If you’ve ever wandered into a Reddit thread about investing, you’ve probably seen them. The Bogleheads. They are the Jedi Order of long-term investing. They don’t believe in any emotion. And if you’re apart of the cult, you better not be doing any trading on the side. You’re supposed to buy the index, sit your butt down, and wait 40 years. If you even think about buying an AI stock or God forbid a little crypto, a guy named Carl in New Jersey will hop in the thread and roast you with a Vanguard white paper from 2006.

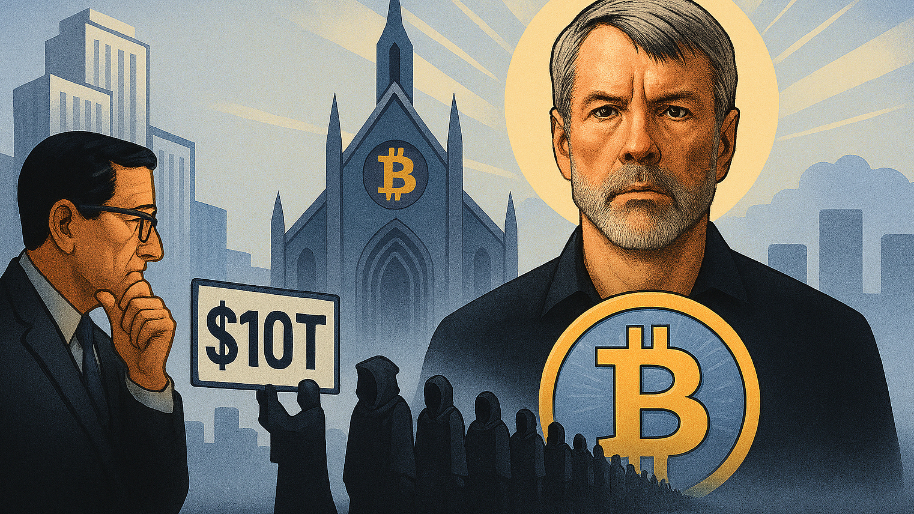

These are the disciples of the late Jack Bogle, the founder of Vanguard and patron saint of low-cost index funds. And their one true commandment? “Thou shalt not buy crypto. Ever.” That’s not an exaggeration. Just a year before his death, Jack himself said: “Avoid Bitcoin like the plague. Did I make myself clear?” So you can imagine the absolute existential crisis happening right now… because Vanguard (the Boglehead mothership) just became the #1 holder of Michael Saylor’s crypto cult. Again, I’m talking about MicroStrategy. The same company that stopped pretending to sell software and now just buys Bitcoin like it’s stockpiling for the rapture.

If you’re wondering how this could happen, that probably means you’ve never not bought single stocks in your life… because index funds don’t discriminate. They’re like that kid in gym class who picks teams by just going down the attendance list.

As more Vanguard funds swell with investor dollars (they’re now managing over $10 trillion), they’ve unintentionally dipped up slices of just about everything… including MicroStrategy. According to Bloomberg data, Vanguard now owns over 20 million shares, or nearly 8% of all MSTR stock. For reference, that’s more than Capital Group, BlackRock, or pretty much anyone not named Michael Saylor. And keep in mind, this isn't just passive exposure… that stake is worth $9.26 billion. But seriously, imagine being a Boglehead who’s spent years sneering at anything with the word “blockchain” in it… only to find out your trusty Vanguard Total Market Index Fund (VITSX) is now lugging around a fat bag of SaylorCoin (the world’s most cultlike crypto stock you could possibly own).

Seriously, the biggest chunk of Vanguard’s MicroStrategy stake comes from VITSX, with 5.7 million shares worth $2.6 billion. Another 3 million shares sit in their Extended Market Fund. And even their actively managed funds (the ones where human beings are supposed to think before buying) have a sprinkle of MSTR too.

Turns out when you index the market, you get the whole damn market. Even the parts you used to call “speculative clown tokens.” There’s a beautiful irony in all this. Vanguard has spent years turning its nose up at crypto. They won’t even let you buy a spot Bitcoin ETF on their platform. When BlackRock and Fidelity launched theirs earlier this year, Vanguard’s response was basically, “Cute. No.” Their CEO even said, “It’s really tough to think about how [Bitcoin] belongs in a long-term portfolio.” And yet here they are… long Bitcoin. Accidentally. Through a company that’s literally become a meme-stock proxy for Bitcoin’s price.

Michael Saylor, naturally, had something to say: “The fact that Vanguard holds such a large stake… reflects the increasing acceptance of Bitcoin as a legitimate reserve asset within the traditional financial community.” It’s the ultimate “funny how life works” moment. Like your high school principal showing up at Bonnaroo. Or a 50 year old who mocked TikTok, now going viral for reviewing lawnmowers.

Now, to be fair, Vanguard didn’t choose this life. They’re just following the rules of index investing. When you track the entire market, you don’t get to pick favorites… even if those favorites make you want to throw up. But still, the moment is rich. The most anti-crypto asset manager in America is now neck-deep in crypto exposure… all because their precious index funds got too big.

So next time a Boglehead lectures you about “staying the course,” just smile and say, “Sure thing, Carl. Just don’t forget to HODL.”

At the time of publishing this article, Stocks.News holds positions in Vanguard Total Stock Market Index Fund ETF Shares as mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer