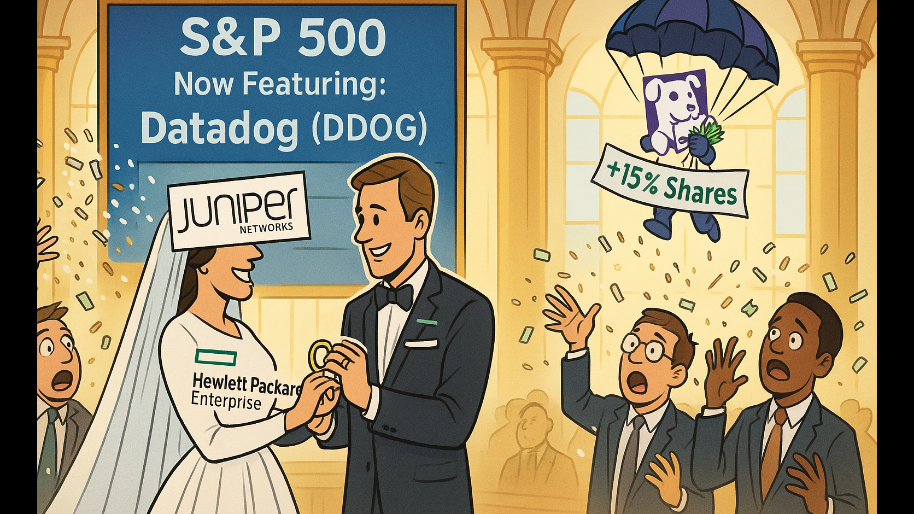

Some people get rich because they’re visionaries. Some get lucky. And then there’s Datadog, which just got handed a winning lottery ticket because Hewlett Packard finally finished swallowing Juniper Networks and the S&P 500 needed a warm body to fill the vacancy. Translation: If you’ve ever wondered what it looks like to get promoted because the guy above you died… this is it.

(Source: Giphy)

In short, S&P Global boots Juniper after the $14B buyout, and Datadog slides in… the index had a gap, and instead of giving the slot to Robinhood (lmao at those bagholders), they let Datadog in. Not necessarily because anyone had a sudden epiphany about cloud monitoring, but because index rules are a straight-up popularity contest with a bean counting.

Naturally, this had shares soaring 15% on the news yesterday, which was bigly considering Datadog was down 5.5% for the year, while the Nasdaq has been ripping in the opposite direction. Meaning if you bought Datadog last week because you “liked the fundamentals,” congrats on accidentally front-running one helluva catalyst.

(Source: Investopedia)

Speaking of fundamentals, Datadog does have some of that dawg in them. For instance, in Q1, the company reported net income of $24.6 million on $761.6 million in revenue. So yeah, they are profitable… which for cloud software puts you in the same club as unicorns, leprechauns, and SaaS companies that don’t pivot to “AI” every six minutes. But alas, cue the parade of analysts who are stepping over themselves to put their two cents in.

Case in point: Dan Ives, the poster child for tech hype, is out here saying Datadog is “well-positioned” for the so-called “big data LLM world”... translation: they inked a partnership with OpenAI, and now every sell-side analyst is contractually obligated to pretend Datadog’s monitoring tools are suddenly the backbone of the AI arms race. Did OpenAI sign a multi-billion-dollar contract with Datadog? No. Is this partnership even material on the financials? Not unless you think “joint press releases” move the needle more than actual revenue.

(Source: Giphy)

And yet, Macquarie’s Steve Koenig, meanwhile, is pushing the narrative that Datadog’s “stable usage trends” and “share gains in a growing market” mean the stock will “continue to outperform.” In plain English: usage hasn’t flatlined, they’re picking up some crumbs from Splunk and Elastic, and Datadog’s guidance is lowballing expectations. Does that mean anything for real cash flow? Marginally. Are institutional buyers putting real money to work because of “stable usage trends”? Not necessarily. They’re buying because their benchmark changed and now they have to… even if that meant Datadog was running its ops out of a server closet in Queens.

Of course, we’ll see how Datadog performs in the long run as a new member of the S&P country club… but for now, it’s definitely worth looking at. As mentioned, Datadog is one of the few cloud companies that isn’t hemorrhaging cash while yelling “AI” like it’s a safe word. They have real customers, sticky usage, and they’re wedging themselves deeper into the guts of cloud infrastructure every time some legacy enterprise wakes up and realizes Splunk still looks like Windows 98.

(Source: Giphy)

Meaning, if you have to own something in this parade of SaaS mediocrity, you could do a hell of a lot worse than a company that collects usage-based tolls on the cloud migration highway… and now gets a permanent seat at every index fund buffet in America. So yeah, take a look, do your due diligence, and place your bets accordingly. Until next time, friends…

Oh, and Happy 4th of July! May your beer be cold, your BBQ smokin’, and your fireworks poppin’.

At the time of publishing, Stocks.News holds positions in Robinhood as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer