Remember when Under Armour was supposed to be Nike’s arch-nemesis? Yeah, and I remember when MySpace was supposed to kill Facebook. But unlike Tom from MySpace (still everyone’s first friend), Under Armour (+30%) just pulled off its best magic trick since convincing people that compression shorts were fashionable.

The company that’s been about as relevant as an NFT in 2024 just crushed earnings like Steph Curry crushes dreams in the playoffs.

They posted $0.30 per share, making analysts who predicted $0.20 look about as accurate as my March Madness bracket. Their gross margin is quickly closing in on 50%. This improvement didn’t happen by chance though. Under Armour credited it to a 3% reduction in inventory and freight costs, along with fewer promotions and discounts in its direct-to-consumer business.

Now let’s get to some bad news: Revenue tumbled 10.7%, landing at $1.4 billion. E-commerce? Took a tumble, down 21%. And it wasn’t just online – every category took a hit. Apparel dropped 12%, footwear slipped 11%, and even accessories lost 2%. It’s safe to say they’re all buckled up on the struggle bus right now.

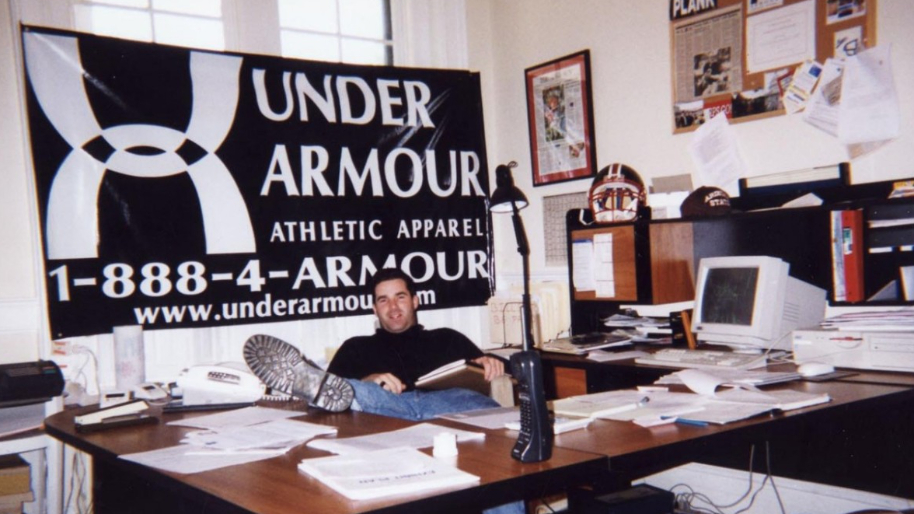

Remember Kevin Plank? The guy who started this whole thing at 23. He’s back, baby. After pulling a Tom Brady-style un-retirement in April, he’s got Wall Street believing in this comeback story more than my wife believes in the Hallmark Channel.

So Kevin basically dropped the “Trust me Bro. plan” which means Under Armour is dropping $140-$160 million on their turnaround plan. This plan is focused on Under Armour being a premium brand with a long term sustainable strategy.

Alright, think of it like finally starting that big DIY project—it’s one thing to buy the supplies, but the real test is actually putting it all together. Under Armour’s already sunk $40 million into this effort, and unlike my half-finished bookshelf, they’re actually seeing some progress.

UBS just slapped a $16 price target on this bad boy (up from $12), basically saying, “Under Armour is just getting started.” They’re staging a comeback, and this time, it might actually stick. The company bumped its EPS guidance to $0.24-$0.27, up from $0.19-$0.21, showing more confidence than they’ve seen in a couple years.

In fact, five analysts just upgraded their projections for the struggling athletic company sporting Steph Curry and Jordan Speith. The consensus: They’re looking at $0.25 EPS this year and $0.35 next year. Not quite Nike numbers, but hey, Rome wasn’t built in a day. Neither was Lululemon’s monopoly on making yoga pants a lifestyle.

But here’s the big question: Can Under Armour keep this momentum going, or is this just another false start? For now, at least they’re not the Skechers of premium athletic wear anymore. And in this crazy market, that’s something worth celebrating.

PS: Our trade alert is up 27% so far today, but with the tiny float it has this thing could SQUEEZE like a fair lemonade tomorrow at the market open. Could it be like our last trade alert that exploded 116% minutes after it dropped? There’s only one way to find out.

Click here to see how you can join the Stocks.News family and get the ticker now…

Stock.News has positions in Under Armour, Nike, Skechers, Facebook, Lululemon, and Netflix mentioned in article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer