Ok, humor me for a sec: Apple moves iPhone production to the U.S., waves a tiny American flag, and makes Tim Cook the face of “Made in America.” Sounds patriotic, right? Maybe even a little sexy in a post-tariff, Cold War 2.0 kind of way, you know?

(Source: Giphy)

But, but, but… there’s a tiny problem with this ideology. And by problem, I mean a mind-bending 90% cost increase, according to Bank of America—they did the math. Ninety. Percent. As in, Apple’s $1,200 brick becomes a $2,300 cry for help, before tax, before AppleCare, before the psychological therapy you’ll need after dropping that kind of cash on a phone that still won't let you sideload apps. What the hell?

In short, Bank of America’s Wamsi Mohan dropped a note this week that basically said, “Yeah, Apple could move assembly to the U.S.—but it’s going to hurt. A lot.” Labor alone would jack up costs by 25%. And that’s before you slap on tariffs for all the parts that still need to be shipped in from China, Vietnam, or whatever country Trump gave a swirlie to this week. Assuming no tariff waivers (lol), Apple’s total iPhone production costs could spike over 90%. Which, understandably, is the kind of overhead that makes Tim Cook break out in cold sweats while impulse buying another Foxconn facility in India.

(Source: Bloomberg)

And the scary part is, this legit could be in the future, especially since China’s now facing a 125% duty wall just to ship components into the U.S. Perhaps you’ve heard? And surprise, China clapped back with 84% retaliatory tariffs on American goods—at this point, let’s please bring back the celebrity deathmatch featuring Trump and Xi, just to top things off. The result, of course, is that everyone’s iPhone could be on the cuffs of costing about the same as a mortgage (no words on if they’ll offer a First Phone Buyer loan option yet).

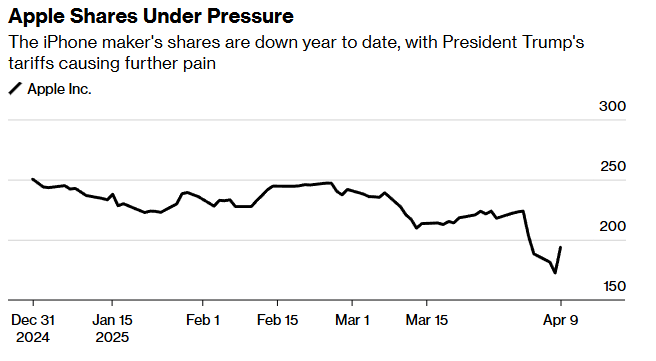

But alas, Apple, to its credit, is trying to play the long game. It’s already moving some production to India and Vietnam, which, fun fact, are also getting kneecapped with tariffs now. So basically Apple’s backup plans are also on fire. Meanwhile, Apple’s stock is up 15% this week, thanks to Trump’s 90-day “just kidding” pause on tariffs for everyone but China. Great for your 401(k), terrible for anything happening in 88 days from now. The stock is still down 18% YTD, and has lost $479 billion since April 2. That’s almost half a Tesla.

(Source: Bloomberg)

What’s more, is that Wall Street’s not exactly stoic about this either. Emotions are high, and Rosenblatt even warned that tariffs could “blow up” the stock. Additionally, Dan Ives cut his price target and called the whole thing a “complete disaster.” So yeah, even analysts are screaming in a pillow regarding Apple these days.

So with that, what’s next? Well, Apple’s not moving iPhone production to the U.S. anytime soon unless it gets a golden exemption and a hug from the USTR. Bank of America still has a $250 price target, but they're not even sure about it. And if you’re one of the people panic-buying iPhones in case the price triples overnight… congrats. You’re part of the problem. And probably the reason Tim Cook still sleeps well at night.

(Source: Giphy)

In the end though, earnings are coming May 1. Wall Street’s expecting $1.61/share on $94B revenue. But if this tariff nonsense keeps escalating, expect Apple to spend most of the call talking about “supply chain optimization” and “geographic diversification”—which really only translates to “we’re not bringing this sh*t back home unless the government pays us to.” So yeah, we can all 100% have our American-made iPhones—but we’ll just have to be ready to finance it like a used BMW LOL.

For now, keep your eyes on what Tim Cook does next, and place your bets accordingly. Until next time, friends…

P.S. The markets played a better rendition of “Eruption” than Eddie Van Halen yesterday, and everyone and their mom was in the mix. However, it was the Stocks.News premium members who really ate good. Click here to ensure you get the juicy exclusive’s for todays price action here…

Stocks.News holds positions in Apple and Tesla as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer