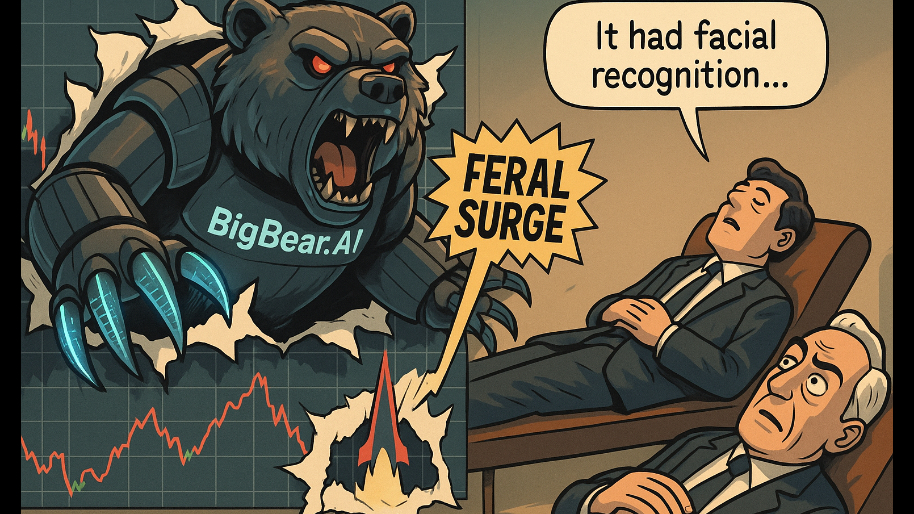

In case you missed it, BigBear.ai just ripped 45% this week, and if you’re wondering why, it’s because investors apparently love nothing more than a company that can scan your face at JFK and sell AI snake oil to the Pentagon in the same quarter. Shares are now up 300% over the last 12 months. Bigly.

(Source: Giphy)

In short, Tuesday, BigBear announced its biometric ID software (thanks to the Pangiam acquisition that cost BigBear $70 million last year) is now being deployed at 12 major ports across the U.S. and Canada… including JFK, LAX, Dallas, Denver, Charlotte, Montreal, Vancouver, Seattle and Chicago O’Hare. That means if you’re flying internationally, your mug is now getting analyzed by a machine learning algorithm trained by a company who went with the name Big Bear instead of Big Brother… coincidence? I think not.

(Source: ID Techwire)

Meaning BigBear is now plugged directly into the U.S. Customs and Border Protection’s Traveler Verification Service. Of course, the company claims they delete your gallery pic within 12 hours, but if you actually believe your biometric data isn’t living on a thumb drive in a Virginia data center, I’ve got some FTX tokens to sell you (same goes for your 23andMe spit).

And yet, it’s not just airport security that has investors all hot and bothered. BigBear is also flashing two DoD contract wins this year (read: Orion DSP and Vane Prototype), while also going full send on its international expansion. For instance, BigBear inked a deal with Easy Lease PJSC to bring its “AI solutions” to the UAE. As for the fundamentals… They are somewhat solid. Revenue is up 5% YoY, and net loss has decreased significantly to $63 million (down from $127.8 million in 2024)... mainly because of the absence of an $85 million non-cash goodwill impairment charge.

(Source: Giphy)

Additionally, the CEO now running this biometric revolution is none other than Kevin McAleenan… a.k.a. the same guy who was Acting Secretary of Homeland Security. So, you know, he’s got some experience with “operational infrastructure,” and also with not blinking while the government quietly builds the world’s most polite surveillance state.

But alas, even with all the hype, and Wall Street eating it up…. BigBear’s business model is still one congressional hearing away from getting nuked. Biometric tech is only sexy until someone’s grandma gets flagged as a terrorist because she blinked weird at TSA. Oh, and government contracts these days are about as stable as a crack head's last tooth (just ask Booz Allen and Accenture).

(Source: Giphy)

In the end, BigBear.ai just gave TSA the juice… and with a 29% short interest on available shares, this thing probably won’t stop squeezing anytime soon. OF course, do what you will with this information and place your bets accordingly. Until next time, friends…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer