Have you or a loved one suffered from Bitcoin’s emotional damage?

Please call 1-800-WE-ARE-COOKED to see if you qualify for compensation. Side effects may include: losing the house, clinical denial, and telling your wife “it’s just a buying opportunity” through clenched teeth.

Because wow… if you were still wondering whether a bear market was coming, you can go ahead and stop wondering. You now have roughly 90% certainty and the market is sending it certified mail.

The world’s most popular gambling addiction plunged as much as 7.6%, did a near-death barrel roll over the $80,000 line, and at one point today was hovering at $80,553… the lowest since April 11.

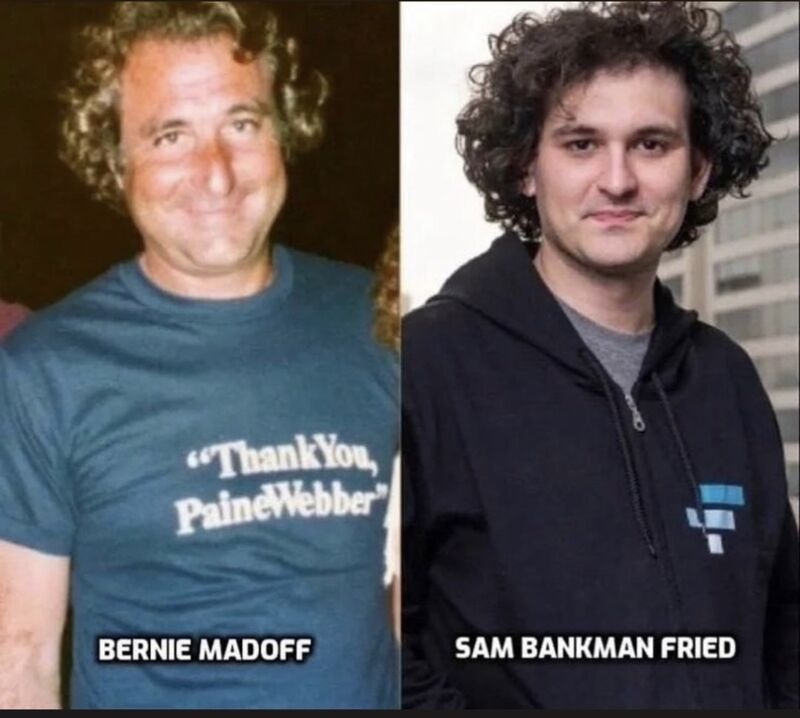

The math is even scarier. Bitcoin is now down 24% this month, 10% this week, and officially heading for its worst month since the Crypto Apocalypse of 2022… the one featuring TerraUSD and Sam Bankman-Fried pulling off one of the worst frauds since Bernie Madoff.

Meanwhile, someone big is panic-selling behind the scenes, and not quietly. A wallet labeled “Owen Gunden” (which has been holding Bitcoin since 2011, back when crypto conferences were basically three dudes in a Holiday Inn lobby) suddenly dumped $1.3 billion worth of BTC out of nowhere.

The liquidations are piling up, too. $19 billion in leveraged bets got vaporized earlier in October, another $2 billion disappeared in the last 24 hours, and crypto’s total market cap fell below $3 trillion for the first time since spring. Bitcoin has now printed 11 straight lower lows, the longest sad-boy streak since 2010, when the only people mining were weirdos and bored computer science majors.

Sentiment is also absolute hot garbage. Coinglass’s fear gauge has officially dropped into “EXTREME FEAR,” the lowest reading since 2022… when every crypto asset waived the red flag and practically went to zero. Even the Michael Saylor memes on Twitter are starting to show he’s getting nervous.

Oh and remember those institutions that told retail to think rationally and trust the ETF structure? Yeah about that... Bitcoin ETFs have seen a record $3.79 billion in outflows this month, with $2 billion alone fleeing BlackRock’s flagship. Ether ETFs are seeing the same story. I guess “crypto winter” is now a group activity.

Through it all, the funniest part is that Bitcoin is getting dumped despite existing in the most aggressively pro-crypto environment ever assembled. You’ve got the POTUS tweeting little heart emojis at miners and Trump’s own sons running a Dollar Tree version of MicroStrategy where the entire business model is literally “buy Bitcoin until someone makes us stop.” And yet as we’ve seen throughout history, nothing can stop Bitcoin’s bear cycle… not even the President himself.

The good thing about all of this is that if you’ve been waiting to get some more crypto at a decent entry… your moment might be creeping up. That is, of course, if you have any money left to buy the dip.

At the time of publishing this article, Stocks.News holds positions in Bitcoin and Ethereum as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer