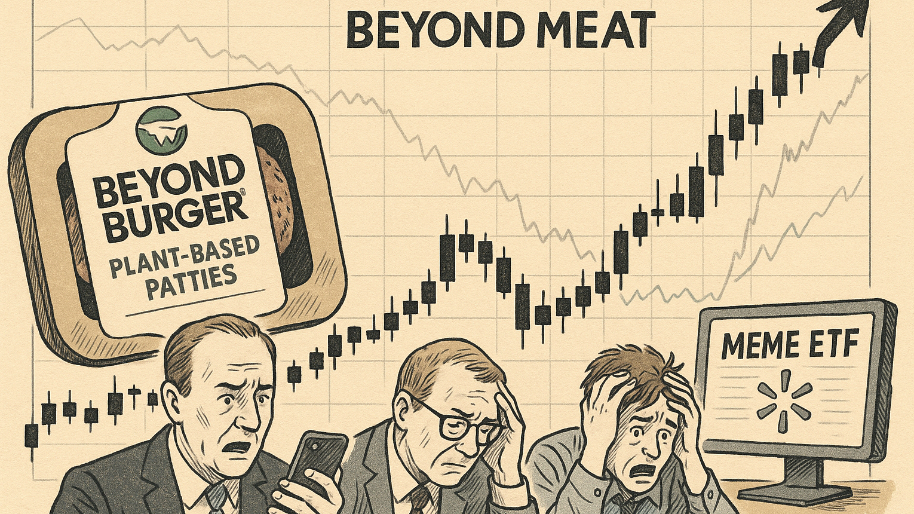

Beyond Meat has clawed its way back from the brink of bankruptcy this week in one of the wildest turnarounds we’ve seen since Opendoor rose from the dead in August. The plant-based meat maker, which was trading for just 65 cents a share last week, exploded more than 127% yesterday in a massive short squeeze (its best day ever). Then it piled on another 60% today after being added to Roundhill Investments’ Meme Stock ETF and announcing a new distribution deal with Walmart.

For a company many investors had written off, the rebound has been remarkable. Once a pandemic-era favorite that climbed above $230 a share after its 2019 IPO, Beyond Meat has spent the last five years in steady decline. Ongoing losses, rising debt, and slowing demand for plant-based products pushed the stock into penny territory earlier this year. Now, in a matter of days, it has found itself back in focus… at least for the moment.

The sudden rally seems driven more by speculation than by any real change in the company’s outlook. Roundhill’s decision to relaunch its Meme Stock ETF earlier this month, after shutting it down last year, provided a new spark for retail traders. The inclusion of Beyond Meat in the fund sent trading volumes soaring, while the Walmart deal offered a convenient storyline to match the excitement.

The real trigger, however, was a sharp short squeeze. Roughly 63% of Beyond Meat’s shares available for trading were sold short, signaling deep pessimism about its future. As the stock began to rise, investors betting against it were forced to buy shares back to cover their positions, accelerating the rally in a familiar feedback loop.

Despite the renewed attention, little has changed in Beyond Meat’s fundamentals. The company remains unprofitable, with no clear sign of a turnaround in demand. Analysts say the rally reflects a return of risk-taking behavior that echoes the 2021 meme-stock craze, rather than a shift in investor confidence about the company’s long-term prospects.

The episode may also point to a broader sense of excess building in the market. The comeback of meme ETFs, sudden short squeezes, and stocks doubling overnight suggests that investors’ hunger for risk remains unusually high. As one market strategist noted, “When sentiment drives prices this far, this fast, it rarely ends well.”

For now, Beyond Meat’s resurgence is a reminder of how quickly markets can swing in an era dominated by retail trading and social media hype. But unless the company can show real progress in its sales and profitability, this latest rally could fade as fast as it appeared.

At the time of publishing this article, Stocks.News doesn’t hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer