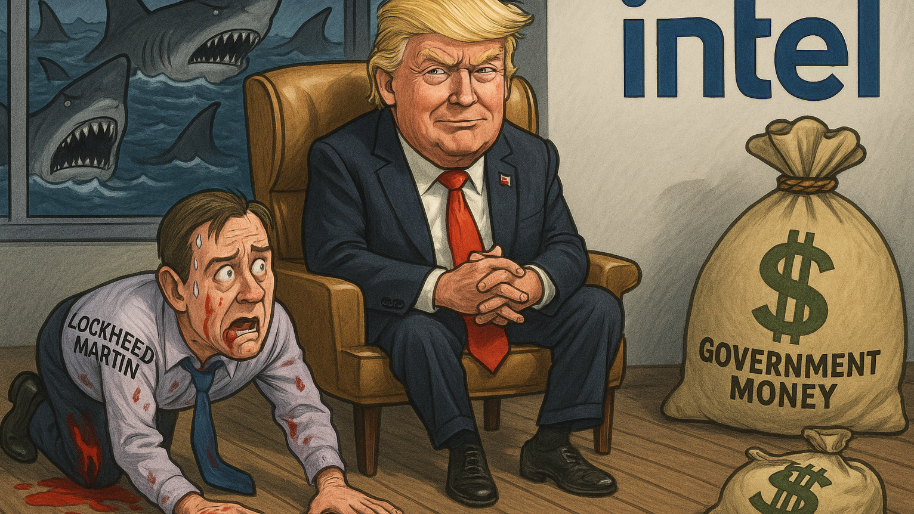

"I'm a Business… Man!"

Rumor has it The Donald is back out on the prowl, hunting for his next company to give the full Intel treatment. And from the sound of it, Lockheed Martin might be the one getting cuffed into a Pentagon pay-to-play relationship… taxpayer cash swapped for some serious equity. (Trump basically has financial ADHD at this point… one day he’s foaming at the mouth about tariffs, the next he’s watching Shark Tank reruns at Mar-a-Lago going, “Look, folks, I can do that too. Mark Cuban? Total lightweight. Kevin O’Leary? Nobody even likes him, they call him Mr. Wonderful, he’s not wonderful. I’ll make the best equity deals.”)

Say what you want about Trump (and trust me, people do), but let’s not pretend Uncle Sam hasn’t been running GoFundMe’s for corporations for decades. Taxpayer money has been flowing to big business like it’s free drink night at Applebee’s… everyone gets a round, and somehow we’re still stuck with the tab. Intel got $11 billion in subsidies under Biden’s CHIPS Act without giving up a single share. Trump flipped that playbook and told voters: if Uncle Sam cuts the checks, Uncle Sam gets equity. Call it socialism, call it capitalism with benefits… either way, at least taxpayers get something back besides another ribbon-cutting ceremony.

But here’s where the Lockheed idea gets tricky. This isn’t Intel. Intel was practically in a wheelchair sipping oxygen after years of losing the chip race to TSMC and Nvidia, desperate for subsidies to rebuild U.S. manufacturing capacity. Trump took that weakness, leveraged it, and said “Fine, we’ll help… but we’re getting stock.” That was a controlled move in a very specific sector.

(Source: CNBC)

Lockheed, on the other hand, is a whole different beast. This is the Pentagon’s first-born child. The company lives almost entirely off government contracts… F-35 fighter jets, hypersonic missiles, missile defense systems. As Commerce Secretary Howard Lutnick bluntly said this week, Lockheed is “basically an arm of the U.S. government.” He’s not wrong. The Pentagon already controls the purse strings and the production line. Writing another check and printing “equity ownership” on top of it? That’s the equivalent of nationalizing America’s largest weapons maker. And that’s where the firestorm begins.

Because Lockheed isn’t exactly thriving right now. The stock is down 19% over the past year, a rough slide for a company that usually acts like a safe haven defense play. Margins are under pressure, big programs like the F-35 are over budget and constantly delayed, and competition for next-gen defense contracts is heating up. They’re not broke, but the shine has definitely worn off. Which is why the timing of this rumor is so interesting: Trump could dangle government investment as a lifeline to stabilize Lockheed’s finances, while claiming taxpayers finally get a piece of the pie.

(Source: CNBC)

The nuance here is huge. With Intel, the government got an asset it desperately wanted to shore up (domestic chipmaking) and it made sense strategically. China controls massive parts of the supply chain, TSMC dominates the high end, and U.S. leadership was looking for ways to close that gap. Equity in Intel, while controversial, could be pitched as an investment in national security and global competitiveness.

With Lockheed, the story isn’t nearly as clean. You’re not trying to rescue a company falling behind foreign rivals… Lockheed already practically owns the Pentagon. They dominate roughly 70% of defense programs, they live almost entirely off U.S. contracts, and as Howard Lutnick put it, they’re “basically an arm of the government” already. Buying equity in Lockheed doesn’t create new leverage against a foreign competitor the way Intel did. It mostly looks like Uncle Sam paying twice for the same thing… once through contracts and again through ownership.

And that’s where it starts to smell less like a smart business play and more like nationalization theater. Free-market Republicans are already squeamish. Rand Paul called the Intel stake “a step toward socialism.” Thom Tillis went even harder, comparing it to Soviet-style state ownership. If Intel was at least defensible as a way to compete with Beijing on chips, Lockheed doesn’t have the same pitch. It’s hard to sell Wall Street (or voters) on why taxpayers should own a slice of a defense giant that already depends almost entirely on taxpayer money.

And yet… this is where Trump’s leverage game comes in. In 2016, he hammered Lockheed on F-35 costs until they shaved billions off the program. Earlier this year, he tossed out the “F-55,” a mythical super-fighter that aviation experts instantly dunked on. But again, the point wasn’t realism… it was pressure. The message was clear: “I can drag you into the spotlight whenever I want.”

So could the Pentagon one day collect dividend checks off missile sales? Maybe, but the business case isn’t nearly as sharp as Intel’s. That’s what makes this rumor so intriguing… not that Trump wouldn’t try it, but that it looks more like a headline-grabber than a tidy taxpayer ROI. At the very least, floating the idea keeps Lockheed on its heels.

Because for Trump, the deal isn’t always about the numbers. Sometimes it’s about the optics, the leverage, and making sure even America’s biggest defense contractor knows who’s boss.

At the time of publishing this article, Stocks.News holds positions in Intel as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer