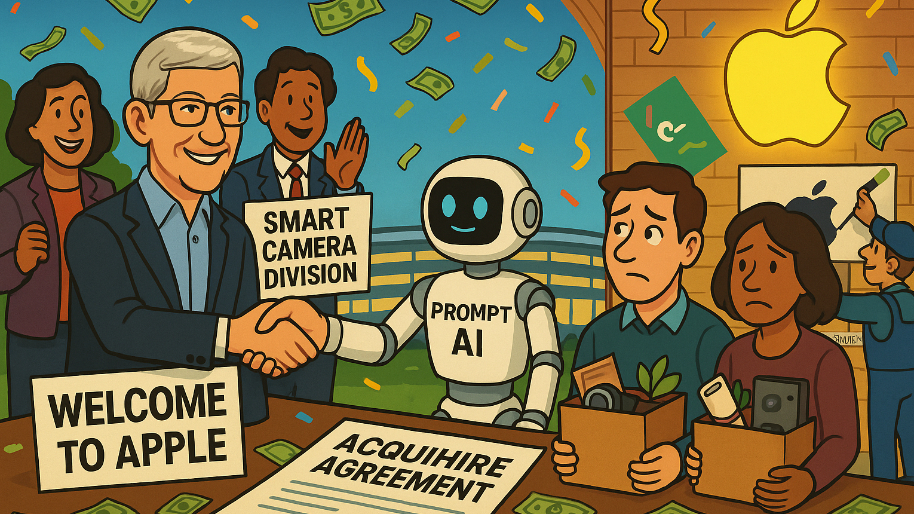

Apple is nearing an agreement to acquire the engineers and technology behind Prompt AI, a small San Francisco-based computer vision startup whose software teaches cameras to understand what they see… a move that underscores Apple’s preference for quiet, targeted acquisitions over headline-grabbing takeovers.

Founded in 2023 by Tete Xiao and Trevor Darrell, both noted researchers from the University of California, Berkeley’s Artificial Intelligence Research Lab, Prompt AI developed an app called Seemour that connects to home security cameras. The software uses computer vision to identify people, pets, and objects, and can generate text-based updates or answer questions about what’s occurred… such as identifying who entered a room or when a package arrived.

The technology worked well, but the business case faltered. At an all-hands meeting this week, Prompt’s leadership told employees that the company would shut down operations and that Apple plans to acquire key staff and intellectual property, according to CNBC. Employees not joining Apple will receive reduced pay and have been encouraged to apply for open roles. Investors will recover some of their investment but “won’t be made whole,” executives reportedly said.

The deal (structured as an acquihire) fits Apple’s long-established playbook. While rivals such as Meta, Google, and Microsoft have spent billions on large-scale AI acquisitions, Apple has built its capabilities through smaller, strategic purchases of early-stage firms with specialized talent. These teams are typically absorbed into Apple’s product divisions, their work later surfacing quietly within iPhones, Macs, and the company’s broader ecosystem.

Prompt’s engineers are expected to join Apple’s HomeKit and Vision Pro units, where the company is expanding its use of computer vision across smart home and spatial computing devices. The acquisition could help improve Apple’s recognition systems for faces, pets, and objects… an area where the company already holds a technical edge through the Vision Pro headset and advanced camera software.

Apple has avoided major corporate takeovers since its $3 billion purchase of Beats Electronics in 2014, opting instead for incremental acquisitions that enhance existing technologies while avoiding regulatory scrutiny. The approach has allowed Apple to remain focused on product integration rather than scale.

The acquisition also comes as Apple faces mounting pressure to demonstrate progress in artificial intelligence. Its recently announced Apple Intelligence platform (a suite of generative AI tools for iPhone and Mac) was met with a muted response from investors and critics alike. Shares of Apple are only up .5% this year, the weakest performance among the major tech giants.

Still, Apple’s strategy in AI has traditionally emphasized refinement over spectacle. Where competitors tout expansive chatbot platforms and research labs, Apple tends to embed AI into daily user experiences… better photo organization, smarter voice recognition, and seamless device interactions. Integrating Prompt’s technology could extend that approach, strengthening Apple’s ability to interpret visual data and enhancing its devices’ contextual awareness.

For Prompt AI, the deal marks a familiar outcome in Silicon Valley’s current AI consolidation wave: a small company with promising technology and limited commercial traction finding a soft landing within a larger ecosystem. For Apple, it represents another methodical step toward fortifying its AI foundation… one quiet acquisition at a time.

If completed, the deal likely won’t generate a public announcement. Instead, its results may surface subtly in the coming months, in smarter security features or improved camera intelligence across Apple’s devices… a reminder that with Tim Cook in charge, the most significant innovations often arrive without much excitement.

At the time of publishing this article, Stocks.News holds positions in Apple, Meta, Google, and Microsoft as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer