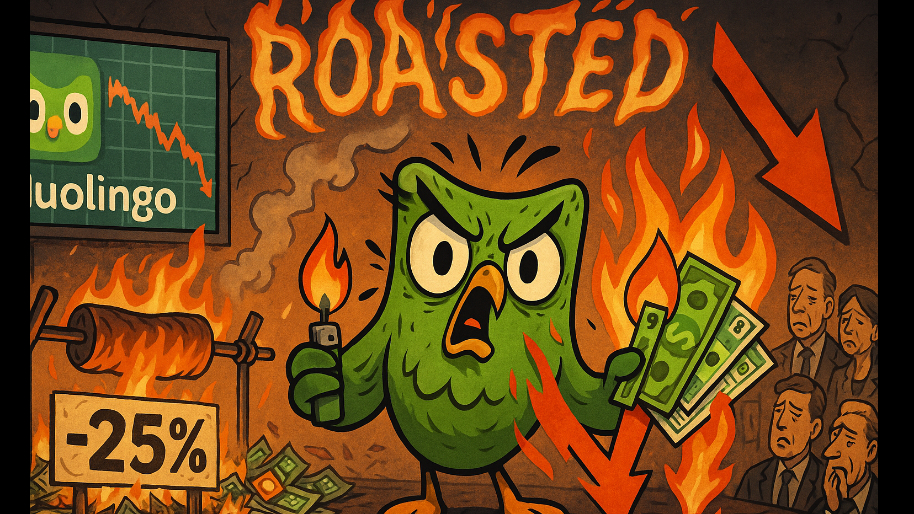

“I’ll take what he’s having…” - Duolingo after watching DoorDash’s stock get pummeled…

In case you missed it, Duolingo just got roasted. Shares cratered -25%, the biggest drop in company history, after CEO Luis von Ahn told investors he plans to spend money to make money. Now if the aftermath of DoorDash’s buzzkill earnings is any indication… the Street didn’t just like it, it threw the whole owl out of the window.

(Source: Giphy)

To be fair, Duo put on an absolute clinic of an earnings. Revenue was up 41% year-over-year to $272 million. Bookings crushed expectations. Paid subscribers hit 11.5 million… the highest ever. And yet, the stock still got annihilated. Why? Because Duolingo said the quiet part out loud: they’re prioritizing user growth over profits. For more context, Luis von Ahn went on CNBC trying to sell the vision: “We’ve made a slight shift in how we invest. We’re investing a lot more in long-term things.”

Translation: we’re lighting cash on fire to build features nobody will use until Gen Alpha is old enough to drink.

(Source: CNBC)

Meaning, Duo is going on tilt to dump millions into AI toys… from video call practice partners to course-building bots that can pump out languages faster than college students forget them. It’s cool tech sure, but it’s also a friggin’ expensive. Plus, given that R&D spending has exploded, user growth is fine-not-great (daily actives: 50.5 million, short of the 51.2 million expected), and bookings for next quarter came in light… the cue for panic selling is valid.

The funniest part though, is that net income was technically $292 million… but that was juiced by a one-time $222 million tax benefit. Without that, profit looks like a limp bizkit. Because of this, KeyBanc downgraded the stock, saying the benefits of these “long-term initiatives” will take “several quarters” to show up. Meta shareholders to Duolingo shareholders: “First time?”

(Source: Giphy)

With that said, the irony is that Duolingo actually is doing what every investor says they want… playing long ball, leaning into AI, expanding the funnel… but Wall Street doesn’t want patience, it wants dopamine. Which means, even though revenues are up, the company’s healthy, and the owl’s still threatening people on TikTok… investors could give a rats a$$. They saw “spending more” and proceeded to yeet the stock.

Of course, this could’ve just created the most enticing “BTMFD” setup of the week… but for now, it’s going to take a lot of buying streaks to keep this thing from becoming even more of a falling life. So given this, do what you will with this information and place your bets accordingly. Until next time, friends…

At the time of publishing, Stocks.News holds positions in Meta as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer