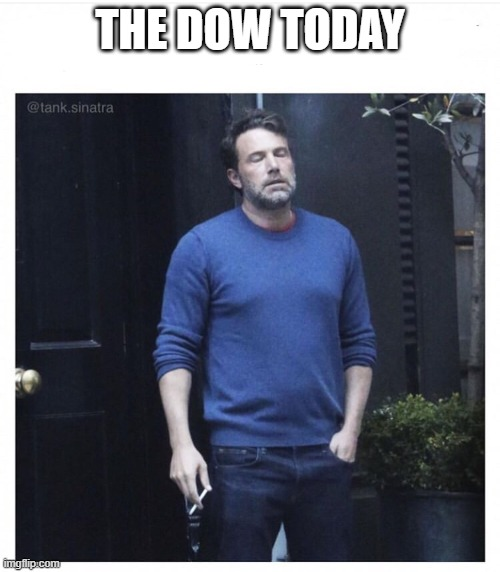

Live look at the Dow today…

After a week of headline whiplash, the S&P 500 ended Friday basically flat (+0.03%) at 6,915, the Nasdaq crept (+0.28%) to 23,501, and the Dow… well, took it lying down dropping -285 points (-0.58%) to 49,098. Alright, let’s get you back to bed grandpa.

Y tho?

Good question. The biggest reason the Dow looked like it needed a cigarette today was mainly because Goldman Sachs got smoked nearly 4%. In short, Goldman’s Q4 earnings technically beat expectations on EPS, but revenues came in lighter than analysts wanted… partly due to a markdown tied to legacy assets like the Apple Card portfolio. So naturally, a revenue miss like that can spook traders even if earnings did look alright.

(Source: Giphy)

But it wasn’t just Goldman Sachs spoiling the rave today. Major bank stocks broadly were trading lower on Friday as Morgan Stanley (-2%), JPMorgan Chase (-1.96%), and others also slid. Blame it on the beef between Dimon Hands and Donnie Deals or the floating 10% interest rate cap… regardless, bank investors got punched. On the tech side, Nvidia (+1.54%) and AMD (+2.35%) were the ones keeping the Nasdaq upright as word on the street is Jensen Huang is planning to visit China soon. Wall Street heard that and started getting all hot and bothered about GPU shipments crossing borders like it’s 2019 again. Bigly.

Intel, however , fell -17% after a disappointing outlook. “Aaaaaand, it’s gone” they all say. After going on a moonshot rally, all gains were wiped away as a weak first-quarter outlook for 2026 and a larger-than-expected Q4 2025 loss kneecapped investors. That said, Spotify (+3%) saw the opposite effect today. Shares were upgraded by Goldman to a Buy, with a $700 target and ~40% upside implied. Meanwhile, Ericsson popped +9% after better profits, a dividend lift, and a $1.7B buyback. Love to see it.

(Source: Giphy)

Oh, and in the middle of today’s havoc, analysts believe that the incoming Arctic storm could freeze more than 10% of U.S. natural gas production because the wells literally freeze. Add to the fact that this storm will cause heating demand to rise at the same time…. And well, we’re screwed. Fun times.

As for the week overall, the S&P posted its second straight losing week, even though Friday ended flat. Translation: we didn’t get nuked… but we also didn’t win. Tech is still holding the entire market together like a single mom with two jobs. Banks are acting moody. Intel is fighting for its life. And now we’ve got weather threatening to freeze the energy supply. So yeah… another week where nothing “broke”… but everything felt like it almost could’ve. Until next time, friends…

If you read all of this, congrats for having a 10 second attention span (better than me). As always, here’s our heatmap for today.

☕ Market Gossip

> Pardoned Binance founder Zhao says his business relationship with the Trumps was ‘misconstrued’ (CNBC): Tell me it was Barron's idea without telling me it was Barron’s idea…

> China Tells Alibaba, Tech Firms to Prepare Nvidia H200 Orders (Bloomberg): You either retire a hero or live long enough to see yourself become the villain (Sup, Jensen Huang)

> Airlines cancel hundreds of flights as massive winter storm sweeps across U.S. (CNBC): In the end, the greatest snowball isn't a snowball at all. It's fear. - Dwight Schrute

> Gen Z Rejects “Radioactive” Diet Sodas for Zero Sugar Ones (Bloomberg): Same, but different… but still same

“WTF” Meme of the Day

Getting cartoon Zucc’d would be next level embarrassing…

At the time of publishing, Stocks.News holds positions in Intel and Spotify as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer