It’s a sad day for another pandemic legend, 23andMe. The Silicon Valley company that once proudly told me I am 25% Scottish is now 100% broke… and has officially filed for Chapter 11 bankruptcy (cue the sound of bagpipes playing “Taps”).

If you’re keeping score at home, that’s a 99% drop from its 2021 high of $320 a share to under $2. Which, coincidentally, is about how much I'd value the DNA test now that the company storing my genetic code is circling the toilet.

This is the same company that once bragged about celebrity shout-outs from Oprah, Eva Longoria, and even Snoop Dogg (the man whose DNA is probably 70% THC). Now, their CFO is moonlighting as the CEO, their co-founder Anne Wojcicki has officially yeeted herself out of the corner office, and California’s Attorney General is practically begging customers to delete their data before it ends up on Craigslist next to used iPhones and “lightly worn” toe shoes.

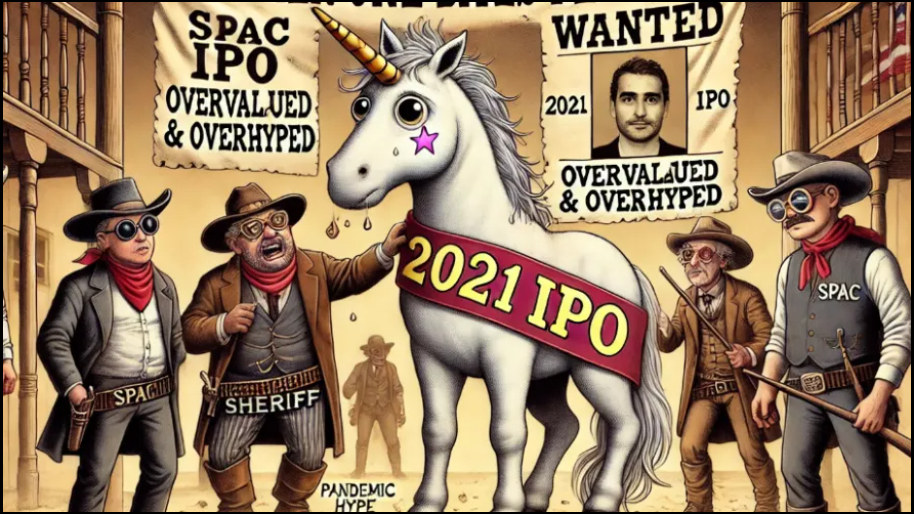

The fall has been... dramatic. 23andMe went public in 2021 via SPAC at a $3.5 billion valuation. At its peak, investors were drooling over a $6 billion company. Today, the stock is a penny stock punching bag. After a nightmare data breach in 2023 exposed the personal info of nearly 7 million users (not DNA, allegedly, just the stuff you’d rather not see leaked like family trees and birth years), the company tried everything to stay relevant.

They laid off 40% of their workforce, tried to go into the drug development business using all that sweet genomic data, and even tried launching a subscription service. Turns out ancestry kits are a one-hit wonder. You spit in a tube, learn you're 12% Irish, maybe order a Guinness, and never log in again. There’s only so many times you can be told you’re at “elevated risk” for caffeine sensitivity before you tune out.

Not surprisingly, Anne Wojcicki didn’t go down without a fight. She tried to take the company private, but a special committee blocked her attempt. All the board members (except Anne) resigned last summer after not getting a buyout deal they liked. So Anne was left clinging to the wheel like the last kid still trying to keep the group project alive while everyone else bailed to “focus on other commitments.”

And then came California’s attorney general Rob Bonta, who basically screamed “pull the plug!” to anyone still trusting 23andMe with their genetic secrets. He urged consumers to request their data be deleted and their samples destroyed. All while the company continues to insist everything’s fine. No need to worry, they say. Your DNA’s safe. Sure. And I’m a Nigerian prince with a bridge to sell you.

Now the company is seeking to sell itself off in bankruptcy court, all while promising to “maximize value” and “continue operations.” In other words: they’re hoping someone shows up and offers more than a free 23andMe test kit and a hug.

Goodbye to another pandemic IPO legend… I just hope you didn’t invest your nest egg before it tanked 99%.

P.S. Just when you thought our beloved congressmen couldn’t get any greasier, one Republican lawmaker decided to YOLO $175k into a stock… right before a major FDIC announcement hit. Lucky timing? Insider edge? You be the judge. We broke it all down inside this week's Stocks.News premium article… click here to check it out ASAP.

Stock.News does not have positions in companies mentioned.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer