If you’ve followed Tesla stock over the last five years, you’ve probably seen Dan Ives’ name more than your own mother’s.

(Source: CNBC)

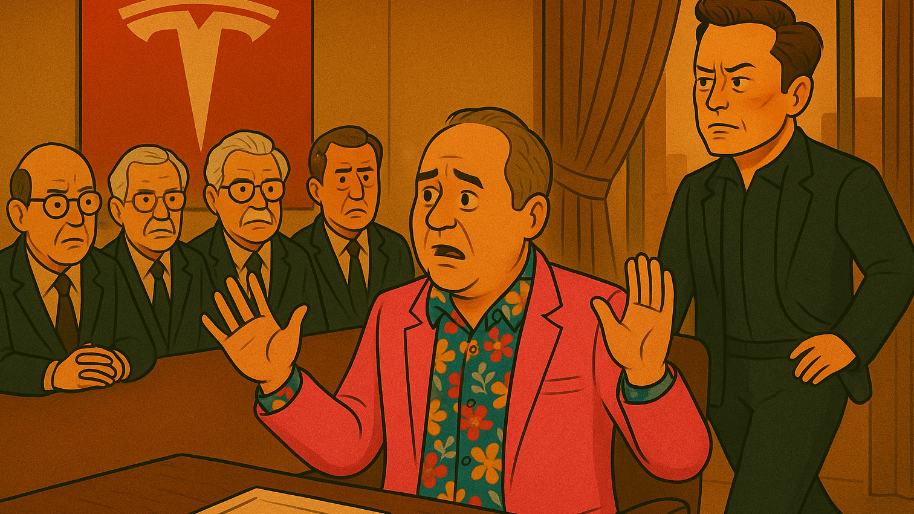

In a world full of analysts tossing out hot takes from behind a Bloomberg terminal, Ives (decked out in his pink suit jacket) somehow became Tesla’s unofficial spokesperson. Since around 2019, while most of Wall Street saw a volatile EV maker with inconsistent delivery numbers and massive panel gaps you could drive a tractor through, Ives was already talking about Tesla’s real identity… a trillion-dollar AI and software empire disguised as a car company. Less Ford, more Apple. If you squinted hard enough and ignored the Twitter meltdowns, it almost seemed believable.

To his credit, he’s stuck with that thesis through thick and thin. When Tesla’s margins cratered, he called it a “speed bump.” When the stock tanked 65% in 2022, he said it was “overdone” (talk about weathering the storm). His $500 price target is still the highest on Wall Street (take that, Cathie). So yeah, Dan Ives hasn’t exactly been shy about his love for the stock. Which made it all the more bizarre when Elon Musk, this week, told him to (and this is a direct quote) “Shut up, Dan.”

To be fair, Elon didn’t lash out completely unprovoked. The tweet came after Ives did the unthinkable: offered some light, constructive feedback. Following an ugly 7% drop in Tesla’s stock yesterday (which erased $68 billion in value) Ives released a sharply worded note titled, “The Tesla Board MUST Act.” The title alone read like a red-alert siren. The substance? Even more so. While it sounds dramatic, he actually wasn’t pulling the ripcord on his bullish thesis. He wasn’t even calling for Musk’s removal. He was simply saying, “Hey, maybe the guy who just launched a new political party should spend more time at his $700 billion company.”

Elon, if you missed it, rang in the Fourth of July not with his 100 kids (or however many we’re up to now) but by announcing the creation of “The America Party” on X, his own platform. No one really knows what it is. There’s no candidate list. No funding details. Not even an actual party infrastructure. Just vague declarations about giving people their freedom back (if he can pull this off, it would be way more impressive than creating a civilization on Mars).

Ives argued this was the final straw. He said the board needs to create a new incentive-driven pay package to keep Musk focused through 2030. He called for time commitments that would ensure Elon’s presence at Tesla (and not wherever Ron DeSantis is holding a fundraiser). And he asked for political oversight to make sure Musk’s latest side quest doesn’t tank shareholder value again. Musk’s response offered no counterargument. No rebuttal. Not even a small clarification. Just a quote tweet: “Shut up, Dan.”

And that’s when it really clicked for Wall Street. Because this doesn’t seem to be a personality quirk anymore… it’s a governance problem. Tesla’s stock is already down 25% this year, the worst performer among the Big Tech giants. At the same time that Nvidia’s breaking records and Apple’s quietly rebounding (very quietly), Tesla continues to lose money while its CEO live-tweets about constitutional reform.

Even Tesla’s most trusted allies are flinching. Analysts at William Blair downgraded the stock this week, saying investors are “growing tired of the distraction.” Pro-Trump hedge fund manager James Fishback even pulled the plug on launching a Tesla-focused ETF, publicly declaring that “Elon has gone too far.” And back in May, The Wall Street Journal reported that Tesla’s board had quietly begun searching for a Musk successor… a claim Elon and the board denied, but one the Journal stands by.

It’s all snowballing at the exact moment Tesla should be laser-focused. This is supposed to be the year of the robotaxi. The year FSD goes full throttle. The year Tesla cements itself not just as an EV company, but as a dominant AI infrastructure firm. Ives still believes that vision is real. He’s sticking with his $500 target. He still sees Tesla as one of the two best physical AI platforms on earth, right next to Nvidia. But even he knows the company won’t get there if Musk is too busy building a political brand to run the one that actually pays him.

Dan Ives spent the last five years defending every twist, turn, and tweet. And if he’s saying it’s time for the board to step in, they should probably listen… or at the very least, shoot Elon a “bro, you alright?” text. … because when you’re #1 cult member has had enough, you know it’s bad.

At the time of publishing this article, Stocks.News holds positions in Tesla, Ford, and Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer