Health insurers saw heavy selling pressure after the federal government released preliminary Medicare Advantage payment rates that came in well below Wall Street’s expectations.

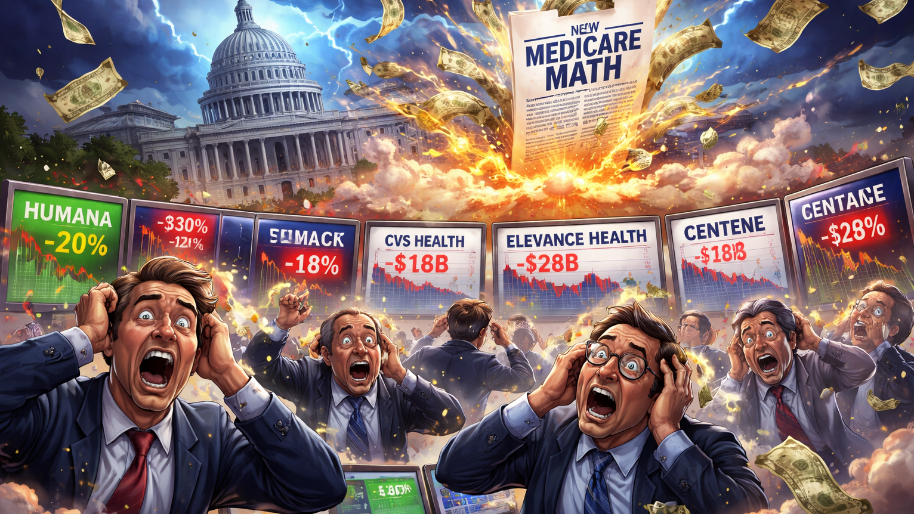

The proposal from the Centers for Medicare & Medicaid Services points to a 0.09% average increase for 2027, a sharp contrast to the 4% to 6% gain analysts had been forecasting. Shares across the managed-care sector dropped quickly as investors recalibrated earnings assumptions.

Humana led the declines, falling more than 20% in early trading. UnitedHealth Group slid nearly 19%, pressured by both the rate proposal and weaker 2026 revenue guidance. CVS Health, Elevance Health, and Centene also posted double-digit losses.

Medicare Advantage has long been a cornerstone of growth for health insurers. The privately run plans now cover more than half of all Medicare beneficiaries, and payment updates from CMS directly affect premiums, benefits, and operating margins.

CMS said the proposal would still boost total payments by roughly $700 million in 2027. But investors focused on what the guidance implies for future margin expansion, especially as the agency also highlighted efforts to curb aggressive billing practices.

Risk adjustment has been a significant profit driver for insurers, allowing higher reimbursements tied to patient diagnoses. CMS said it wants to modernize that process to improve accuracy and reduce unnecessary spending… language that raised concerns about tighter controls going forward.

CMS Administrator Mehmet Oz said the proposed changes are intended to ensure Medicare Advantage remains affordable for beneficiaries while protecting taxpayers.

CMS is expected to finalize the rates in early April, but markets moved quickly in response to the initial guidance.

The implication for investors is that policy assumptions carry as much weight as enrollment trends or cost controls. When expectations around payments change, valuations tend to adjust quickly… and Tuesday’s selloff highlighted just how closely the sector tracks those signals.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer