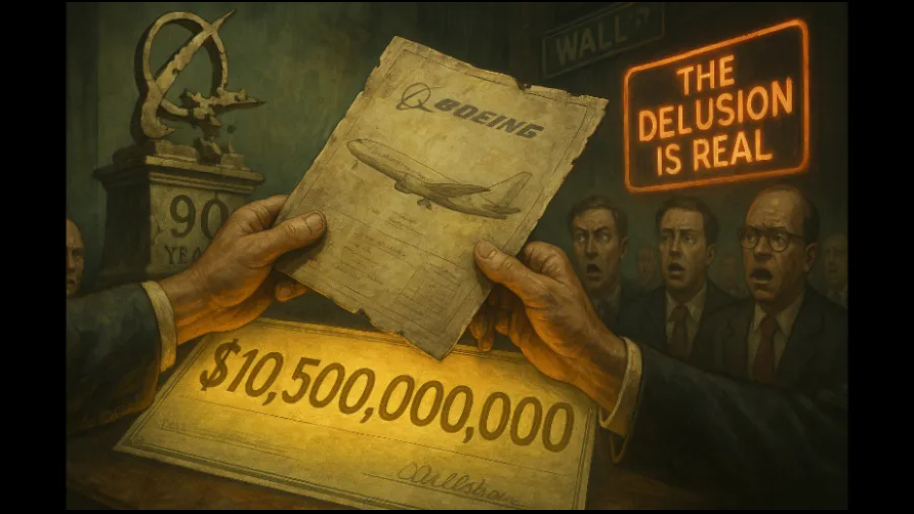

Boeing just sold off one of the only parts of the company that hasn’t been actively pissing itself in public. Jeppesen, the 90-year-old navigation unit that basically invented modern flight planning, is getting pawned off to Thoma Bravo, a private equity firm that likes its software scalable, its balance sheets clean, and its exit multiples juicy. The deal’s expected to close for north of $10.5 billion in cash, which is either a genius move or a desperate gasp, depending on how much Boeing investors have been drinking.

(Source: Giphy)

In short, this is Boeing liquidating the crown jewels because it’s broke and bloated. It's like selling your kidneys to pay off your gambling debts, then telling everyone you're “refocusing on core priorities.” Good one. But still, CEO Kelly Ortberg is calling it a “strategic move”, especially as the company’s still recovering from the 737 Max fiasco, the Dreamliner delays, the panel that decided to yeet itself mid-air in January, and a two-month strike that froze production harder than a Mitch McConnell briefing.

So now they’re offloading Jeppesen, ForeFlight, and a few other digital units to Thoma Bravo (a firm that, might I add, doesn’t give a damn about aviation). They care about margins, recurring revenue, and finding some other sucker to pay double for it in five years. This is what private equity does. They buy stable, cash-generating businesses from idiot corporations trying to “streamline,” then flip them for profit while the original owner bleeds out.

(Source: New York Times)

For Boeing, it’s not a total “get shafted moment”. They did buy Jeppesen for $1.5 billion back in 2000, and now they’re selling it as part of a $10.5b bundle. On paper, that looks like a win—which technically it is—but in reality, this is exactly what happens when your core business turns into a safety risk and a punchline. The absolute hilarious part about this though, is Boeing acting like this sale will help them get back to building planes better.

What does selling your flight data and planning software to private equity have to do with fixing your production line? Nothing. Absolutely nothing. This is about plugging holes in a balance sheet that’s been bleeding red for five years straight. Boeing's debt load is obscene, its cash flow is anemic, and investors are getting twitchy. Meanwhile, Thoma Bravo gets a high-margin software business with zero exposure to Boeing’s PR dumpster fire. Jeppesen and ForeFlight don’t crash into mountains or have bolts falling out mid-air. They just make money. And that’s what makes them valuable, and it’s what makes Boeing stupid for letting them go.

(Source: Giphy)

So yeah, sell the software. Strip down to the metal. Hope nobody notices that the one part of your business that still worked just got flipped to a firm with zero interest in aviation and every interest in wringing it dry. Boeing says this is a reset. Reality says it’s a liquidation. But of course, the market? Well it’s doing what any delirious person would do… It’s cheering for no reason. Investors see a $10.b billion cash injection only to forget that the house is still on fire.

But hey, it’s something I guess. Meaning, keep your eyes on Boeing to see what kind of decisions they’ll make with their new found brinks truck and place your bets accordingly. Until next time, friends…

P.S. Oh, I’m sorry, I didn’t know you liked getting rekt. Let’s face it, retail investors get the short end of the stick all day everyday. It’s the smart money’s world, and we are just living in it–only useful when it comes to liquidity purposes in the market. Meaning, if you’re as pissed off as I was when I found out Milli Vanilli was lip syncing the whole time, then it’s time to go from investing blind, to investing smart. Luckily for you, the key is right here as a Stocks.News premium member. Click here to see exactly how our premium members are printing while others quake in the face of today’s market chaos.

Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer