Last night, my dad called me up, and before I could even say hello, he hit me with: "Boy, Trump sure is getting a lot done in his first days in the White House… he's stopping the funding of condoms to Hamas, deporting illegals, releasing the JFK files, and he’s even vowing to get rid of federal taxes.” (At this rate, I half expected him to say Trump was also handing out free steaks, pardoning Joe Exotic, and finally getting the McDonald’s dollar menu back to pre-covid prices.)

But this morning, it’s his own stock making the move. Truth Social, just announced it’s getting into financial services with a new brand called Truth.Fi (I take it they’re really into the Truth branding).The news sent DJT stock soaring over 11% in early trading, proving once again that if there’s one thing Trump knows how to do, it’s staying in the news.

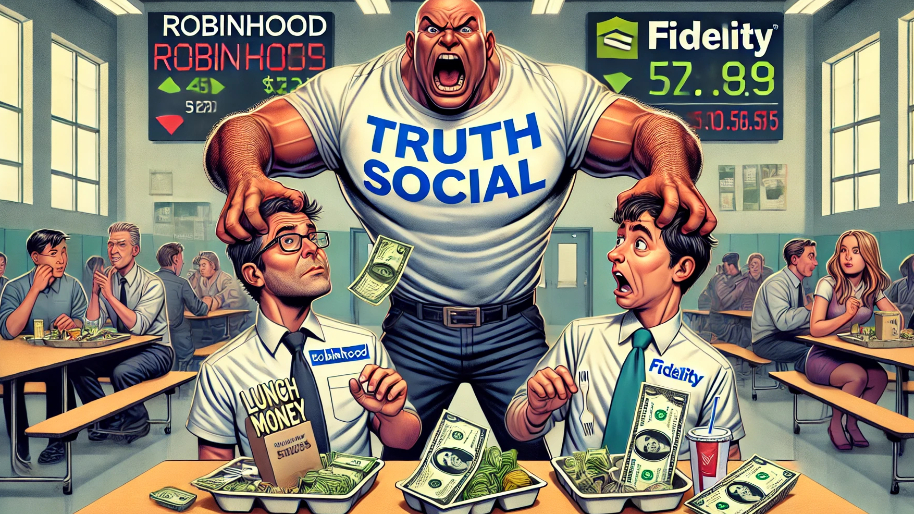

According to Trump Media, Truth.Fi will focus on financial services, investment vehicles, and decentralized finance. (Basically, it’s aiming to be the MAGA version of Robinhood, hopefully minus the “oops we froze your trades” moments). The company’s board approved an initial investment of up to $250 million, which will be custodied (managed) through Charles Schwab. The funds will be spread across ETFs, separately managed accounts, and (you guessed it) crypto.

(Source: The Guardian)

It’s a logical next step for DJT, which has already expanded into streaming with Truth+ Streaming (which, let’s be honest, has probably been streamed about as much as a MyPillow infomercial at 2 AM). Now, with Truth Social + Truth.Fi, Trump’s media, tech, and finance empire is starting to take shape… or at least look impressive in a press release. Here’s where things get intriguing though. Trump Media’s cash reserves exceeded $700 million at the end of 2024, meaning they’re actually a threat. (Yes, a company that once made just $3.4 million in revenue in a single quarter is now sitting on nearly three-quarters of a billion dollars in cash. You do the math.) The company has real money to play with, and it’s telling all the competitors in financial services to watch their backs.

This comes after months of complaints from conservatives that major banks have been unfairly "de-banking" them. So, in true Trump fashion, instead of waiting for the system to change, he’s just building his own alternative. According to Truth Social’s CEO Devin Nunes, Truth.Fi will focus on “American growth, manufacturing, and energy companies, as well as investments that strengthen the Patriot Economy.”

Before today’s pop, DJT stock had been down 11% in January and took a 12% crap earlier this month. But, like any good meme stock, it doesn’t stay quiet for long. It also doesn’t hurt that Trump indirectly owns 114,750,000 shares, held in a revocable trust. Meaning… if DJT rips higher, Trump wins big.

The stock’s movements have been closely tied to Trump’s political fate, spiking after the assassination attempt in July and dropping after that awkward debate with Kamala Harris. If the trend holds, expect the stock to rise and fall 10% just about every day over the next 4 years (or whenever Trump posts something cryptic on Truth Social).

P.S. You know what winning looks like? Two back to back alerts in less than a week that have skyrocketed 876% and 173% (both in less than a day!). Click here to join Stocks.News premium before we release our next explosive alert…

Stock.News has positions in Robinhood and McDonald’s.

Did you find this insightful?

Bad

Just Okay

Amazing

Disclaimer: Information provided is for informational purposes only, not investment advice. We do not recommend buying or selling stocks. Stock price discussions are based on publicly available data. Readers should conduct their own research or consult a financial advisor before investing. Owners of this site have current positions in stocks mentioned throughout the site, Please Read Full Disclaimer for details Here https://app.stocks.news/page/disclaimer