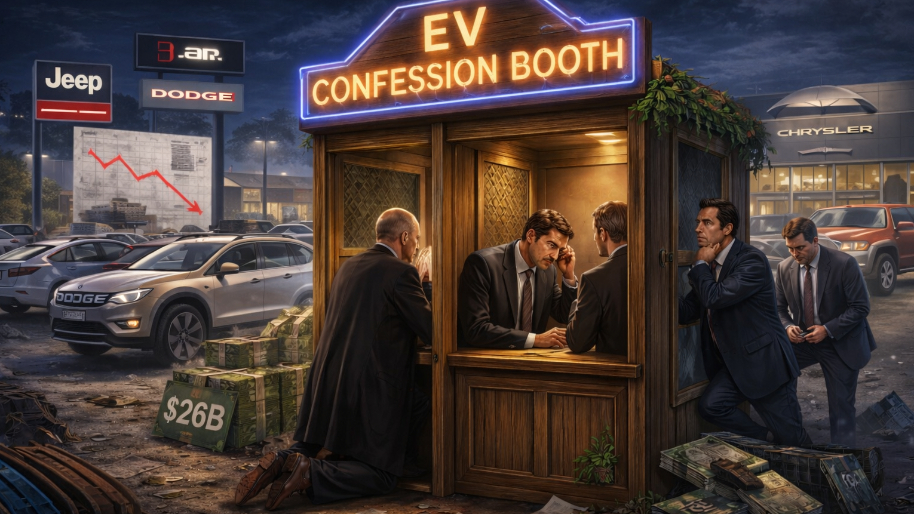

“So… we might’ve gotten a little ahead of ourselves.” -Stellantis, nervously shaking at the mic

Stellantis CEO Antonio Filosa deserves some kind of trophy for pulling off one of the biggest corporate oopsies in modern auto history. The Jeep-and-Chrysler parent more or less meandered its way to the earnings-call mic and admitted, yeah… we’re gonna need to reset this entire thing. And just like that, the pain train began

Stellantis is currently down (checks notes in disgust) 28% after the company announced it’s taking over $26 billion in charges tied to its electric vehicle ambitions that never quite found… customers. I’m sure Ford CEO Jim Farley is probably smiling ear to ear thinking “and here I thought I did a bad job with our EV division.”

So what actually went wrong, aside from the obvious problem of not selling enough EVs? The short version is that Stellantis bet hard that adoption would ramp fast. Instead, consumers looked at the pitch and said, “Cool tech… but the batteries are awful in the winter… also, have you seen interest rates lately?”

The company admitted the charges “largely reflect the cost of over-estimating the pace of the energy transition.” Translation: we built for a future that showed up late, underdressed, and (most importantly) without its wallet.

(Source: Marketwatch)

When the dust settled, most of that $26 billion hit came from canceled EV programs, write-offs tied to battery supply chains that no longer make sense, and resizing factories and production plans around demand that never actually materialized. About $17.5B of that is tied directly to the U.S., where Stellantis had to realign products with what buyers actually want… which, spoiler, still includes gas engines and hybrids.

For years, automakers like Ford and Stellantis chased EVs because regulators told them to and because Tesla was trendy, not because customers were lining up with deposit checks. That worked when governments were aggressive and subsidies were flowing. Then the rules changed. Donnie Politics rolled back emissions rules and EV incentives, and suddenly a lot of “inevitable” EV math stopped penciling.

(Source: The Hill)

Even Europe is backtracking on all those “green energy” claims. Remember the EU’s once-hardline 2035 combustion ban? Well, now it applies to only 90% of new vehicles. That 10% escape hatch matters… especially when charging infrastructure still feels… anemic? CEO Antonio Filosa announced EVs are still part of the future… but the pace will now be driven by buyers, not mandates (which is kinda how any business should be ran).

When Stellantis says it wants to be a “beacon for freedom of choice,” what it really means is: we’re selling hybrids and gas vehicles again because people actually want them. That includes doubling down on modern internal combustion engines… aka the stuff that gets folks into the dealership TODAY.

And yes… this hurts. Stellantis pre-released some ugly numbers: a net loss expected for 2025, a dividend suspended in 2026, plans to raise up to $5.9 billion via hybrid bonds, and about $7.7 billion in actual cash payments spread over the next four years. None of that screams confidence.

But here’s the thing… Stellantis isn’t alone. Not even close. This is quickly turning into an industry-wide confession booth. Ford has already flagged roughly $19.5 billion in EV-related charges, while General Motors has pulled back after taking about $7.1 billion in EV hits. Everyone overbuilt. Everyone misread demand. Stellantis just ripped the band-aid off faster… and louder.

There is, however, a sneaky bullish angle if you squint hard enough. UBS analysts more or less said the reaction makes sense, but the cleanup matters. New management, largely one-time charges, and a very clear pivot back toward profitable vehicles.

And despite all the EV wreckage, Stellantis still gained U.S. market share to 7.9% in the second half, held its #2 position in Europe, announced a $13 billion U.S. investment plan with 5,000 new jobs, and launched 10 new products while killing off the ones that couldn’t make money. So perhaps this could be a turnaround play after all.

At the time of publishing this article, Stocks.News holds positions in Ford and Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer