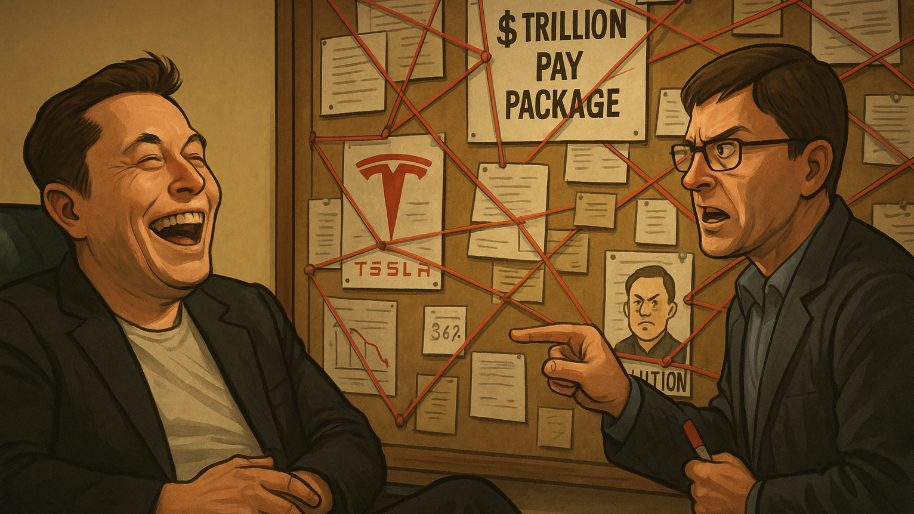

You know that feeling in the school cafeteria when you’re laughing at someone else getting roasted… and then the guy doing the roasting suddenly swivels, points at you, and cooks you alive?

Yeah. That’s Elon today… sitting at the lunch table, mid-chuckle, when Michael Burry turns and says, “Alright buddy, your turn.”

Burry has apparently taken a short break from calling Nvidia the next Enron to fire a fresh missile straight at Tesla. This all comes right after he shut down Scion Asset Management and told investors he’s “not in sync with the market,” AKA: “You people keep buying stocks I’m actively screaming about… I can’t do this anymore.” So he grabbed a bag of his own money, walked out, and set up shop on Substack so that his bearish followers can pay him $400 for his “the world’s gonna end” commentary. And folks… he is writing.

(Source: New York Post)

According to Burry, Tesla is “ridiculously overvalued” and has been “for a good long time.” (Tell us something we don’t already know Mike.) He then went on to paint Tesla as a mythic giant whose legs are made of shareholder dilution. Between Elon’s ever-expanding stock-based comp and the way Tesla routinely hands out shares like company-branded keychains, Burry thinks shareholders are getting carved up one sliver at a time.

Then we get to the $1 trillion Musk package, where Burry went full "detective board with red string." In his words, it’s not a reward… it’s a guarantee that dilution will continue forever. Tesla already dilutes about 3.6% per year with no buybacks… which he points out is worse than Amazon and only slightly better than Palantir, which is not the kind of company Elon should be proud of keeping.

From there he pivots to what he calls the Elon Cult, and this is where he really starts cooking. He argues the faithful were “all-in on electric cars until competition showed up, then all-in on autonomous driving until competition showed up, and now all-in on robots until competition shows up.” Basically, every time a Tesla storyline stops looking invincible, the narrative jumps to the next frontier, and the valuation happily follows along like a golden retriever chasing a tennis ball.

This isn’t Burry’s first dance with Tesla, of course. Back in 2021 he famously shorted about half a billion dollars’ worth of it before later downplaying the whole thing as “just a trade.” So no, he’s not publicly short today, but the new Substack absolutely reads like a man who hasn’t forgotten the taste of blood.

Meanwhile Tesla keeps climbing higher, shares up around 14% this year, still commanding 41% of the U.S. EV market, still trading at a P/E ratio near 300 because markets apparently believe robotaxis and humanoid butlers are right around the corner. Supporters think the trillion-dollar package locks in Elon’s focus. Critics like Burry think it locks in shareholder pain.

What he’s really betting on, though, is the mythology. Not Tesla-the-company, but Tesla-the-legend… the ever-expanding promise machine. And in true Cassandra fashion, Burry seems to expect no one to listen until something snaps. He literally named his newsletter after a prophet doomed to be right only after it’s too late.

So if 2026 melts down, go ahead and send your complaints to Michael Burry. He’ll probably frame them.

At the time of publishing this article, Stocks.News holds positions in Tesla and Amazon as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer