Aluminum is putting the “metal” in Heavy Metal…

Hold onto your Bud Lights friends because your favorite metal, aluminum, just ripped through $3,000 a ton this week for the first time since 2022. Translation: Something is definitely breaking behind the scenes and nobody wants to admit it yet.

(Source: Giphy)

In short, aluminum is officially on the special sauce that was hogged by Gold and Silver in 2025, as everyone is starting to realize that inventories are empty, smelters are offline, and the metal that literally holds modern civilization together is getting scarce. More specifically, China has capped smelting capacity, while Europe kneecapped its own production thanks to electricity prices that look like ransom notes. Meanwhile, demand didn’t get the memo.

Construction is still chugging along as renewables keep stacking metal. Add in the fact that every EV ever built is basically an aluminum smoothie and voila… supply gets tighter than my jeans, demand gets sticky, and prices start mooning. That said, it’s not just aluminum smelting faces off. Your drug dealer's favorite metal (read: Copper), just wrapped its best year since 2009, nickel popped after Indonesia hit pause on mining approvals, and base metals in general are acting like they know something the equity market is still pretending not to see. Which, so far, tracks.

(Source: Yahoo Finance)

Because while everyone’s been busy arguing about AI valuations and rate cuts, the physical economy has been quietly eating through inventories like it’s 2021 again. Mines from Chile to the Congo had accidents. Tariff paranoia shoved shipments into the U.S. early. Warehouses got drained. Nobody rebuilt slack capacity because capital is expensive and regulators hate fun. Now we are here. Aluminum futures were up 17% last year, the best run since 2021, and now that prices have broken $3,000… it doesn’t take a genius to see that this isn’t just a random headline, but a dang signal flare.

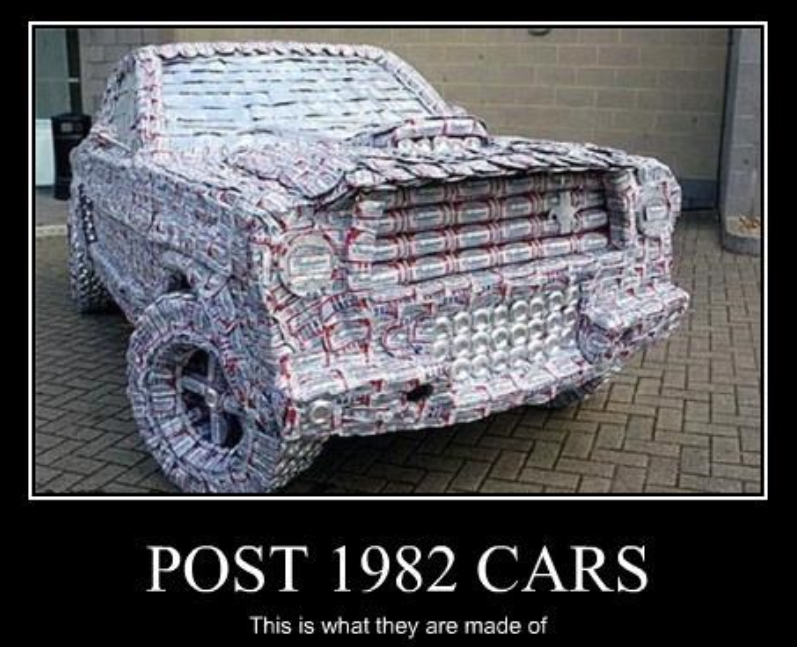

Keep in mind, this is the metal used in cars, planes, power grids, soda cans, buildings, and half the stuff you touched today. When this moves, something catches a cold. Manufacturers are already sweating as investors are waking up late, which is tradition. Translation: Base metals are going feral to the point that it’s reminding everyone that inflation doesn’t die just because the Fed wants it to. Meaning, in the short term the market is going to stay tight. You don’t just spin up smelters overnight, and new capacity takes years.

(Source: Memebase)

Long term though, supply will eventually respond. Think Indonesia, new projects, all the works. But that’s a later thing. Right now, aluminum at $3,000 is the market making one thing very clear: Stocks can argue narratives all they want. Commodities just show receipts. Place your bets accordingly, friends. Until next time…

At the time of publishing, Stocks.News does not hold positions in companies mentioned in the article.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer