Hey Siri, define “fumbling the bag”...

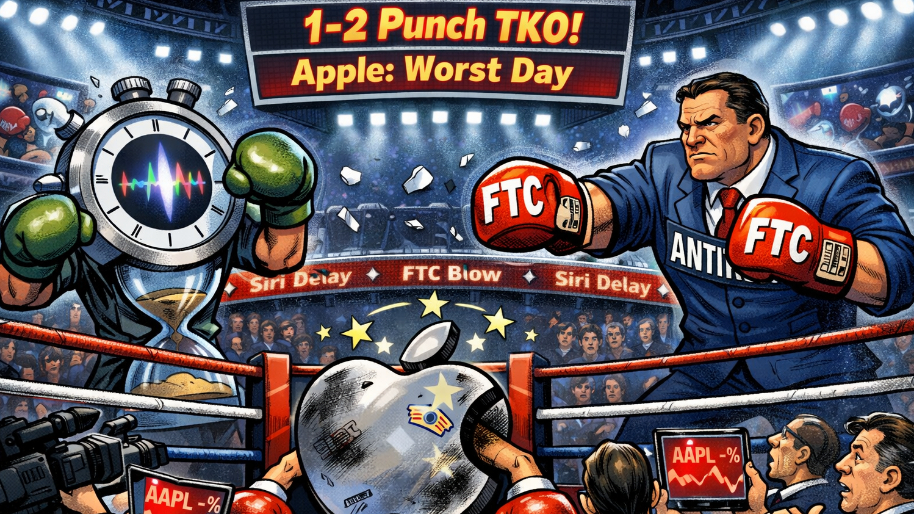

Timmy Apple is back on his bull sh*t as Apple ate its worst single-day beatdown in nearly a year yesterday (read: -5%). And yet, it’s hard to pick which bullet hurt investors more. Was it Bloomberg dropping a nuke Wednesday night that Siri's long-awaited Gemini injection won’t ship until May at the earliest? Or was it the FTC deciding now's a great time to dip its proverbial pen into Apple's ink over alleged bias in Apple News? Spoiler: it was probably both.

(Source: Giphy)

For starters, there's no doubt that Siri has been cursed. Apple's been hyping this AI overhaul for months…basically their answer to everyone dunking on them for being late to the ChatGPT party…and now Bloomberg's reporting the rollout's been pushed back internally. Again. The update was supposed to drop "within a couple weeks," but sources are saying it could trickle out slowly over several months instead. Translation: Apple is giving us the Jen Psaki treatment.

However, don’t you worry Apple mouth breathers, because Apple still says “it’s on track to launch in 2026”. Sounds legit. Meanwhile, the FTC's Andrew Ferguson sent a letter to Tim Cook on Wednesday pressing Apple to review its Apple News curation policies after "reports" that the app's been promoting left-leaning outlets while suppressing conservative ones. Whether that's true or just vibes-based grievance posting doesn't really matter to the stock… regulatory scrutiny is regulatory scrutiny, and the market hates uncertainty.

(Source: CNBC)

Meaning now, Apple's dealing with an AI delay, an FTC probe, and the general consensus that Big Tech is spending way too much straight cash homie on infrastructure that may or may not pay off. Case in point: UBS downgraded the entire U.S. tech sector to neutral earlier this week, citing "software uncertainty" and bloated capex. Software stocks have been puking for a week straight as investors collectively decided maybe betting on infinite AI growth was a bit optimistic. Woof.

But, but, but…. Apple beat earnings last month tho? Yes but even still the stock is down nearly 4% YTD after yesterday's bloodbath wiped out its 2026 gains entirely. Turns out even the most cash-rich company on the planet isn't immune when the narrative shifts from "AI leader" to "AI laggard with regulatory problems."

(Source: Giphy)

Of course, Apple’s been here before. They've survived worse. But this particular clusterf*ck cocktail of delayed product launches, FTC heat, sector-wide rotation out of tech… definitely isn’t something that resolves itself in a couple earnings call. This is a "wait and see if Siri's actually good when it ships" situation, and the market's not known for its patience. Meaning, Timothy Apple is going to need more than a polite email response to the FTC and a "trust us, it's coming" on Siri to turn this around. The stock needs a win, and right now, all it's got is a delay and a subpoena. Until May, I guess. Or later. Who knows anymore.

Translation: Place your bets accordingly, and keep your head on the swivel, friends. Until next time…

At the time of publishing, Stocks.News holds positions in Apple as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer