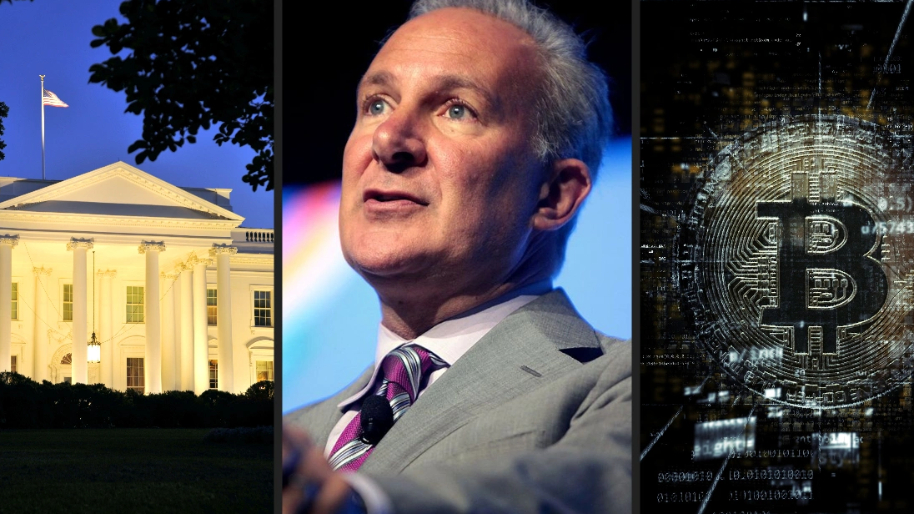

If you’ve noticed Peter Schiff dialing down his usual Bitcoin slander lately, don’t worry, you’re not losing your mind. The man who has spent years calling Bitcoin a glorified Ponzi scheme (while conveniently ignoring gold’s own not so stellar history) seems to be shifting his attention. And now accusing Trump of orchestrating the biggest pump-and-dump the crypto market has ever seen.

Just last week, Schiff was gleefully narrating the absolute bloodbath in crypto. Bitcoin had plunged nearly 30% from its $109,000 post-election high. Ethereum was down 50%. And MicroStrategy got absolutely vaporized, losing over half its value after tossing another $2 billion into Bitcoin before the market tanked. Everything in crypto was sinking, and Schiff was reveling in the carnage.

But then, Trump happened. The “Don” dropped a bombshell announcement about a government-backed Bitcoin reserve, and suddenly, the crypto market came roaring back to life. Bitcoin surged, altcoins followed, and MicroStrategy (left for dead just days earlier) rose from the ashes. Schiff, always quick to call out market manipulation, immediately pointed out that if Trump had done this with stocks, there would be impeachment hearings by now. Instead, because it’s crypto, nobody seems to care.

Schiff has a point. If a sitting president strategically hinted at a massive federal investment in, say, Tesla stock (right before his family members bought in) there would be immediate investigations. But in crypto? Apparently, that’s just another Tuesday. Schiff called out the hypocrisy, arguing that the lack of regulation allows people (even former presidents) to manipulate the market at will. And if the government is suddenly picking winners, why Bitcoin? Why not Solana, Cardano, or (his words, not mine) Fartcoin?

For years, Schiff has been roasting Michael Saylor like a rotisserie chicken for MicroStrategy’s reckless decision to buy billions in Bitcoin… often near all-time highs. But somehow, even with its brutal dips, Bitcoin keeps bouncing back, and Saylor isn’t exactly drowning in regret. On the other hand, Schiff’s beloved gold, which had been taking full advantage of inflation fears and political uncertainty, is starting to lose its hotness.

Gold had a good run, climbing as high as $2,910 an ounce recently. But the trade is cooling off. The once-lucrative arbitrage opportunity between London and New York gold prices (where traders were making $60 per ounce just by shipping gold across the Atlantic) has stalled out like an old Jeep Wrangler. That premium has now shrunk to about $10.

Even more telling, gold stockpiles at Comex depositories just hit a four-year high of 39.5 million troy ounces. That’s a lot of yellow metal sitting around. And when supply starts piling up like unsold Pelotons in a warehouse, it’s usually a sign that demand is weakening.

A few things. First, the panic-driven rush to hoard gold due to Trump’s tariff policies is winding down. Traders were front-running the possibility of tariffs on gold, which led to a physical squeeze. Now that the dust is settling, gold’s price momentum is fading. Lease rates for borrowing gold in London (previously at historic highs) are also coming back to earth.

Second, there’s the U.S. dollar. While a weaker dollar had been a tailwind for gold, it’s not dropping fast enough to keep the rally alive. And let’s not forget interest rates,,, if the Fed finally pivots to rate cuts, gold might still get a bump, but for now, traders are rethinking their safe-haven investments.

Nowhere to be found… at least not on Twitter/X, flooding timelines with his usual “Bitcoin is a scam” threads just to trigger the laser-eyed maxis. Because let’s live in reality… even despite the recent dip, Bitcoin has been putting up big numbers, and Schiff’s golden argument is looking a little tarnished. Sure, gold isn’t crashing, but its upside potential suddenly doesn’t seem as exciting as, say, a 300% Bitcoin rally.

If gold keeps dipping, we might finally see Schiff do the unthinkable… quietly admit that maybe, just maybe, he underestimated Bitcoin. But let’s be honest, he’ll probably just double down on gold maximalism and call for $10,000 gold by 2030. Some things never change.

PS: Last week, I broke down a stock that both Nancy Pelosi and Cathie Wood just bought… but here’s the thing: it was only available for premium members.

Not only did I reveal the stock, but I also dissected Nancy’s trade structure, proving she’s in it for the long haul. If you weren’t a premium member, you missed the breakdown on why her entry signals serious conviction… the kind of insight that separates smart traders from the ones just chasing headlines.

If you want real stock picks and trade ideas every single day—not just the surface-level news everyone else sees… you need to check out our premium membership. We dig through SEC filings and insider trades daily, flagging the best opportunities. And when we find a can’t-miss trade, we break it down in a full write-up… so you know exactly what’s happening and why it matters.

Don’t miss the next one. Click here and become a premium member today.

Stock.News has positions in Tesla.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer