A recipient of one of the hottest IPO's of the year... CoreWeave, famous for renting out Nvidia GPUs to companies running AI models... looked at the stock chart that’s dipped 29% in the last month alone and thought, “Fine. If you clowns don’t want to invest in us, then we’ll just become the investor and see if that changes your mind.”

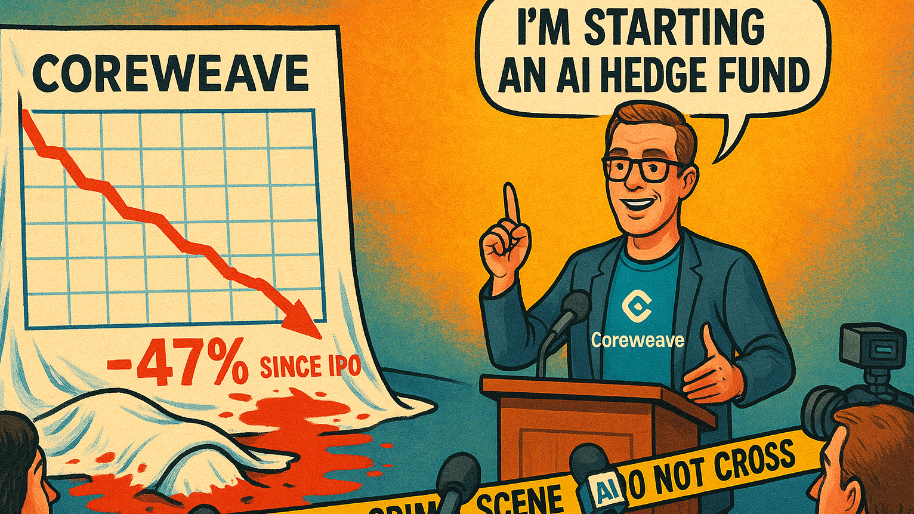

This isn’t satire, this is literally what they just did. Just a reminder in case you forgot… CoreWeave went public in March at $40, ripped to $187 by June as everyone who missed Palantir and decided “screw it, this will do,” and then spent the summer falling down the stairs until it landed in the low $90s. It’s been the gold standard in AI volatility… hot one week, ice cold the next.

So what does management do? They roll out CoreWeave Ventures… a new fund aimed at bankrolling early AI startups. And as they were hoping, investors actually bit. Shares popped 8-9% on the news because Wall Street’s always a good sucker for an AI catalyst.

(Source: CNBC)

And on paper, it actually makes sense. Rather than sticking to the role of hardware landlord (leasing Nvidia GPUs to every LLM wannabe) they’re now taking ownership stakes in the tenants. They already have nine portfolio companies, including Toronto-based Moonvalley, and they even bought up OpenPipe, a tiny reinforcement-learning outfit, to show this isn’t some side project thrown together on a whim. Management told the Wall Street Journal the checks could run “seven to nine figures.” (It reminds me of when my buddy got into insurance sales and told me, “Yeah, I could make $10k a year or $500k if I really crush it.” Cool, thanks for narrowing that down.)

And now that I’ve got all my jokes in… I actually think it’s a smart move. And let me tell you why. Giving startups money is one thing, but giving them compute (actual Nvidia hardware that’s booked out for years) is the real play. Cash is everywhere right now. AI startups raised more than $100 billion in the first half of the year alone. What’s scarce is access to GPUs, and CoreWeave happens to be sitting on the supply. That turns their venture fund into more than another check-writing machine. Think of it like a Trojan horse situation. Founders get funding, sure, but they also get locked into CoreWeave’s infrastructure, effectively turning today’s investments into tomorrow’s customers.

Unfortunately for investors who still look beyond the headlines… the financials are about as fugly as it gets. And sure, people will point to the fact that Q2 revenue was an incredible $1.21 billion, up more than 200% from a year earlier, with a $30 billion backlog from OpenAI and a hyperscaler. But that growth came with a $300 million net loss, thanks to insane buildout costs and heavy interest payments. Add in insider selling right after the IPO lock-up and a $9 billion all-stock deal for Core Scientific that looks more like “holy overpay” every week, and it’s not hard to see why the stock keeps getting hammered.

In any normal sector (let’s say oil, for example) if a company’s stock was sliding, the balance sheet looked grim, and management suddenly announced, “We’re starting a hedge fund”… the market’s reaction would be swift: a laugh track, a round of eye rolls, and another leg down in the stock price. But nail the letters “AI” on the door and suddenly it’s considered visionary. A brand-new IPO with no profits can say, “We’re going to invest in startups now,” and instead of panic-selling, investors call it “genius capital allocation.”

That’s the insanity of this moment: in any other industry, this move screams desperation. In AI, it gets you a 9% bump and is considered a growth catalyst.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer