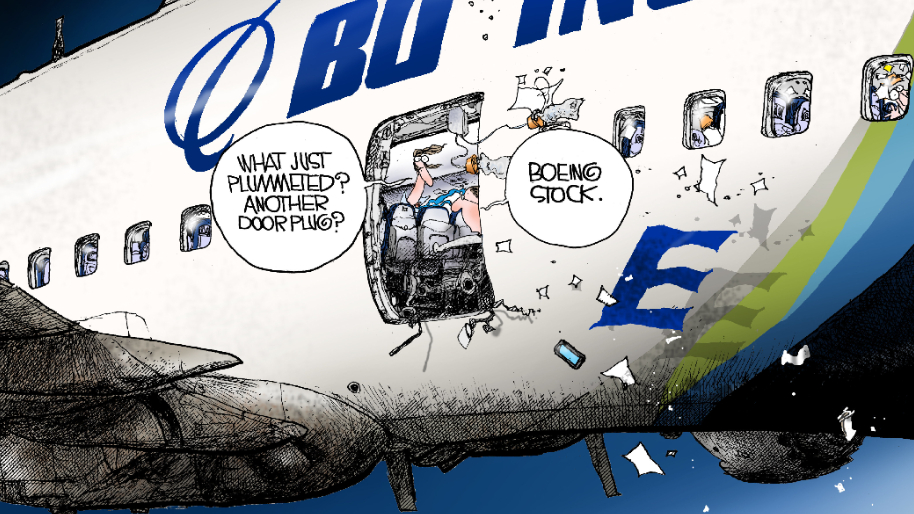

Well, well, well... it’s been a whole five minutes, so you know what that means—it’s time for another round of “What Did Boeing Screw Up Now?” And this week, the aerospace company isn’t disappointing in its usual underwhelming way.

Boeing just hit a new 52-week low, and this time it’s thanks to an ongoing labor dispute with the International Association of Machinists and Aerospace Workers (IAM).

Let’s rewind to two months ago when Boeing's earnings report looked about as promising as a soggy Big Mac. The only profitable sector in the entire company was—you guessed it—fixing its own planes. That’s right, Boeing is making more money off cleaning up its messes than actually selling planes. Add in an impressive $1.4 billion loss, and they might as well slap a trophy on their boardroom table for “Most Poorly Run Business on Planet Earth.”

So, naturally, the strike couldn’t have come at a worse time. According to consulting firm Anderson Economic Group, the first week of the strike has already racked up a staggering $571 million in costs. Talk about bleeding cash. At this rate, Boeing might want to consider selling stock just to keep the lights on.

With Boeing’s financials looking like they’re held together with duct tape and wishful thinking, CEO Kelly Ortberg (who, by the way, just took over last month) announced some aggressive cost-cutting measures. These include furloughing executives, managers, and basically anyone with a pulse. Yep, even the execs are getting furloughed—because nothing screams “we’ve got this under control” like telling your highest-paid decision-makers to take an unpaid vacation.

Ortberg wrote a note to employees that read more like a breakup letter: “While this is a tough decision that impacts everybody, it is in an effort to preserve our long-term future.”

With Boeing shares already down 39% year to date, Wall Street analysts aren’t exactly optimistic. Morningstar equity analyst Nicolas Owens even slashed his price target from $219 to $216 per share, citing productivity losses and delays.

He also noted that Boeing's contentious relationship with its machinist union has been dragging on for decades, and this latest strike could last through the end of the year—just in time to ruin everyone’s holiday plans.

And just in case you thought things couldn’t get worse, Boeing’s $58 billion in debt looms large, with only $12.6 billion in cash to cushion the blow. Analysts from Jefferies even hinted that Boeing might need to raise more cash soon, potentially by selling stock. As if investors weren’t already crying in the shower every night.

For now, Boeing is at a crossroads. The company needs to ramp up production of its 737 Max jets to 38 per month by the end of the year, but the strike is throwing a wrench into that plan. Boeing insiders claim they’re “ready to hammer out an agreement,” but after two full days of mediation last week, the union and company are still at odds.

Boeing's stock keeps sinking, and investors are hoping management has an emergency plan. Instead, execs are stuck in a game of financial whack-a-mole. Moody’s has already warned that if the strike drags on, Boeing could be in for even rougher turbulence—cue the barf bags.

Just like that one friend we all have from high school, Boeing’s never going to get their act together.

P.S. On Thursday, we released an alert exclusively for our premium members, and by market close, the stock skyrocketed 140.45%. If you missed this one, don’t worry—you don’t have to miss the next. Another big opportunity is likely to drop this week. Click here to become a premium member and get in before the next stock takes off!

Stock.News does not have positions in companies mentioned.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer