Somebody get my portfolio some milk…

If you or someone you love has been victimized by a bi-polar market that has you jumping out of your seat one day and crying in the corner the next… you may be entitled to compensation retail therapy.

(Source: Giphy)

In short, the market as a whole was taken behind the barn today with the Dow dumping 669 point, the S&P plummeting -1.5%, and the Nasdaq sliding -2%. Why? Because once again the main conversation today wasn’t “how big is the AI TAM?”... it was “who gets to add #opentowork on their Linkedin next?”. Starting with Cisco Systems, shares fell through the floor -13% after a limpt bizkit guidance. When the guys selling the digital plumbing start sounding cautious during an AI gold rush, people notice. It’s like the shovel company whispering, “Yeah… about all that digging.”

From there, the paranoia spread. Financials caught heat as Morgan Stanley (-5%) and friends slipped as the market decided AI might start nibbling at wealth management. Having Clawbot tell you which stocks to buy is cool… but autonomous portfolio construction at scale? That’s where financial stocks get rekt. And yet, it wasn’t just financials.

(Source: Giphy)

Logistics stocks got absolutely body-checked. C.H. Robinson cratered 15%. RXO (-20%) and J.B. Hunt Transportation Services (-5%) were right there as well. The logic is simple: if AI can optimize routes, pricing, dispatch, and freight matching in real time, somebody’s legacy revenue stream turns into a bean counting error. Elsewhere, commercial real estate also caught strays. CBRE (-9%) and SL Green Realty (-4.6%)slid on the idea that widespread AI automation = higher unemployment = less need for office space. We haven’t fixed the work-from-home hangover, and now traders are pricing in an AI layoff cycle on top of it. Woof.

As for software names… well, you guessed it, they keep bleeding. Salesforce (+.23%) is now down roughly 27% year-to-date. Autodesk (-4%) off 22% YTD. The same sector that was supposed to ride AI tailwinds is suddenly staring at margin pressure and product cannibalization. Which brings me to out beloved Apple. Shares cratered -5%, worst day since April, after reports its Siri upgrade hit testing issues and delays. Investors have been pricing Cupertino like it’s about to drop an AI nuke on the ecosystem. Instead we get an Elon level delay. Oh, and silver puked -8%.

(Source: Reddit)

Meanwhile, boring won.

Walmart (+4%), Coca-Cola (+2.87%) followed by staples and utilities led the S&P sectors, both up around 2%... a.k.a., the market's version of aspirin. Not much more details there, other than the people of Walmart continue to spend, and Coke is America’s wine of choice. As for the moral of the story today, it’s this: for two years, AI was framed as pure upside. Capex boom. Productivity surge. Margin expansion. Everyone wins.

Now traders are staring at the other side of the trade. Disruption means displacement. Efficiency means headcount pressure. Automation means someone’s legacy business model quietly gets turned into a case study. Whereas now, capital is rotating and defensives are catching bids. Translation: Anything that smells replaceable gets smoked. Meaning, keep your head on the swivel, and place yo bets accordingly. Until next time, friends…

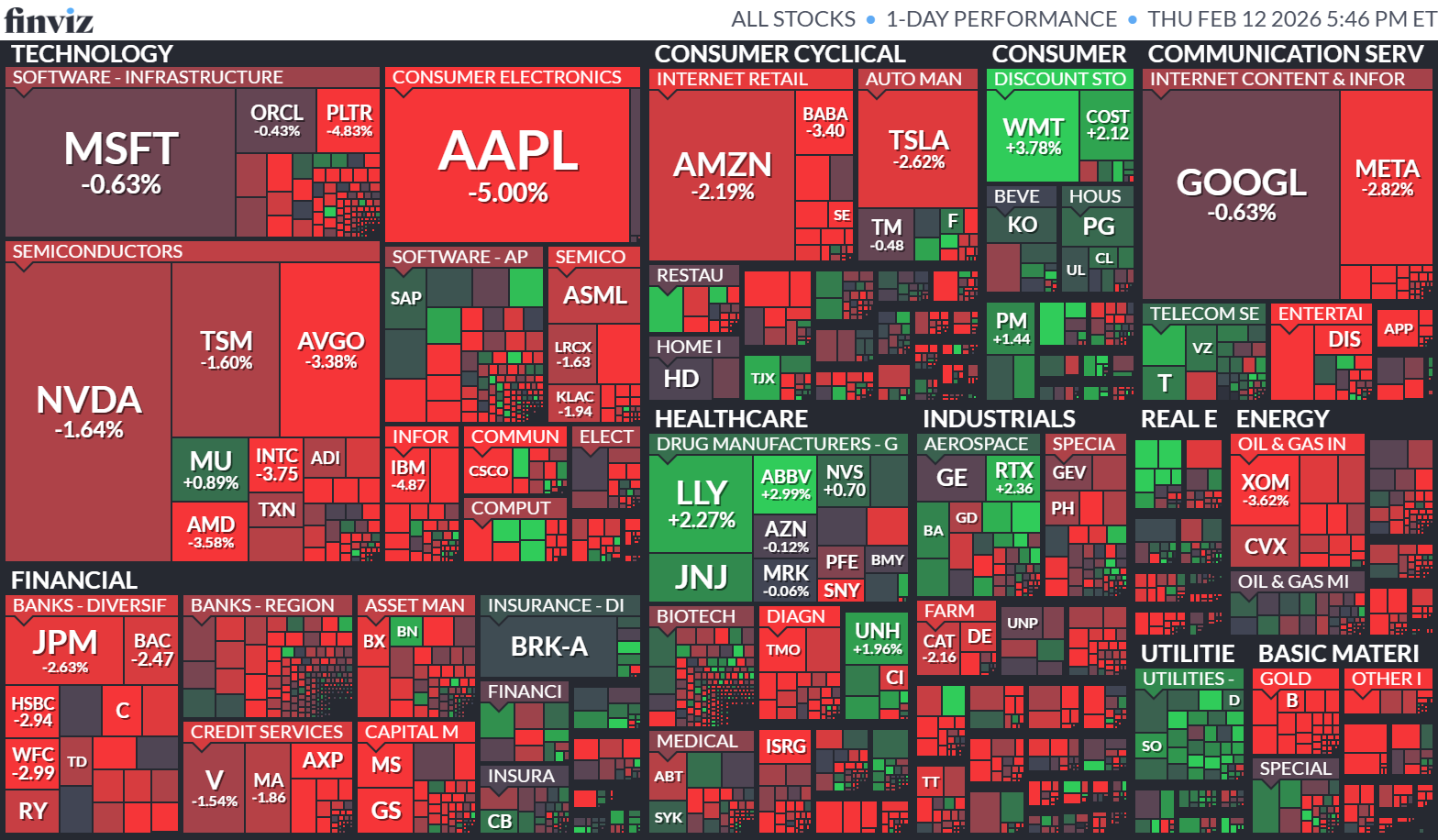

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

☕ Market Gossip

> Realtors report a ‘new housing crisis’ as January home sales tank more than 8% (CNBC): Live look at real estate investors right now…

> Gold Sinks in Shock Selloff as Traders Cover Stock-Rout Losses (Bloomberg): Aaaaaaand it’s gone…

> Apple’s Latest Attempt to Launch New Siri Runs Into Snags (Bloomberg): You hate to see it (… unless you’re short Apple).

> Anthropic closes $30 billion funding round as cash keeps flowing into top AI startups (CNBC): Things @sama hates to see: that ^

“WTF” Meme of the Day

At the time of publishing, Stocks.News holds positions in Apple and Coke as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer