If you’ve spent the last three months watching your Robinhood account go higher than Snoop Dogg and Willie Nelson at a cannabis farm, first of all congrats (you deserve it)… but let’s not pretend you’re the next coming of Peter Lynch. You’re just strapped to a market that’s high on rate-cut hopium and pretending bad news doesn’t exist. I mean come on, the S&P has been sprinting like it’s got loan sharks on its tail, Nvidia’s making moves like it wants to buy the entire Nasdaq and rename it Nvidaq, and even the meme coins have clawed their way back into the conversation. (Because if there’s one thing retail traders never learn, it’s anything.)

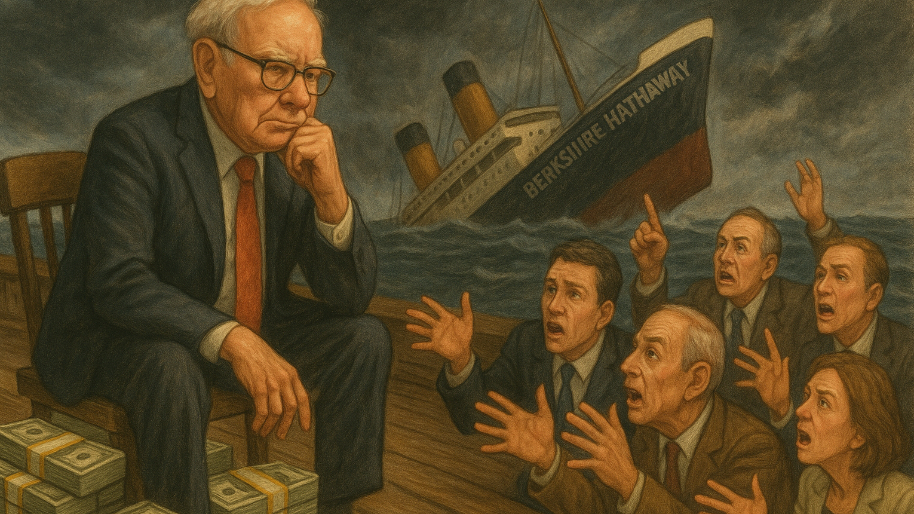

But while everyone else is YOLOing into AI stocks and pretending risk doesn’t exist, the greatest investor of all time (Warren freakin’ Buffett) just posted his second straight earnings miss. This is the same guy who turned insurance and Coca-Cola into a $900 billion empire. And now, just weeks after announcing his retirement as CEO at the end of the year, let’s just say his farewell tour is not going how he had planned.

For starters, Berkshire Hathaway’s Q2 operating earnings dropped 4% year over year, landing at $11.16 billion. That’s down from $11.6 billion last year and (more importantly) missed Wall Street estimates again. The main drag came from insurance underwriting, which fell 11%. If you’re wondering why that’s a big deal… it’s because insurance is Berkshire’s favorite business of all time. It brings in massive “float” (aka cash from premiums they get to invest before paying out claims). When that business slips, the whole empire feels it.

Now, it’s not like everything else inside Berkshire fell apart. BNSF Railway profits rose 11.5%, and Berkshire Hathaway Energy jumped 18%. Their manufacturing and retail arms held steady too. But it wasn’t enough to offset the insurance stumble. Then came the real disaster: a $3.8 billion writedown on Kraft Heinz. Yes, that same Kraft Heinz Buffett helped merge back in 2015 with 3G Capital. It was supposed to be a classic value play… boring, stable, lots of mac & cheese. Instead, it’s been an anchor around Berkshire’s neck. The stock is down 62% since the merger, while the S&P 500 is up 202%. (We all have that one loser in our portfolio we try not to talk about. Warren’s just happens to cost $8.4 billion.)

On top of that, Berkshire got hit with $877 million in foreign currency exchange losses… mostly due to euro and yen-denominated debt that lost value when translated back into dollars. And this isn’t the first time. Last year, that same line gave them a $446 million gain. This year it’s just one more banana peel under the earnings report.

Now technically, yes… Berkshire still made $12.37 billion in net income. But that’s down 59% from last year, and most of that drop came from stock portfolio hits and that Kraft write-down. (Also, a quick note: U.S. accounting rules force companies to report unrealized gains and losses on their public investments… even if nothing was sold. Buffett has said before he thinks this is nonsense, and this quarter is a prime example of why.) Still, here’s where it gets kinda creepy… they didn’t buy back a single share of their own stock. Not one.

(Source CNBC)

And this is a company that’s sitting on a $344 billion pile of cash (for reference, 10 years ago, Berkshire only held $67 billion in cash). Normally, when Berkshire’s stock drops more than 10% like it has since May, Buffett would pounce. After all, he’s said before that he’d repurchase shares when they trade below intrinsic value. So either he thinks Berkshire’s still overvalued (which is mildly terrifying if you’re a shareholder)… or he’s keeping his powder dry for a bigger play.

But so far? There aren’t any deals and not a single big buy to be seen. Just more selling… $6.9 billion in stock sold vs. $3.9 billion bought. That marks the 11th consecutive quarter of Berkshire being a net seller. At this point, it’s like watching a guy sit at the poker table with a mountain of chips… and refusing to bet.

Which brings the most important question of all… what’s he waiting for? Well, for one, Trump’s back with a fresh batch of tariffs, and Berkshire says that could mess with “most, if not all” of its businesses. And they’re already seeing the effects… Fruit of the Loom revenue dropped 11.7%, Jazwares fell 38.5%, and even Garan (a kids’ clothing brand) is down 10.1%. The company says tariffs and trade delays are already screwing up shipments. (If your SpongeBob underwear is late, now you know why.)

That means Buffett’s looking around and saying, “Nah, too risky.” And it kind of makes sense. Stocks are expensive. The Fed’s still pretending it can stick the soft landing. And the trade war feels due to cause a selloff. But still… two quarters of misses, a mountain of untouched cash, and no buybacks? That’s not exactly the Buffett we’re used to.

Obviously, this doesn’t mean we should all dump our portfolios and sit in cash like Buffett. But it’s worth paying attention. Since May, Berkshire has underperformed the S&P, and let’s just say no one’s exactly peeing their pants in excitement over Greg Abel, the handpicked successor stepping into the most valuable shoes in finance. (Talk about a tough follow-up act.)

Buffett’s legacy is still legendary. But at some point, sitting on $344 billion while stocks moon and deals get scooped up by private equity firms isn’t caution… it’s paralysis. Unless, of course, Buffett sees something coming that we don’t (knock on wood).

At the time of publishing this article, Stocks.News holds positions in Robinhood and Coca-Cola as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer