When a private company does layoffs, it’s a sad day. The CEO chokes back tears during an all-hands. His wife brings in banana bread. Managers hug it out with the team and say stuff like, “You’re more than just a colleague.” Even the company dog looks depressed.

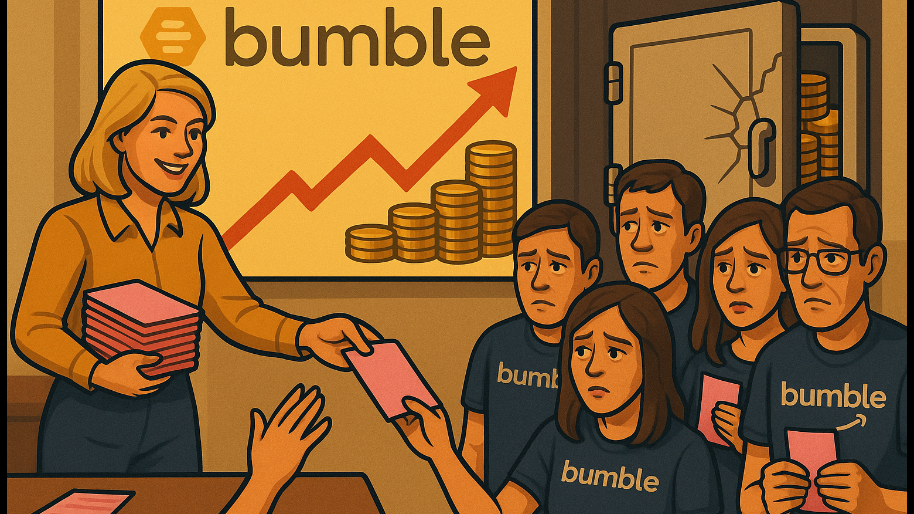

But when a public company like Bumble announces layoffs… Wall Street institutions act like someone just cured cancer. BlackRock high-fives Vanguard. Sage Street updates their valuation models. CNBC spins it as “unlocking shareholder value.” And the stock jumps like someone just rang a bell at the NYSE on IPO day.

Today, Bumble announced it was laying off 30% of its workforce (roughly 240 people) as part of what it called a “reconfiguration of its operating structure.” Let me translate that for you: they’re cutting costs because the business hasn’t been working, and they’ve finally stopped pretending otherwise. The layoffs will cost Bumble somewhere between $13 million and $18 million in the short term, mostly in severance and restructuring charges. But the company expects to save $40 million annually going forward, and that’s the number Wall Street really cares about. Investors immediately rewarded the move. Shares popped 26% on the news (down to only 20% now).

To the outside world, that may seem tone-deaf. Hundreds of people lose their jobs, and the stock surges? But in the public markets, where performance is judged quarter by quarter, that kind of aggressive cost-cutting signals something that’s been missing from Bumble for a while: accountability. And let’s be honest… Bumble needed to do something.

When the company went public in 2021, it was valued at nearly $15 billion. The pitch was a “female-first” dating app that struck a nerve in the post-Tinder era. Three years later, it’s worth about $538 million. That’s a 96% nosedive… easily one of the worst public market flops we’ve seen this decade outside of SPAC land and failed metaverse fantasies (remember when someone bought $1 million worth of digital land?).

(Source: CNBC)

The business has been leaking for a while. User growth is slowing, and paying users (the real lifeblood of the business) actually declined last quarter, from 3.5 million to 3.47 million. Meanwhile, Bumble’s Premium Plus subscription (pitched as a “see and be seen” upgrade) has underperformed so badly, shareholders are now suing, alleging the company misled investors about how it was actually doing (not great).

Then came the marketing disaster. In 2024, Bumble launched a billboard campaign with the slogan “Celibacy isn’t the answer.” They thought it was edgy. But it turns out, it was not. The backlash was swift and brutal, especially given Bumble’s roots in female empowerment. Critics called it tone-deaf and patronizing. Bumble pulled the ads, issued an apology, and donated the remaining ad space to domestic violence organizations. But the damage to the brand was already done.

Whitney Wolfe Herd, Bumble’s founder, had stepped away from the CEO role but returned earlier this year. These layoffs are her first big move since getting back in the driver’s seat, and they mark a clear shift from Bumble’s old strategy of “grow at all costs” to “please, for the love of God, let’s survive.” Whether it’s strategic or desperate is still up for debate, but either way, it signals that Bumble is finally willing to face the music.

Along with the layoffs, Bumble also raised its second-quarter guidance. Revenue is now expected to land between $244 million and $249 million, with adjusted EBITDA between $88 million and $93 million. Those numbers aren’t amazing, but paired with $40 million in expected savings, they tell investors: “We’ve cut the fat. The numbers will look better next quarter.”

That’s enough to get the stock moving in the short term. But it doesn’t mean Bumble is out of the woods. The entire online dating industry is struggling with user fatigue. Gen Z is burnt out on swiping. Hinge has taken the crown as the “serious dating app,” and newer players like Thursday and Feeld are drawing niche audiences with more thoughtful models. Bumble’s in a strange spot… it doesn’t own a category anymore, and its identity is blurry.

The layoffs bought Bumble some time… but not much. Sure, Wall Street clapped this week (a 26% pop is a nice distraction when you’ve lost 96% of your value), but cost-cutting alone doesn’t rebuild a business. Eventually, investors are going to ask the obvious question: how do you actually get money in the door?

That’s where the real work begins. Hinge figured it out by positioning itself as the “dating app designed to be deleted”... and then charging users for features like seeing who liked them or setting dealbreakers. Even Tinder, for all its burnout, still gets people to cough up cash for Boosts, Super Likes, and monthly tiers that promise slightly less rejection.

Bumble hasn’t nailed that formula. Premium Plus was supposed to be their answer, but it fizzled. If they want a real comeback, they need a product people are not only willing to use… but willing to pay for. That might mean better algorithmic matchmaking, more intentional features, or honestly, just fewer bots and weirdos. One thing’s for certain: they better figure this out fast.

At the time of publishing this article, Stocks.News holds positions in Vanguard (VTI) as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer