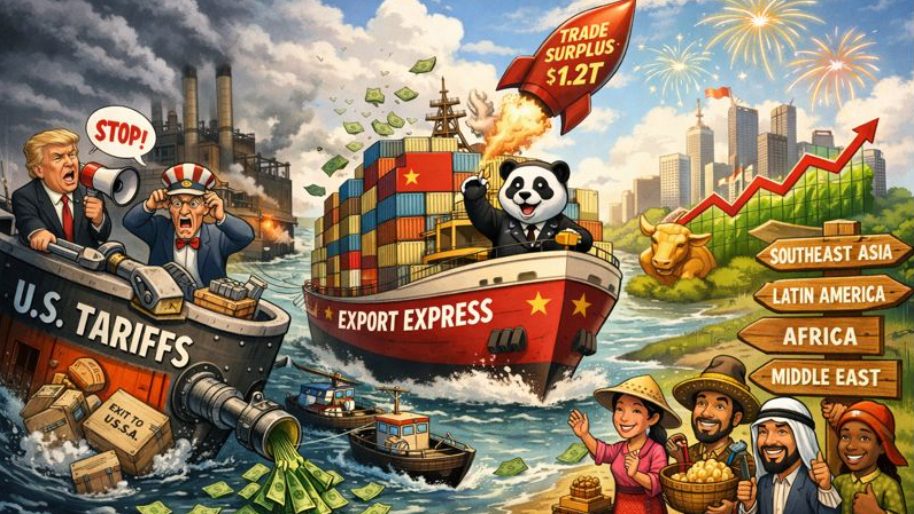

If you thought Trump’s tariffs would grind exports to a halt… the actual data is going to shock you.

China just posted its largest trade surplus on record, coming in at nearly $1.2 trillion in 2025, even as U.S. trade restrictions remained firmly in place.

The topline numbers were solid across the board. Total goods trade rose 3.8% last year to 45.47 trillion yuan ($6.5 trillion). Exports carried the load, climbing 6.1% to roughly $3.8 trillion, while imports barely budged, rising just 0.5% to about $2.6 trillion. That widening gap between exports and imports is what pushed the surplus to a new record.

But the real story isn’t actually about growth… it’s where that growth came from.

Exports to the U.S. dropped sharply, falling 28% in 2025 as tariffs on Chinese goods stayed near 47.5%, levels put in place under Donald Trump that have made selling into the U.S. far less appealing. But instead of pulling back, Chinese exporters adjusted.

More goods were sent to Southeast Asia, Latin America, Africa, and the Middle East, where demand has been rising and trade barriers are lower. In other words, China didn’t lose buyers… it found new ones.

In response, stocks in mainland China and Hong Kong moved higher after the data was released, with the Shanghai Composite Index hitting its highest level in more than a decade.

Zooming out, this fits the bigger picture for China’s economy. Consumer demand at home remains weak, and the property sector is still dragging on growth. Because of that, exports continue to play an outsized role in keeping the economy moving. While officials have talked about shifting toward a more consumer-driven model, most economists agree that kind of transition takes time.

Meanwhile, exporters have been getting more creative. Some manufacturers have moved lower-end production to nearby countries in Southeast Asia, which helps them sidestep the highest U.S. tariffs while still supplying global markets.

Of course, that shift comes with trade-offs. As Chinese goods flow into new regions, local producers in those countries could feel the squeeze from cheaper imports. Analysts warn this could eventually lead to more trade defenses outside the U.S., especially in smaller economies.

As for the politics, tensions haven’t gone away. Trump has suggested China could open its markets further to U.S. products, again pointing to his relationship with Xi Jinping, while Chinese officials continue to argue that tariff wars hurt everyone involved.

For now, though, the real story is that while the numbers tariffs changed the routes Chinese goods take… they haven’t slowed the export machine.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer