I once gave a best man’s speech at my best friend’s wedding. Spent the night before crafting the perfect opening joke… tight timing, good callback, just the right amount of inappropriate for a Baptist crowd. I step up to the mic, clear my throat, deliver the punchline with confidence… Crickets. Not a giggle. Not even a courtesy chuckle from the groomsmen. So I did what any panicking best man would do: went straight to the emergency line I swore I wouldn’t need. “Tough crowd.” Turns out the mic wasn’t even on. The sound guy had one job. But sure, yeah, no emotional damage done whatsoever.

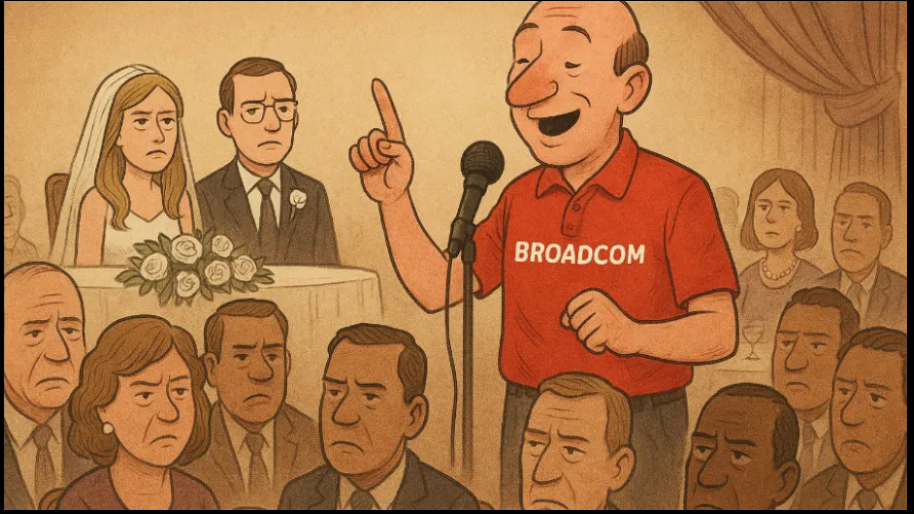

Anyway, Broadcom’s earnings call this week reminded me of that exact moment. Because Broadcom walked on stage with a killer script (record-setting revenue, AI chip sales booming, software growing faster than my hairline’s retreat) and Wall Street still sat there with arms crossed like someone just pitched them another frozen yogurt startup idea.

Let’s look at the numbers, because Broadcom really has brought the heat. In Q2, Broadcom posted $15 billion in revenue. That’s a 20% year-over-year jump. AI-related revenue? Up 46% to $4.4 billion (no big deal). Net income hit a thicc $7.79 billion. They even beat estimates on both top and bottom lines. Their software business (thanks, VMware) brought in $6.6 billion… a 25% increase. That alone would be enough for the board to breathe a sigh of relief.

But Wall Street responded with a -4% after-hours dip like Broadcom just announced it was gonna go back to making blockchain toothbrushes (this is a joke, don’t look it up). So what’s the problem? The thief of all joy: expectations. Or, to be more specific… straight-up delusions dressed in Goldman Sachs polos. Wall Street wasn’t reacting to the actual numbers. They were reacting to the vibe. You see, investors have been watching Nvidia’s run, and now they expect every chipmaker to deliver Tesla-in-2020 levels of vertical growth (very realistic).

Broadcom said next quarter revenue should come in around $15.8 billion. That technically beats consensus estimates of $15.7 billion. But some analysts had gotten drunk off AI Kool-Aid (as I like to call it) and whispered projections nearly a billion dollars higher. That’s what we call a hype hangover.

CEO Hock Tan tried to reassure the crowd by saying Broadcom’s hyperscaler clients (Amazon, Google, Microsoft) are still “unwavering” in their AI investments and that custom chips are part of a “multiyear journey.” Unfortunately, “multiyear journey” is investor code for: “go ahead and sell now, check back in 2026.” In an era when everyone wants AI numbers now, not “someday,” that just doesn’t hit the same. Even if the fundamentals look damn near flawless.

Look, Broadcom didn’t flop. They absolutely crushed it… just not in a way that satisfied the expectations of investors waiting for a second coming of Jensen Huang. And the truth is, Broadcom’s in a great spot. Apple and Google are locked in. AI networking demand is still surging. They’re sucking in billions from chips and software. The earnings were solid. The guidance was solid. But hey… tough crowd.

Stock.News has positions in Tesla, Amazon, Google, Apple, and Microsoft.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer