After a year that likely had CVS shareholders nervously hovering over the buy button every single day, 2025 is off to a much better start. In 2024, CVS Health saw its stock drop over 40%, largely due to massive losses in its insurance unit, Aetna. But now shares have jumped 48%, making up for some of that pain, while Walgreens, its longtime rival, has barely moved, up just 3%.

CVS spent the last 3 quarters missing earnings estimates like StormTroopers miss their targets in every Star Wars movie. The main culprit was that their insurance unit was losing massive amounts of money. But, somehow they figured out a way to beat last quarter’s expectations and they're also forecasting 2025 profits between $5.75 and $6 per share.

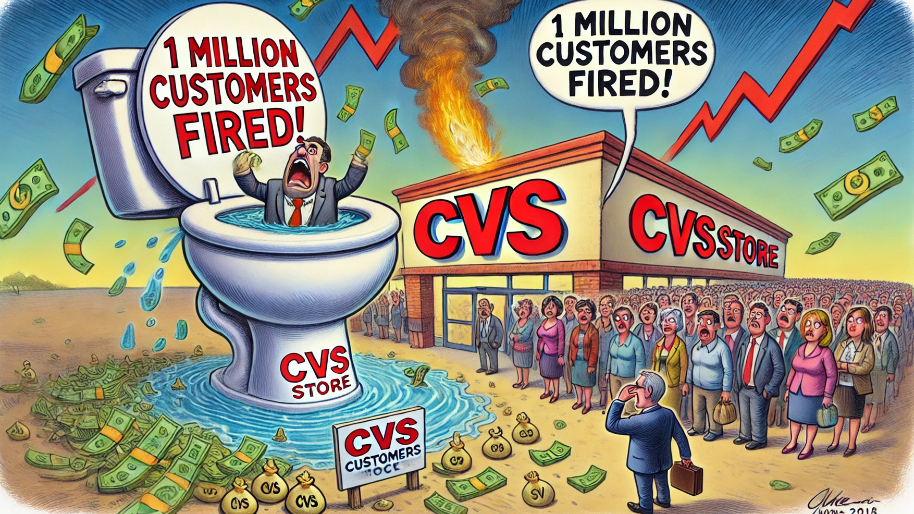

New CEO David Joyner, barely 100 days into the job, is already making major moves. His Einstein strategy? Make less money by serving fewer customers. On paper, it sounds counterintuitive, but CVS is dropping unprofitable health plans, raising premiums, and shedding about one million insurance members, including 800,000 in the individual market. Even Medicare Advantage enrollment is expected to shrink by a high single-digit percentage. The idea is simple: stop insuring customers who rack up huge medical bills and focus on the ones that are more profitable. Sometimes, the best way to make money is to stop losing it.

Unlike Walgreens, which is mostly just a prescription pick-up spot for your grandma, CVS runs a three-part business model: retail pharmacies, insurance through Aetna, and a Pharmacy Benefit Manager, which acts as the middleman in the prescription drug supply chain. This setup gives CVS a few extra levers to pull when things get ugly… something that’s making analysts a little more excited about the company’s future.

Michael Cherny of Leerink Partners recently upgraded CVS to "Outperform," raising his price target from $55 to $75, citing stabilization in the insurance and PBM sectors. Elizabeth Anderson of Evercore ISI expressed similar confidence, noting that the latest earnings beat has restored investor trust.

But let’s not pretend everything is fixed just yet. Medical costs are still painfully high, and CVS’s medical loss ratio (the percentage of insurance premiums spent on actual healthcare) was 94.8% last quarter. That’s an improvement from the 95.2% disaster in Q3, but it’s still way worse than the 88.5% from a year ago. CFO Thomas Cowhey admitted that costs remain elevated, though Q4’s impact was less severe than expected (which is like saying the fire alarm is still going off, but at least the flames aren’t reaching the ceiling yet).

CVS is pulling off one of the biggest comebacks in healthcare, but the real challenge is making it last. If medical costs keep rising or the insurance restructuring doesn’t go as planned, the stock could tank again. But with an improved business model, better Medicare Advantage ratings, and a more disciplined approach to its insurance division, CVS might actually have the momentum to keep this rally going. For now, analysts are putting faith in Walgreens little brother for the time being. But if CVS stumbles again, at least those mile-long receipts can still double as emergency toilet paper.

PS: If you’re tired of stock tips from finance bros on Twitter… you should check out premium. Our exclusive stock write-ups come straight from real investors… people who analyze the markets daily and know what moves matter. You’ll get expert insights, insider trading alerts, and high-value picks multiple times a week.

Stocks.News has positions in CVS and Walgreens mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer