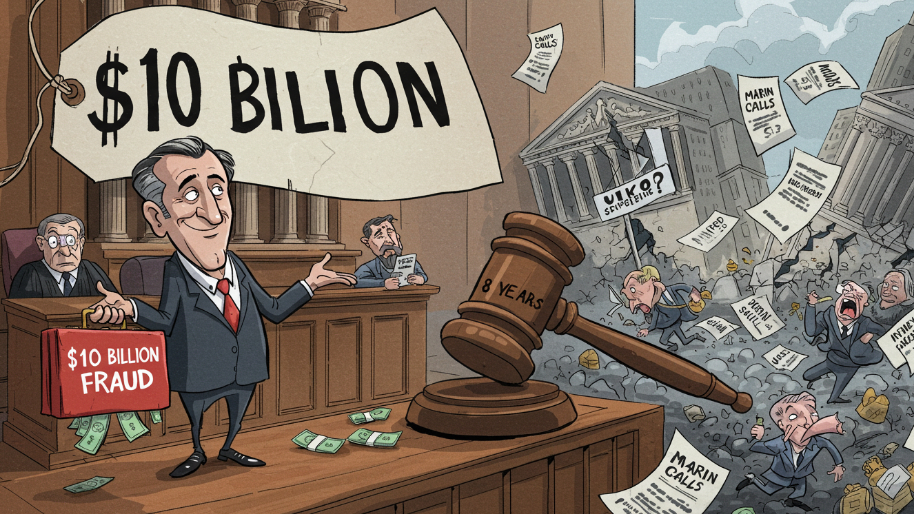

Patrick Halligan, the former CFO of Archegos Capital Management, just got handed eight years in federal prison for his supporting role in one of the biggest financial disasters this side of Lehman Brothers. His ex-boss, Bill Hwang, already got smacked with an 18-year sentence back in November, so in the grand scheme of things, Halligan’s getting the CFO discount. Call it a “buy one fraud, get one lighter sentence” deal.

(Source: Giphy)

For those not up to date on this clusterf**k—back in 2021 Archegos was a $36 billion family office playing Wall Street like it was Monopoly. Hwang and Halligan somehow convinced banks to lend them enough money to leverage that $36 billion into over $100 billion in positions. And then, surprise surprise, the whole thing imploded when margin calls came knocking, leaving a $10 billion crater in the balance sheets of some of the world’s biggest banks.

Credit Suisse alone lost $5.5 billion, and the fallout was so bad it basically got them merged into UBS. Meanwhile, Nomura and Morgan Stanley were left holding the bag, proving once again that even the smartest guys in the room can get played like a friggin’ fiddle.

(Source: Bloomberg)

Additionally, Halligan’s eight-year sentence comes courtesy of U.S. District Judge Alvin Hellerstein, who described him as less culpable than Hwang but still “extraordinary” in his role. Translation: “You weren’t the ringleader, but you sure as hell weren’t just following orders.” Halligan was the guy who helped grease the wheels, allegedly training Archegos employees to lie to banks about the firm’s financial health and cooking up talking points when the walls started to close in. His pitch? Archegos wasn’t insolvent—it just had a “liquidity issue.” LOL and Sam Bankman-Fried just had “trust issues.”

Naturally, Halligan’s defense team leaned hard into the “he’s a good guy with bad friends” narrative, pointing out his “essential goodness” (whatever that means) and his personal struggles, including health issues with his kids and the total implosion of his career. They also tried to throw shade on former Archegos risk head Scott Becker, who testified against Halligan after penning some truly psychopathic emails wishing death on his former bosses.

(Source: Bloomberg)

One gem from Becker? He said he hoped Halligan would die in a plane crash. Two years later, he upgraded his death wish to include both Halligan and Hwang suffering “painful, slow deaths” from COVID. Whadda sad little man Becker must be.

But alas, the question now is whether Halligan’s eight years will actually stick. Like Hwang, he’s been granted bail while appealing his conviction, so there’s a non-zero chance he’s spending the next few months sipping lattes instead of trading commissary ramen. But let’s be real: whether it’s eight years or 18, the real punishment is knowing that your name will forever be synonymous with one of Wall Street’s most epic collapses. Well, that and the fact that your former colleagues are probably reading your sentencing memo and laughing over martinis.

(Source: Giphy)

In the end, Archegos, Halligan, and Hwang are just another cog in the lesson of “F’around and find out” on Wall street. Sure, Hwang might have been the “dynamic force,” but Halligan’s spreadsheets and spin jobs were what kept the wheels turning until the whole operation crashed and burned. And while Wall Street loves a good redemption arc, something tells me neither of these guys will be getting the Adam Neumann treatment anytime soon.

As always, take this as a warning to when greed takes over—and as always, stay safe and stay frosty, friends! Until next time…

P.S. Our recent $DWTX alert skyrocketed 876% in less than ONE-DAY! Click here to join Stocks.News to make sure you take advantage of our next alert…

Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer