antitrust enforcement… proof that sometimes government overreach is the best founder accelerator on Earth.

(Source: CNBC)

As for more receipts on the day legends will be written about, Figma’s offering raised $1.2 billion, though let’s be clear… Most of that went to existing shareholders like Dylan Field’s pockets. Sequoia, Greylock, Index Ventures, and Kleiner Perkins all dumped shares like the early WeWork crew, while many, many more degenerate retail traders flooded in to take their place. Why? Well, because the company is one of the few latest AI babies that isn’t just hype with zero cash flow. The company pulled $247–$250 million in Q2 revenue, up 40% YoY, and banked up to $12 million in operating income. Oh, and 1,000+ clients pay them over $100K a year… including Google, Microsoft, Netflix, and Uber. If you’ve ever opened a Google Slide deck and thought, “Wow, this layout looks like it was made by a sleep-deprived intern with a Figma license,” now you know why.

(Source: Infinum)

However, the bigger story, is the backdrop that lead to this absolute chaos. Translation: Adobe got saved from itself, and accidentally minted a monster. For context, back in 2022, Adobe agreed to buy Figma for $20 billion… a price that made no sense then and makes even less now. Regulators balked, citing competition concerns. Adobe shrugged, killed the deal, and went back to whatever it does now… a.k.a. Grifting consumers with hidden fees and horrendous cancellation hurdles.

(Source: Digital Synopsis)

And yet, by doing so, they created their own final boss. Figma’s now worth more than Adobe’s entire Creative Cloud business. The lesson: Some things are worth fighting for, and Adobe just got a raw lecture in it. Additionally, this is just another example that the IPO markets is officially open season. In fact, if any company raised a Series C in 2021 and hasn’t IPO’d yet, you can bet your tail the board is already drafting tweets in the Notes app titled “We’re excited to begin our next chapter…” this morning. Chime, Circle, CoreWeave, Hinge Health, and Omada have all tested the waters this year. And now that Figma has successfully ripped faces off, we’re likely looking at a fresh wave of exits, hot takes, and laughable fintech valuations.

In the end, Figma had a day, while those who got in early pumped their bags to obscene levels. Of course, we’ll see how today goes. But just remember, what goes up, comes down just as fast. Meaning, keep your eyes on Figma who is currently up an additional 20% in pre-market, and place your bets accordingly. Until next time, friends…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer