UnitedHealth: “I never said thank you.”

Warren Buffett: “And you’ll never have to.”

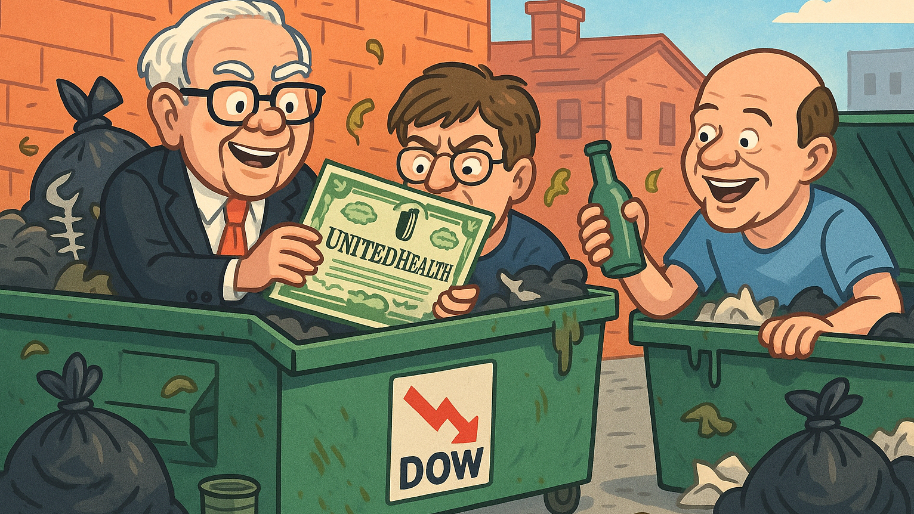

Would you just look at that? Grandpa Buffett just dusted off his checkbook and swooped into Gotham’s sketchiest alley (UnitedHealth’s beaten down stock chart) with a $1.6 billion buy. Berkshire scooped up 5 million shares, and Wall Street did what Wall Street always does when Warren makes a move: hit Ctrl+C / Ctrl+V like their lives depended on it. The ripple effect was instant. UNH ripped 14% in a single day, its best run since 2008. (Yes, that 2008… the year all our dads “nearly had a heart attack” watching their 401k implode while still rocking cargo shorts.)

And just to be crystal clear, UnitedHealth wasn’t just in a dip, it was in a f**king free fall. Shares were down nearly 50% YTD before Friday… the single worst performer on the Dow (and that’s saying something). Prior to Warren’s liferaft purchases, It was trading at a P/E under 12, its cheapest in more than a decade. (That’s “yard sale at 3 p.m.” cheap.)

And it’s not like they had a clean balance sheet, either. The company’s been through hell this past year: the DOJ breathing down their neck over Medicare billing fraud, their CEO Andrew Witty bailing in May, a new earnings outlook so bad it missed Wall Street’s lowest bar by a mile, and rising medical costs that destroyed margins. And to make things worse, they were accused of taking advantage of elderly people in nursing homes by overbilling and aggressively pushing services that critics say they didn’t need. (Picture your grandma getting a surprise $8,000 bill for a “wellness consult” when all she asked for was a blanket.)

(Source: The Guardian)

So why would Buffett buy this flaming wreck? Because chaos is his love language. The man has a track record of walking into disasters like he’s Gordon Ramsay inspecting a failing restaurant: “It’s raw… but I’ll take the whole place.” Back in 2008, when the market was doing the financial-crisis Harlem Shake, he dropped $5 billion into Goldman Sachs. In 2011, he slid $5 billion into Bank of America when it looked like they were one “Reply All” email away from collapse. Dude basically has a fetish for Fortune 500s mid-nervous breakdown. Sidenote: have you noticed everytime without fail that Buffett makes a big buy, everyone on Twitter suddenly becomes a value investor?

This isn’t your typical boring health insurer anymore. With Buffett, Burry, and Tepper piling in, UnitedHealth is now in meme stock rehab. One minute it’s the face of Medicare fraud probes, the next it’s trending on FinTwit alongside Sydney Sweeney memes.

Buffett turns 95 this month and is handing off Berkshire’s CEO gig to Greg Abel at year’s end, so maybe it was one of his lieutenants (Todd Combs or Ted Weschler) pulling the trigger. But does it really matter? The move screams Berkshire DNA: buy when it’s ugly, and hold until everyone forgets why they hated it in the first place.

Of course, Friday’s pop doesn’t fix UnitedHealth’s cesspool of lawsuits, costs, and bad press. But Buffett’s stamp of approval carries weight. Every time he’s stepped into these kinds of messes (Bank of America, Goldman Sachs, take your pick) it’s worked out pretty damn well.

And for now, Buffett’s $1.6 billion splash into the most hated healthcare stock on the Dow was enough to make Wall Street pretend UnitedHealth’s problems didn’t exist… at least for a day.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer